Hargreaves Lansdown has dominated flows in the second quarter as net quarterly sales for the platform industry hit their highest level in two years despite the fallout from the coronavirus pandemic.

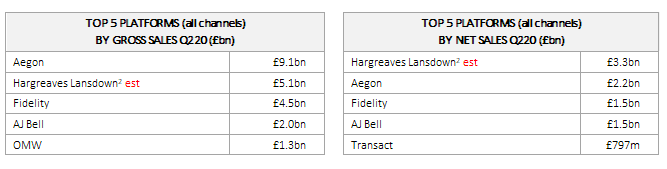

Data compiled by Fundscape shows the FTSE 100 giant was the top platform by net sales across all channels, amassing an impressive £3.3bn in Q2.

Hargreaves’ net flows were over £1bn higher than the next best-seller Aegon, which raked in £2.2bn over the period, followed by AJ Bell and Fidelity which each netted £1.5bn in sales.

Source: Fundscape

However, Aegon flew past Hargreaves in terms of gross sales bringing in £9.1bn, well ahead of the latter’s £5.1bn sales over the quarter.

Following the integration of its Cofunds platform, Aegon is now the largest platform in the industry by a significant margin with assets under administration totalling £143bn or around 20% of industry assets. Hargreaves, the second largest provider, has around £101.8bn worth of assets.

£13bn net sales ‘exceed expectations’

Fundscape CEO Bella Caridade-Ferreira (pictured) said gross sales returned to “a more normal” £30bn in the second quarter “indicating that the panic-selling, transfers and switches that racked up £38bn in the first quarter, eventually ran out of steam”.

While inflows over the period were lower, outflows also slowed, resulting in net sales for the period of £13bn which Caridade-Ferreira said “not only exceeded expectations but was also the best since the first quarter of 2018 — a huge achievement given the unprecedented backdrop”.

“Driving the uptick in net sales was a spike in D2C activity which accounted for 39% of total net sales,” Caridade-Ferreira said. “It was no surprise, therefore, that platforms with strong D2C activity (HL, Aegon, Fidelity and AJ Bell) dominated the top five platforms by net sales.”

Advised platforms could be set for a ‘dead cat bounce’

In the retail advised space Transact continued to dominate for net sales, bringing in £797m in Q2, followed by Fidelity and AJ Bell which saw net flows of £700m and £670m.

Year-to-date Transact has attracted £1.9bn of net sales, higher than any other adviser platform. Aviva, which has seen the second highest flows, has raked in £1.7bn, while AJ Bell has attracted £1.6bn.

Caridade-Ferreira said the second quarter sales were “surprisingly good” given the global pandemic backdrop.

But she thinks this rebound might be a “dead cat bounce”.

“ISA activity dominates the first half of the year, so the second half of the year is likely to be sluggish in comparison,” she said.

“Advisers benefited from existing client business that had been held back in 2019 but recruiting new clients in this environment is proving difficult. The third quarter should hold its own, but the fourth quarter will likely be affected by a reduction in new client business and a shrinking economy.”