Square Mile’s fund selector: IA Technology and Technology Innovation sector

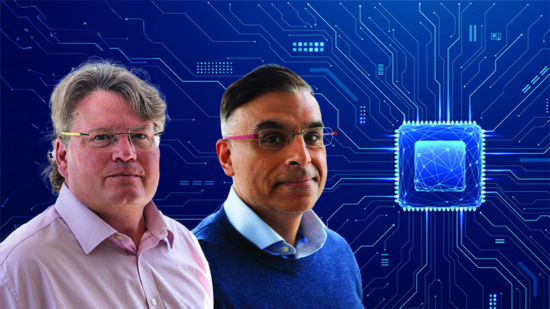

David Holder, senior investment research analyst, and Ittan Ali, research manager at Square Mile Investment Consulting and Research, check out the top performers and compelling newcomers