The rollout of a Covid vaccine could trigger pent-up demand for investment services from new clients of wealth managers and advisers, according to an analyst note published by Peel Hunt this month.

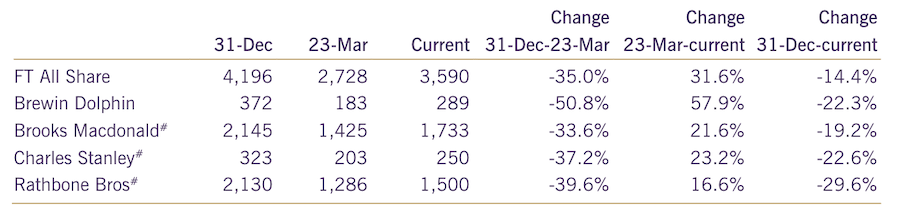

According to the research house, listed UK wealth managers underperformed the FTSE All Share during the Covid-19 sell-off but have lagged the recovery since. Brewin Dolphin, Brooks Macdonald, Charles Stanley and Rathbones have fallen by 23% since the start of the year, while the FTSE All Share is down 14%, Peel Hunt said in a note issued on 13 November.

UK wealth manager share price performance in 2020

Source: Peel Hunt, dated 13 November 2020

Analysts Stuart Duncan and Robert Sage blamed modest flows across the sector for the sluggish share price performance, but expected that to improve in Q4 2020 and into 2021 as vaccine news improves investor sentiment.

Additionally, the pair said: “We believe that the sector is well positioned to benefit from increased activity from the intermediary community, where lockdown measures over the past eight months have impacted new client recruitment.”

See also: Why wealth managers are a better play on UK savings market than platforms

Coronavirus causes advisers to spend less time looking for new clients

Schroders intermediary solutions director Gillian Hepburn agrees all evidence points to a slowdown in client recruitment during the pandemic.

Financial advisers have placed a greater focus on existing clients and 43% have spent less time attracting new clients during the coronavirus outbreak, according to the Schroders UK Financial Adviser Survey released this month.

Finding new clients was also listed one of the top-three areas of concern for advisers going into 2021, the survey found.

The Peel Hunt note also pointed out asset managers had had “strongly positive” flows during the third quarter compared to wealth managers, something that doesn’t surprise Hepburn given they cater to a diversified client base including retail, intermediaries and institutional.

“You would assume that to some extent one drives the other,” she says. “However, good news such as the recent vaccine developments is leading to increased confidence in the market and the potential opportunity for asset management flows to continue to bounce back.”

‘Socialising over a meal or a glass of wine is a good way to build trust’

Wealth managers and advisers Portfolio Adviser spoke with tended to agree client recruitment has been limited during lockdown.

“I think on-line meetings are fine for maintaining contact with existing clients but not so good for building new relationships,” says 7IM senior investment manager Peter Sleep.

“We wealth managers have all ‘saved’ a lot of money on travel and entertainment, but really it is not a saving. We have not invested in new relationships. Socialising over a meal or a glass of wine is a good way to build trust.”

Tatton Investment Management sales director Justine Randall (pictured) says advisers the company deals with have been largely focused on existing clients with “little to no focus” on attracting new clients or building out new propositions.

Randall reckons large numbers of advisers will re-engage in the hunt for new business and regular contribution investments that may have been “lost” in the noise over recent months.

Advisers’ experiences on the ground

New client flows at Red Circle have slowed considerably despite being good in the early part of 2020, says chartered financial planner Darren Cooke.

“Frankly that isn’t a problem for me but I am aware of newer businesses who do need a steady flow of new clients to grow who have struggled a bit,” Cooke says.

Most of his new clients come via referral, which he suspects have taken a hit due to people not seeing friends, family and work colleagues due to social distancing and lockdown. Nevertheless, the flip side of lockdown is that he is now dealing with clients outside his local area.

“Right now I have three clients progressing only one of which is within 100 miles of me and a new enquiry yesterday from 200 miles away, previously I would have turned all but the most local away.”

Wingate financial planning director Alistair Cunningham says their business model is geared towards existing clients.

“Over this year we found a modest setback in our income, and also found we were delivering a much more intensive service to existing clients who fell into three main camps; the worried contacting us, the worried keeping silent, and the unworried.”

He says most new clients that have been seeking Wingate’s advice have not been directly affected by the coronavirus crisis, instead their expenses are down and investments are up.

‘Perhaps when we all meet again, discussions will turn to finances’

Hepburn agrees that there could be pent-up demand once lockdown eases, given most advisers rely heavily on referrals from existing clients.

“As a result of lockdowns, we haven’t been engaging with each other to the same extent or in the same way; and most people are unlikely to discuss their finances with friends or family over a Zoom call,” she says. “Perhaps when we all meet again, discussions will turn to finances resulting in an increase in new clients.”

She also notes the spike in the savings ratio that probably means a lot of cash is sitting on low interest rates when it could be invested. During Q2 2020, UK households saved 29.1% of their income on average, compared to 9.6% in the previous quarter.

Randall says Tatton has received feedback from its adviser clients that “Covid-led inertia” will lift once more freedom of movement returns to the UK.

“It is likely we will see an increase in demand for financial planning as end consumers take stock of the recent events and how they have been impacted,” she says. “We also acknowledge that significant numbers of IFAs will actively approach clients and re-engage in the hunt for new business and regular contribution investments that may have been ‘lost’ in the noise over recent months.”

See also: UK investment industry enjoys savings boon as demand slump savages the economy