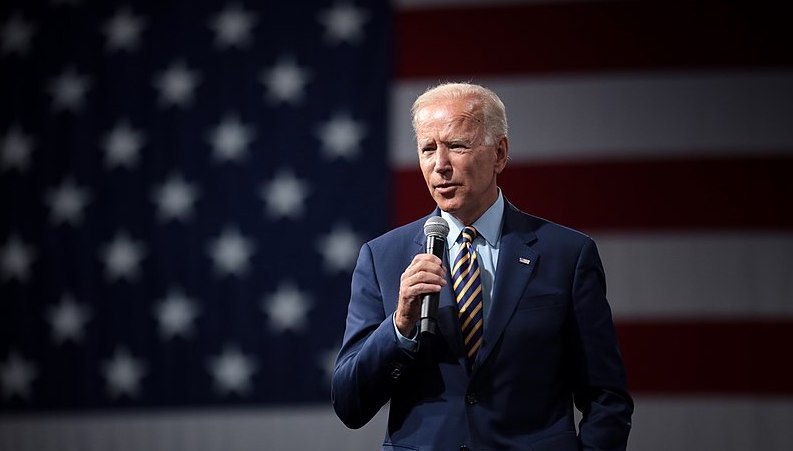

We are less than 20 days out from the US presidential election. This time around the stakes are even higher as the showdown between Joe Biden and Donald Trump plays out in the midst of a global pandemic.

Democratic nominee Biden is currently polling higher than Trump, as his predecessor Hillary Clinton did before him in the 2016 campaign. But four years on markets and analysts have learned the hard way to expect the unexpected.

During one of Jupiter’s recent webinar events, executive chairman Edward Bonham Carter asked audience members who they thought would win the 2020 race. Around 52% said Biden, while 47% of respondents went with Trump. “Looks rather like the Brexit vote to me,” Bonham Carter said, mulling over the figures.

“I think there is more chance of a ‘surprise’ than many people are anticipating,” says 8AM Focussed fund manager Andy Merricks. “Hearing a lot of commentators in the UK you’d be forgiven for thinking a Biden win is a formality.

“It wouldn’t surprise me in the slightest if Trump got re-elected as people seem to have very short memories.”

Richard Buxton, head of strategy for Jupiter’s UK Alpha Fund, also believes the probability of Trump winning a second term is greater than is being predicted by the markets.

Speaking to Bonham Carter, he said: “I thought for a long time that it probably would be Biden, but I confess I’m actually changing my mind,” noting that rioting over the summer, which happened separately to peaceful Black Lives Matter protests, may have “played a bit to the law and order Trump card”.

“There’s an awful lot of people who don’t like to admit they’re Trump voters, so I think it’ll be a lot closer than the current polling suggests.”

Buxton was in the minority who rightly predicted Trump would win the 2016 presidential election. At the time he told Portfolio Adviser that, like the EU referendum, the US election would boil down to a protest vote.

Inconclusive result could trigger extreme volatility

One of the key issues this time around is that the election result may not be clear on 4 November, the day after the election. This is due to an unprecedented influx of mail-in ballots as Covid, which Trump and his wife Melania contracted, prevents people from heading to the polls in person, according to GDIM investment manager Tom Sparke.

“With so much voting by mail there will be more complicated procedures than in previous elections, and it may be a week or more until the conclusion,” Sparke says.

An inconclusive result, especially in the event of a close race, means there is “potential for extreme volatility should this uncertainty inflame social unrest”, says Psigma Investment Management head of investment strategy Rory McPherson.

Brewin Dolphin investment director Janet Mui says her base case in November is for a Biden presidential win and a Democratic clean sweep of the House of Representatives and the Senate.

Mui points out that FiveThirtyEight pollster Nate Silver’s election model currently favours Biden over Trump. Out of 40,000 simulations Biden wins 77% of the time, compared with Trump’s 22%. Trump’s current odds are lower than Silver’s final forecast in 2016, which gave him a 28.6% chance of winning versus Hillary Clinton’s 71.4% odds.

Democrats are currently leading in the Senate race, though Mui admits it is a closer contest. Democrats took back the House in 2018 following the so-called “Blue Wave”, and are expected to hold on to their majority, she adds.

Despite anticipating a close contest, ultimately Merricks thinks the current recession will scupper Trump’s chances.

“It is very, very rare for an incumbent to get back in on the back of the electorate suffering job losses and financial hardship on the scale of what has happened this year. So, ironically it may be an invisible virus that no wall could keep out that does for the current administration,” he says.

The US jobs market has been gradually recovering since April when the level of unemployment skyrocketed to 14.7%, the worst since the Great Depression, and 36 million Americans found themselves out of work. But despite unemployment falling to 8.4% in August, the US has only recovered half the jobs lost at the start of the coronavirus and there are worries that more people could find themselves financially strapped when the government stimulus cheques stop coming.

Democratic clean sweep could be the best outcome for markets

Discretionary fund manager (DFMs) largely see Biden’s victory as a win for equity markets, given Democrats’ propensity to spend, spend, spend.

Biden’s plan calls for $5.4trn (£4.2trn) in new spending over a decade, a big chunk of which would go to long-term infrastructure and climate initiatives, Mui says, as well as social spending on healthcare, education and housing.

Brewin Dolphin favours the US market and is currently overweight in its tactical asset allocation.

