Whether the White House is ultimately painted red or blue after 3 November has implications beyond the borders of the US, not least the potential to either reignite or quell trade wars with China and other nations.

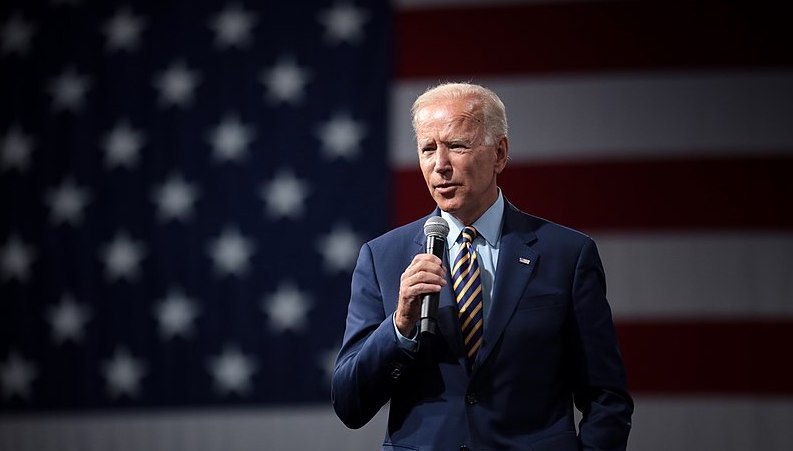

Investors may need to reshape their portfolios depending on which way the US electorate falls, but it will not simply be a question of Donald Trump versus Joe Biden.

The outcome in the Senate and House of Representatives races will also be important, determining the extent to which each candidate can implement their policy agenda and its effect on currency.

At the moment, the odds appear to favour a Democrat sweep of the Senate and Presidency, but elections always have the capacity to surprise.

More trade wars?

Perhaps the biggest question for international markets will be on trade. Galvanised by winning a second term, Trump would almost certainly renew – and even extend – his trade war agenda.

This will certainly focus on China, but may also extend to Latin America and, notably, Europe. Trump has previously accused Europe of being as bad as China on protectionist tariffs.

PGIM Fixed Income European chief economist Katharine Neiss says: “If Trump is re-elected, we would not be surprised to see a resumption of threats to place tariffs of 25% on European cars.

“If this occurs, it will likely lead to retaliation. Should we see wider escalation between the two powers, it would lead to negative GDP impacts of an order of magnitude larger than that seen in the US-China trade war.”

In contrast, if Biden wins, there is likely to be greater stability and cooperation on the global stage.

“The (US and Europe) could work cooperatively to reform the WTO resolution mechanism, as well as form a united approach to China – particularly around industrial policy, to ensure a level playing field,” says Neiss.

“The US and EU could also modernise the global trading framework to bolster trade in services, something both regions would benefit from enormously.”

Two paths for the dollar to take

This stability would be felt elsewhere as well.

Coupland Cardiff Japanese equities portfolio manager Richard Aston points out that a strong Democratic showing is likely to have some favourable implications for Japan; with an expectation that it would lead to a softer and clearer relationship with China.

The trajectory of the dollar is subject to considerable debate. The consensus appears to be that Biden’s more expansive stimulus package and measured approach to foreign policy is likely to see the dollar weaken.

Trump’s more erratic approach to foreign policy and tougher stance on stimulus could see it strengthen. It has historically been the case that the dollar has benefitted from global instability even when the US has been the source of that instability.

A weak dollar is likely to benefit emerging markets and commodities more than any other area, but European equities could also be pulled higher.

Garraway DFM chief investment officer Mark Harris says: “A weak US dollar would be highly supportive of emerging market currencies, bonds, and equities, especially as they could be leveraged into a robust global recovery. European and emerging market equities are extremely cheap on several measures relative to US equities and we believe this may be unwound to some degree.”

He believes improvements in trade relations with Europe under a Biden administration could be one of the main transmission mechanisms for European equities to improve.

“The exception would be if the euro strengthened significantly against the US dollar this would act as a headwind to exporters in the eurozone.”

On the basis that the world tends to benefit from a strong US economy, there is considerable debate on which candidate would deliver stronger growth.

While the Republicans will argue that their tax-cutting agenda will boost growth, the Democrats will claim that the multiplier effect of welfare spending and support for jobs will drive the economy in the longer-term.

Ultimately, both will inherit the same existing macroeconomic environment and in practice, much will be determined by the trajectory of Covid-19.

A diverging approach to climate change

The final area of significant differentiation between the candidates is on climate change.

Trump would see the US and European position on climate change continue to decouple. It may mean global oil companies can limp on, though there will be those who argue that this simply postpones the inevitable.

Neiss says that a Biden victory is likely to see a European/US partnership on climate change, which could be good news for stocks that support the energy transition.

Tom Fitzgerald, co-manager of the Amity International fund at EdenTree Investment Management, sounds a note of caution on how much difference a Democratic or Republican win will make: “To be able to put in place more controversial policies, control of both the House of Representatives and the Senate is necessary.

“It is difficult to see president Trump regaining control of the House of Representatives, were he to win. Similarly, it is difficult to see the Senate shift to a Democrat majority. Therefore, a divided Congress appears the most likely outcome.

“While political gridlock is not a desirable scenario, it may comfort investors to know that it could act as a considerable restraint on the more radical proposals on both sides.”

After a year of turmoil, global leaders may be relieved to hear that.

For more insight on continental European investment, please click on www.expertinvestoreurope.com