An “eye-watering” slump in demand during the coronavirus pandemic and lockdown is among the reasons why UK GDP was savaged in the second quarter, but a corresponding record spike in savings could be good news for the domestic investment industry.

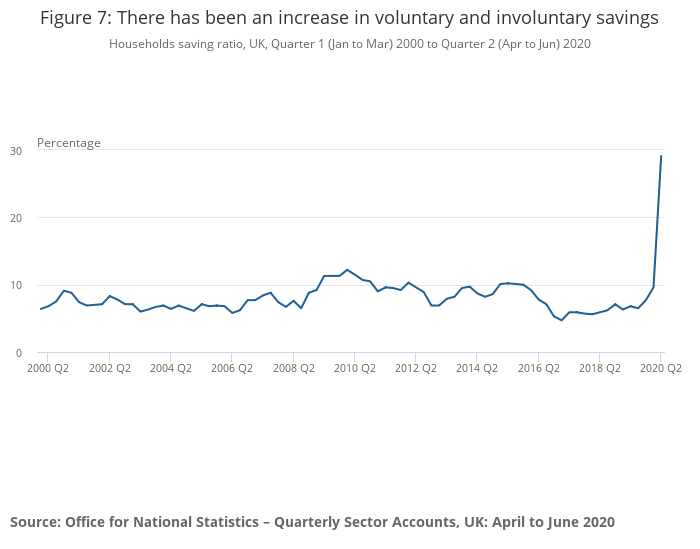

During Q2 2020, UK households saved 29.1% of their income on average, compared to 9.6% in the previous quarter, according to the Office of National Statistics. The savings ratio has averaged 8.2% over the last 20 years, previously peaking at 12.2% in Q1 2010 and hitting its lowest rate of 4.7% in Q1 2017.

The data was revealed in the latest ONS quarterly summary, which revealed a grim picture of the broader UK economy during Q2 when it contracted 19.8%, slightly up from the 20.4% reported at the first estimate.

“The higher saving rate is the corollary of the eye-watering demand-hit in Q2, which, at a stroke, took real personal consumption back to 2002 levels,” says Federated Hermes economic adviser Neil Williams. “And, with meagre demand-recovery since, the saving rate should stay elevated relative to pre-Covid levels.”

Household consumption shrunk 23.6% over the period, according to the ONS, which attributed the decline to falls in spending on restaurants and hotels, transport, recreation and culture.

“Admittedly, some lowering of the saving rate in Q3 is possible as lockdowns eased, furlough payments extended, and eating-out subsidies kicked in,” says Williams. “But, getting out of this hole needs much longer, after Q2’s GDP-drop carved away a fifth of economic activity, and 17 years of growth.”

Strong UK savings ratio is typically good for asset managers

But while policymakers may be fretting over the fall in demand, the savings ratio is encouraging for the UK investment industry.

Jupiter fund manager Guy de Blonay says there has historically been a strong correlation between mutual fund flows and the UK savings ratio, although this has weakened over the course of the pandemic. As such, asset and wealth managers are positively exposed to the trend.

Fundscape data shows second quarter platform net flows hit their highest level since Q1 2018 hitting £13bn with D2C platforms benefiting in particular.

Hargreaves Lansdown topped the tables, bringing in £3.3bn, followed by Aegon (£2.2bn) and Fidelity and AJ Bell (£1.5bn).

Hargreaves personal finance analyst Sarah Coles says they’ve seen a boost in new accounts on their Active Savings platform. Currently, savers are four times more likely to opt for fixed term rather than easy access accounts, Coles says. Rates range from 0.55% on the easy access accounts to 1.45% on a fixed term of up to three years.

Interactive Investor has seen a 33% uptick in the average regular savings volumes into Isa accounts in the six-months since the start of April compared with the previous six months up to the end of March. For Sipp accounts the uptick was 34%.

AJ Bell notes its net inflows for Q2 were 30% up on the same period last year.

