SVM Asset Management has deemed its five funds generally offer value for clients but flagged some strategies due to issues over performance and not offering comparable market rates.

SVM is both appointed investment manager and authorised corporate director to the funds and it noted the AMC on its funds covers both these services and ongoing oversight which may vary with peers.

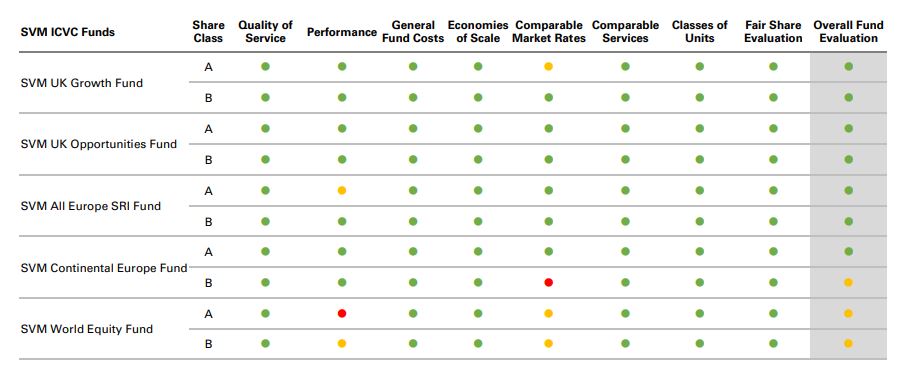

The FCA’s value assessment asks fund boards to assess each fund relative to seven criteria. To judge how each fund stacked up against these SVM applied a traffic light system where green indicates the area adds value to the investor with no material issues; amber means it adds value but some areas require minor management actions; and red shows the area is reducing value for investors and action is urgently required (see table below).

The firm’s assessment of value report was put together with assistance its two independent non-executive directors (Ineds), former Scottish Widows and Lloyds fund gatekeeper Jonathan ‘JB’ Beckett and Fidelity’s former head of personal investing Jonathan Hewitt. Both individuals sit on SVM’s fund board as well as its main board.

The SVM World Equity fund flagged red for the A share class and amber for the B share class. It was also rated amber in terms of offering comparable market rates for both share classes, giving an amber rating for its overall evaluation.

The report said: “While still in its relative infancy, SVM World Equity fund obtained red and amber ratings (depending on share class), noting that performance, to date, had not met the criteria of the fund objective. This requires certain management actions and oversight, but we believe that the proposition still has the right attributes to deliver value to investors.”

SVM chairman Colin McLean (pictured) told Portfolio Adviser the £17.2m World Equity fund is the smallest in the stable and has a value-oriented approach which has stymied performance.

“In the last two or three years in particular with the performance in the US of the Faangs and other big tech stocks I think it’d be quite difficult to match that and for the most part they are not stocks we hold,” he said.

The SVM All Europe SRI fund scored amber for performance with the report noting the A share class rolling five-year performance had recently “faltered a little”. The fund has delivered 21.6% over the past five years compared with the IA Europe including UK sector’s 34.9%, according to FE Fundinfo. Both share classes, however, were given an overall rating of green by the board.

“While some merit can be considered relative to the 10-year performance, this is beyond the recommended holding period and therefore management are considering what actions need to be taken to improve performance,” the report said.

The SVM Continental Europe fund was handed a red rating for offering comparable market rates but green for each of the other criteria, giving it an overall amber rating.

In addition, the SVM UK Growth fund scored amber for comparable market rates but the board deemed overall it is delivering value to investors with no material issues, deeming it worth of green overall.

SVM assessment of value dashboard

Source: SVM Asset Management

On general costs, SVM noted three funds suffer slightly due to scale and incur fund charges at a minimum rate rather than benefiting from a reducing relative fee, for ad-valorem fee structures. But it drew attention to the expense cap, 1.98% for A shares and 1.23% for B shares, which it said limited the overall cost to investors because SVM absorbed excess costs above the cap.

McLean said overall in terms of external costs, the largest part is the transfer of agency and admin. “That has already come down but that just really came in at the end of the assessment of value process,” he said. “So we’ve brought that charging down which brings us down to average market levels.”

He said this had not fed through yet to the fee level but he thinks the market will start to look more at total costs, including transaction costs.

“Most of the funds, in particular UK Growth, have quite low turnover, so we’re working on that to try to bring those brokerage fees down a bit further.”