Latest Stories

-

Investors urge companies to recommit to diversity and inclusion

Includes Rathbones Investment Management, Sarasin & Partners, Scottish Widows and NEST

ESG|

|

2 minutes -

ECB delivers seventh consecutive interest rate cut

Interest rates were reduced 25bps to 2% as the bank casts an eye to economic growth

News|

|

2 minutes -

UBP’s chief bond strategist: Growth slowdown could be fixed income ‘sweet spot’

Mo Kazmi discusses reasons to be positive for fixed income despite jittery government bond markets

Investment|

|

6 minutes -

Calastone: UK investors back European equities in cautious May

US fund inflows were at their second-lowest level since 2023, while European equities enjoyed their strongest month in a year

Investment|

|

2 minutes -

Fidelity International to launch custom funds for Flying Colours

Two OEICs will be exclusive to Flying Colours Advice clients

News|

|

1 minute -

RBC BlueBay Asset Management appoints global equity portfolio manager

Former Columbia Threadneedle Investments portfolio manager Jonathan Crown joins

News|

|

1 minute -

Private credit tipped to dominate alternative fund launches in 2026

Private credit is poised to become the fastest-growing strategy in European alternative investments over the next 12–18 months

Investment|

|

2 minutes -

Track to the Future – with Goodhart Partners’ Gary Tuffield

Gary Tuffield discusses unsustainable global debt levels, frothy private equity markets and why prioritising cost may prove… costly

News|

|

6 minutes -

Ninety One reports £4.9bn in outflows but positive flows in H2

Equities were the main driver of outflows, mainly from global and sustainable products

News|

|

1 minute -

Octopus Investments CEO exits

Benjamin Davis steps away after 14 years at the firm

News|

|

1 minute -

Woodford portfolio platform to launch this week

W4.0 will officially launch on Friday

Latest news|

|

1 minute -

May fund performance: Tech funds bounce while bonds suffer

IA Technology & Technology Innovation was the top-returning sector, up almost 9% over the month

Investment|

|

2 minutes -

Newton IM cuts global head of sustainable investment role

Therese Niklasson leaving the firm alongside a trio of fund managers

News|

|

2 minutes -

As defence ETFs launch, where do niche funds fit into portfolios?

Investors discuss asset allocation after a spate of defence ETF launches

Analysis|

|

5 minutes -

Pacific Asset Management makes senior distribution hire from Jupiter

John Tevenan joins as head of global financial institutions distribution

News|

|

1 minute

Analysis

-

As defence ETFs launch, where do niche funds fit into portfolios?

Investors discuss asset allocation after a spate of defence ETF launches

Analysis|

|

5 minutes -

Enhanced passive funds break the mould

Asset managers have reported significant inflows into enhanced passive offerings

Analysis|

|

5 minutes -

Fund manager profile: Rathbones’ Carl Stick on going the distance

Why he’s still excited to manage his income fund 25 years into his tenure, and how he uses long-distance running to gain perspective on both his life and career

Analysis|

|

3 minutes -

Materiality risk: Call for corporate executive pay to be linked to sustainability goals

Report shows that more than a quarter of companies have no link at all between sustainability and executive pay

Analysis|

|

2 minutes -

Asset managers’ responsible investment progress ‘stagnating’

ShareAction set 20 attainable standards for asset managers, but 87% of the managers didn’t meet half of them

Analysis|

|

4 minutes -

Security matters as hackers hit retailers where it hurts

How are fund managers viewing recent cyber attacks on retailers such as Co-op and M&S?