Though Mui believes a Biden win and a divided Congress would be the most market-friendly outcome, with the Republican-controlled Senate able to shoot down corporate tax hikes and more “anti-business regulation”, she notes a Democratic clean sweep might be the best outcome from an economic growth perspective.

“There would be more immediate stimulus to combat the Covid-19 fallout than there would be if Congress was divided,” she explains. “This increased spending, and other initiatives like labour market protections and raising the minimum wage, would help to address the rising inequality that has developed across the US in recent decades.

“Less inequality probably means more aggregate spending, due to the fact that savings rates are highest among the higher-earning cohorts of society.”

DFMs sticking by US allocations heading into the 2020 election

Regardless of the outcome, DFMs are not planning on switching up their allocation to the US.

“Given the need to resuscitate the economy, we don’t envisage either candidate focusing immediately on their left-tail objectives,” McPherson says, which for Trump includes tariffs and threatening to fire Jay Powell, and for Biden higher taxation. As a result, “the backdrop of a supportive monetary and fiscal environment likely helps to maintain the status quo”.

Psigma currently holds the Montag & Caldwell Large Cap Growth Fund and Findlay Park American in its portfolios but remains slightly underweight the US on valuations grounds. “Although we respect it as a top-quality growth market, we think the relative valuation opportunities in places like Japan provide a greater margin of safety,” McPherson says.

Sparke holds the T Rowe US Large Cap Growth Fund, which invests in “global giants” that tend to be unaffected by possible changes in domestic policies, as well as Artemis Extended Alpha, a style-agnostic 130/30 strategy, which he says tends to take less risk than the average fund.

Recently he has been adding exposure to US smaller companies via the JP Morgan US Small Cap Fund to diversify away from the tech giants. He envisions the asset class doing well under Biden or Trump.

“The small-cap exposure may do well from Trump’s America First policies, which could boost domestic corporates,” Sparke says. “In a Biden-led America I would expect the smaller companies to also do well but from a potentially more empowered consumer and an ambitious jobs plan.”

Merricks’ exposure to the US is a byproduct of his thematic plays in cyber security, healthcare innovation and AI and robotics. Although roughly a third of his 8AM Focussed Fund is held in US companies, he only owns one US-targeted fund, a US Industrials ETF, which he added to the portfolio recently to gain exposure to a broader-based US recovery “other than the Faangs just flying”.

Biden bump

A curious thing happened in the immediate aftermath of the 2016 election. The stunning outcome resulted in a so-called ‘Trump bump’ for US stock markets, with the S&P 500 rising close to 30% in 2017, with out-of-favour industrials and banks initially leading the charge.

McPherson believes there could be a repeat value rally in 2020, particularly if Biden wins in November.

“Ultimately, as the volatility around the outcome settles, one would expect inflation to pick up and the reflation trade to spark a shift away from the very expensive growth sectors into the more economically sensitive value sectors,” he says.

“Perhaps this shift could be more acute in the event of a Biden clean sweep as markets might fear higher rates of corporate taxation hitting the big index stocks at the same time as increased fiscal spend sparks the shift to value sectors.”

Mui disagrees, viewing sectors such as energy and financials as vulnerable following a Democratic clean sweep, with stricter regulatory controls and less generous tax laws introduced.

Big pharma, which makes up 15.4% of the S&P 500, could also be at risk given Biden’s plans to expand Medicare coverage, which would give more people access to cheaper healthcare, and repeal legislation that allows healthcare companies to avoid negotiating with Medicare over drug prices.

Instead, she would expect to see a Biden bump for green energy and infrastructure companies. In August, Biden unveiled a $2trn plan to tackle climate change and fuel the US economic recovery in the wake of the coronavirus crisis.

“Renewable energy producers – wind, solar, hydroelectric – and equipment manufacturers stand to benefit, as do silver miners, as silver is a component of photovoltaic cells,” Mui notes.

Clean auto makers like Elon Musk’s Tesla would also do well, as Biden’s plan involves giving Americans a cash voucher to trade in their petrol car for an electric vehicle, as would the railway sector, she says.

Higher corporate taxes could also indirectly benefit Reits, Mui notes, “as their special tax status could be more appreciated by investors”.

Merricks also expects gold to do well in the immediate aftermath of the election as the dollar will likely weaken regardless of who wins initially.

What if Trump refuses to concede?

A potentially big risk that could send markets into a tailspin is if Trump loses the electoral vote but refuses to concede.

Trump has repeatedly signalled he might not accept the election results and has peddled conspiracy theories about mail-in ballots leading to voter fraud, while at the same time trying to undermine the US Postal Service.

According to McPherson, this scenario should not be discounted given how close the election is expected to be and that more Democrats vote by post than Republicans. “This could lead to confusion and delay around the outcome of the election, which in turn could spark more civil unrest.

“Should this come at the same time as a slowdown in global growth – something not totally unfathomable given the potential pick-up of the virus and weaning-off of fiscal spend – then it could be the spark that lights the tinderbox.”

There’s also the continued threat of the US/China trade war, which Merricks reckons would not go away in the event of a Biden victory “and may well escalate”.

Biden will be more focused on the human rights issues in China as well as the threat to trade, which could see him come down harder on president Xi, he says.

“This is the second wave I’m most concerned about. The second wave of Covid-19 will most likely be met with a vaccine and is unlikely to trigger a market response such as we saw in March 2020. A second wave of the US-China trade war is potentially far more damaging to global markets on a longer-term basis.”

This article first appeared in the October 2020 issue of Portfolio Adviser.