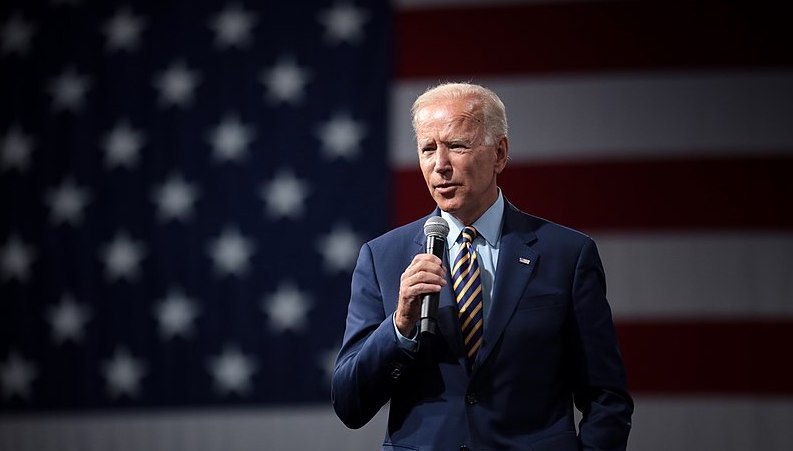

Markets are braced for the US election result to potentially take days to be called as Donald Trump’s Florida win leaves Joe Biden’s path to victory focused on key battleground states in the Rust Belt, such as Pennsylvania, Michigan and Wisconsin.

The incumbent has also prematurely declared victory for himself and said that he will take the US election to the Supreme Court.

US markets had rebounded on polling day in anticipation of a decisive victory for Biden following a sell-off last week. Going into the 3 November election, betting odds and national polls were in favour of Biden with Fivethirtyeight stating he had an 89% chance of taking home the presidency.

But with Trump scooping Florida, a win that was necessary for him to remain in the race, the election looks set to go down to the wire.

At 7.30am GMT, Biden had secured 225 electoral college votes out of the 270 needed to win compared to 213 for Trump. Pennsylvania, Michigan and Wisconsin have already indicated it could take days for their votes to be tallied.

See also: DFMs predicting a ‘Biden bump’ as 2020 US election looms

Likely delayed US election result is worst outcome for markets

Institutional investors surveyed in the lead-up to the US presidential election described no immediate outcome as the worst result for markets. Of the 1,377 respondents surveyed by Citi, 45% expected US equities to fall by more than 10% if there was no result by Thanksgiving on 26 November, with a further 30% expecting markets to fall five to 10%.

The tightness of the race also heightens the risk of a contested election.

Trump had already tweeted unsubstantiated claims in the early hours of Wednesday morning that he was up “big” but that the Democrats were trying to “steal the election”. He doubled down on those remarks in a speech later in the morning when he called for voting to stop and stating he would be taking the result to the US Supreme Court.

“We were getting ready to win this election. Frankly, we did win this election.”

His false claims of victory come despite the fact that at 7.30am GMT he was lagging Biden by 1.7m in the popular vote with 66.3m in favour of the Democrat candidate and 64.6m in favour of Trump.

Brewin Dolphin investment director Janet Mui has previously told Portfolio Adviser that prolonged uncertainty would be a further headache for markets already concerned about Covid-19 and heightened restrictions in Europe. It would mean little chance of US stimulus passing in the near term and that the US dollar and safe havens were likely to benefit temporarily in the short term,” Mui said.

See also: US election 2020: What happens if Donald Trump refuses to concede?

Nevertheless, the most market-friendly result remains on the table with Democrats’ hopes of taking the Senate looking increasingly slim.

The Citi survey found a Biden White House and split Congress was seen by institutional investors as the best outcome because it would curb the Democrat’s chances of getting any large increases in corporation tax or any of his most redistributional agenda items through Congress.

Biden plans to increase corporation tax to 28%, from 21% currently. Trump hasn’t discussed corporate tax policies in any detail.

See also: What the US election 2020 means for trade, the dollar and climate change

The four factors underpinning markets regardless of who becomes US president

While market uncertainty looms in the near term, an investment report published by Rathbones last week said the four pillars supporting markets were unlikely to be affected by the candidate that landed in the White House.

Rathbones head of asset allocation Ed Smith named those as: hope for a timely, effective vaccine; supportive fiscal policy; supportive monetary policy; and a levelling off of the US-China trade war.

“It might help keep things in perspective. In most cases, there is little change,” Smith said. “Historically, a presidential candidate committing to very loose fiscal policy would have caused investors to expect tighter monetary policy. But the Federal Reserve has committed to holding interest rates near zero until the end of 2023, even if inflation rises above 2%.”

Trump’s “one-trillion dollar infrastructure plan” involves $200bn of federal funding, $200bn from state and local government and the remainder from the private sector. In contrast, Biden’s plan involves $1.3trn of federal spending on infrastructure, plus a further $5trn from other sources.

A Trump White House and split Congress would likely see him focus more on trade where he doesn’t need Congressional approval, the Rathbones report said. But while US-China relations have unnerved markets during the Trump presidency, Biden is expected to take a similarly anti-China approach to trade, albeit in a way that is less erratic and more rules-based, said Smith.

See also: Charles Younes: Will US funds still be a beacon of stability once the election is done and dusted?