Analysis|

|

6 minutes

Investments

-

IA reports strongest fund flows of year in April amid tariff turmoil

Inflows of £1.1bn were recorded in the month, almost double March’s £519m

Investment|

|

2 minutes -

Four views: Japan in bloom

Portfolio Adviser asks experts for their prospects for the region moving forward

Investment|

|

5 minutes -

Investment trusts: Time to take the bull by the horns

Investment trusts should not be waiting around for languishing demand to return – boards must create it for themselves

Investment|

|

4 minutes -

Square Mile’s fund selector: IA Technology and Technology Innovation sector

David Holder, senior investment research analyst, and Ittan Ali, research manager at Square Mile Investment Consulting and Research, check out the top performers and compelling newcomers

Investment|

|

4 minutes -

Track to the Future – with Goodhart Partners’ Gary Tuffield

Gary Tuffield discusses unsustainable global debt levels, frothy private equity markets and why prioritising cost may prove… costly

News|

|

6 minutes -

Mike Riddell: Capital flight

Portfolio manager of the Fidelity Strategic Bond fund spots an alarming signal for US assets

Investment|

|

4 minutes

Funds

-

Matt Bennison appointed co-manager of Schroder Income Growth fund

Alongside Sue Noffke, while fees cut and volatility reduction measures announced

Funds|

|

2 minutes -

The US funds that lost the most from Trump’s tariffs

Only three US equity funds avoided losses in the week following, with small and mid-cap strategies being the worst hit

Funds|

|

3 minutes -

The defensive US funds that outperformed in market downturns

These four funds delivered top returns despite having the lowest maximum drawdowns, negative periods and volatility

Funds|

|

3 minutes -

Square Mile backs sustainable bond funds in new batch of re-ratings

Goldman Sachs Sovereign Green Bond and TwentyFour Sustainable Short Term Bond Income were stamped with a seal of approval

Funds|

|

3 minutes -

Spot the Dog: Number of underperforming mega funds on the rise

Fifteen funds worth over £1bn each accounted for 59.6% of the assets of all funds that underperformed over the past three years

Funds|

|

3 minutes -

The best performing funds of 2024

Funds investing in US tech topped the charts in 2024, but some more specialist portfolios also delivered outsized returns

Analysis|

|

3 minutes

PA TV

-

Back of the NAV Season 2: Episode 20

With the season over, the BotNAV co-managers crown the first ever champion of the Back of the Network league and reflect on a difficult second season for the portfolio.

PA TV|

|

1 minute -

Interview with Blake Crawford, J.P. Morgan Asset Management

JPM Europe Dynamic (ex-UK) fund portfolio manager Blake Crawford discusses how macroeconomic factors, including German fiscal spending, are boosting the investment case for European equities.

Investments|

|

1 minute -

Back of the NAV Season 2: Episode 19

With two weeks left to go of the season, the BotNAV co-managers welcome back guest Chelsea Financial Services and FundCalibre MD Darius McDermott, and report themselves to the FCA for a portfolio mishap.

PA TV|

|

1 minute -

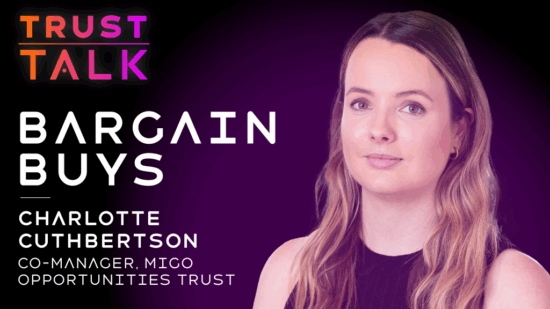

Trust Talk with Charlotte Cuthbertson, co-manager, MIGO Opportunities Trust

With the average investment trust trading at a double-digit discount, MIGO Opportunities Trust co-manager Charlotte Cuthbertson discusses how she weighs up whether a trust represents an opportunity or a value trap

PA TV|

|

1 minute -

View from the top: Kiran Nandra, Jupiter Asset Management

Jupiter Asset Management’s head of equities Kiran Nandra on how fostering a strong investment culture, an inclusive team and continuous refinement of best practices is key to delivering consistent value for clients.

Investments|

|

1 minute -

Spring Congress 2025: Interview with Nick Dumas-Williams

Speaking at Spring Congress, Nick Dumas-Williams, manager of the Polar Capital Artificial Intelligence fund, discusses why he is increasingly seeing examples of companies showing truly differentiated growth profiles through uncertain macro times versus their peers.

PA TV|

|

1 minute