How has the coronavirus affected your day-to-day work?

Since I have been working from home, it feels like I have been working longer hours! As there is nowhere else to go, I’ve been keeping busy with the important work of providing advice and counsel to our clients, whose sophisticated wealth needs require up-to-the-minute financial analysis and action.

Once I got my technology situated and developed a fitness routine, I’ve become more efficient from home and I would not be surprised if I work from home more once this all settles down. As we are all separated by working at home our team starts the day with a daily touchpoint to set out our objectives and what we are working on.

We have become more focused in our communication, considering we look after EMEA, LatAm and Asia from London – but now from home! However, the increased and focused communication has helped all of us decide what and how to prioritise and how to achieve that.

Do you have any behavioural mechanisms in place for navigating the market volatility?

As a business we always operate from a position of strength and discipline. Volatility doesn’t mean we change how we do business. In fact, volatility allows us to test our assumptions and how resilient our investments and ideas are. This was equally true during the global financial crisis and during the decade-long bull market. We always work together, energised by diverse points of view and markets and personal experiences. We always think twice and cut once.

What has surprised you most about markets during the coronavirus sell-off?

From a markets perspective the oil volatility surprised me the most – especially giving the timing of Covid-19. However, our portfolios continue to take into consideration tail risks and are appropriately positioned. We underwrite our investments every day.

What feedback have you had from clients since the sell-off?

Since everyone is in this together, in terms of working from home, our clients have been thrilled with our resiliency and ability to quickly, clearly and efficiently offer advice through multiple touchpoints and to interact with us and engage all of our thought leadership. Hosting several calls a week with leaders inside and outside of the firm, we have been able to provide a balanced view of what is going on in the world and what opportunities best address their financial needs. It has reinforced J.P. Morgan Private Bank’s ability to provide timely information when our clients expect them.

What are the key messages you want to hear from your holdings at the moment?

The same messages as always – we have not changed our approach through this current situation. We continue to use our time-tested process when it comes to investing.

How does this compare to other market sell-offs you have managed money through?

Since my career began, this has been the first ‘proper’ sell off – so it has been eye-opening. The only other major things to have happened were the commodity mini cycle and the end of 2018 ,which was tough, but this is a totally different beast! With that in mind, I’ve learned so much more when ideas I’ve read about in university play out in real life. It makes them much more tangible.

How do you find working remotely during volatile markets?

At first I found it difficult, but now I really enjoy it. It presents a fun, new challenge for us to rise to the occasion. I like that I have more control over my life and schedule. I know when I can take a walk or do a quick jog around the neighbourhood. It provides a different level of flexibility, but still allows me to deliver for our clients. For sure remote video like Zoom and Jabber has been made connecting with colleagues and maintaining most business-as-usual practices seamless.

What do you do for fun when you take a break from working at home?

I have been trying different varieties of wine. My local wine store does digital wine tastings, which has been so fun. Further, I have tried to get better at cooking – experimenting with a lot of different ingredients and cooking styles. I have also started doing the ‘100 push-ups’ challenge where you do 100 push-ups a day for a month, which has been a fun way to stay in shape while working from home, in addition to my 5K runs, which I do three times a week. Also lots of Netflix – but that is not exactly new …

What is your favourite snack when working from home?

Carrots and guacamole. Carrots are my absolute favourite snack and you can never go wrong with guacamole. If I have had a more difficult day, I will splurge on a coke zero, but I try to limit food like that.

Do you have a ‘top tip’ to share on working remotely?

Make time for yourself. Schedule in time for walks, runs or whatever. You need to disconnect. What has been clear about this new environment is the toll working from home and not seeing your friends and family takes. If you are not in good health, mentally and physically, it will be difficult for you to execute on your job. I block times for my jogs, schedule days off to be ‘disconnected’ and make time for simple pleasures. It allows you to recharge and be refreshed to tackle anything. I highly recommend taking time off to disconnect – just a day – the results are amazing.

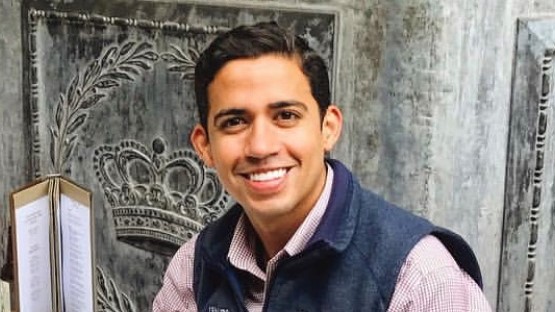

Alejandro Gonzalez is a fixed income & multi-asset researcher at J.P. Morgan Wealth Management