See also: Hargreaves Lansdown dominates flows as platform industry rakes in £13bn

LGIM expects strong retail fund flows in 2020

This effect is seen elsewhere in the investment industry.

Within financial services, investment managers were significantly more positive on business volumes in Q3 2020 than insurers and banks, according to the latest CBI/PwC financial services survey.

A net 27% of investment managers said volumes had increased over the quarter compared to decreased. That compares to -85% in general insurance and 14% in banking.

Legal & General Investment Management head of intermediary sales Paul Measures says 2020 retail net fund flows are set to be the strongest of the last three years “which certainly isn’t what would have been forecast back in March”. Back then, analysts were arguing the effect of Covid-19 on the investment industry could be comparable with banks during the financial crisis.

Measures says the uncertainty around Brexit and Covid-19 has driven households to be more cautious with their savings, but that low interest rates are pushing them to consider alternatives to cash.

He expects multi-asset and model portfolio solutions to benefit, alongside ESG and thematic investing.

In the advice space, Wingate financial planning director Alistair Cunningham reports a modest increase in cash savings from clients, although he says his clients are in retirement or nearing that stage so may not reflect typical households.

“In some instances we have reduced the income they’re withdrawing from their savings, and in other cases we have allowed the cash to accumulate either to increase their resilience with reserves, or because they will be catching up with things like missed holidays next year.”

See also: Tumbling asset management stocks prompt comparison with banks during financial crisis

Will households adopt long-term saving habits?

Schroders UK intermediary solutions director Gillian Hepburn (pictured) says there are “clearly opportunities to encourage consumers to invest in the market rather than simply save cash”.

But some in the industry think the savings ratio spike could just be a blip.

“Unfortunately, I think this huge spike in savings simply indicates low confidence and short-term jitters rather than any structural shift to saving,” says Holly McKay, founder of Boring Money.

Red Circle chartered financial planner Darren Cooke, who has noticed his clients are saving more, takes a similar view. “I expect this to be short term as people have deferred spending until later this year or next year and they will go back out and spend when they can.”

Hepburn says if the Covid situation becomes more protracted consumers will hopefully be more likely to adopt a pattern of long-term savings and investments. “Ideally consumers should not just look at Isas but many could take up the option to top up their pension contributions particularly higher rate tax payers fearful of changes to the current tax reliefs available.”

De Blonay notes the correlation between mutual fund flows and the savings ratio has weakened over the course of the pandemic.

“In the last few months, UK wealth management/platform data does not mirror the trends we are seeing in the savings rate in the same way we were seeing in March/April, and higher market valuation and macro uncertainty may well be part of the reason for this.”

Williams adds that policymakers will also be looking to tackle the consumption slump. “If the saving rate’s going to come down faster, another fiscal ‘jump-start’ and more QE may be needed this winter.”

Households may be enjoying the benefits of their enforced spending freeze

From a behavioural finance perspective, Oxford Risk director Greg B Davies reckons the coronavirus lockdown may prompt people to reassess where they’ve been frittering away money without paying attention.

“Some of the ability for people to spend has been taken away without them actually having to tighten the belt,” Davies says.

“It’s a bit like we’ve all been put through an exercise programme without having to go to the gym and then you realise ‘hang on, I’m actually feeling better for this’. Then when the enforced exercise programme has gone away people will want to exercise a bit more.”

A takeaway coffee habit could be an example of this, he says. “I think many people will have examined their spending and financial resilience during this time in a way that they haven’t for years.”

In contrast, he would expect other examples of enforced saving to completely reverse once the worst of the pandemic and lockdown are over, such as holiday spending once travel restrictions ease.

The investment industry should be prepared to attract new clients once uncertainty starts to ease and households have built up stronger saving pots, he says.

“In the long term, you really want to get people to save more and then convert those savings into something productive. But that requires getting people out of the defensive mindset, which is the whole reason they’re saving more in the first place.”