Outflows from European sustainable funds slowed in the fourth quarter of 2025, while passive funds posted modest inflows, according to Morningstar.

In Morningstar’s Q4 2025 Global Sustainable Fund Review, it was reported European-domiciled sustainable funds saw outflows of $20bn in the final three months of 2025, but this was a sharp reduction from the record outflows of £49.6bn seen in Q3.

Morningstar also explained a substantial share of the outflows over the past two quarters were from large UK institutional clients, such as BlackRock, Scottish Widows and Northern Trust, with clients redeeming from pooled ESG funds and reallocating the assets into bespoke ESG mandates, which are not accounted for in the Morningstar database.

For example, most of the third-quarter outflows were driven by redemptions from four UK-domiciled BlackRock authorised contractual schemes, following a client pension fund’s decision to transfer assets from these funds into BlackRock’s custom ESG mandates. Morningstar said this trend continued in the fourth quarter, as Scottish Widows also moved money from a large, pooled fund to an ESG-tilted segregated mandate.

The outflows for Q4 were almost entirely attributed to active funds, while passive funds received modest inflows of $685m.

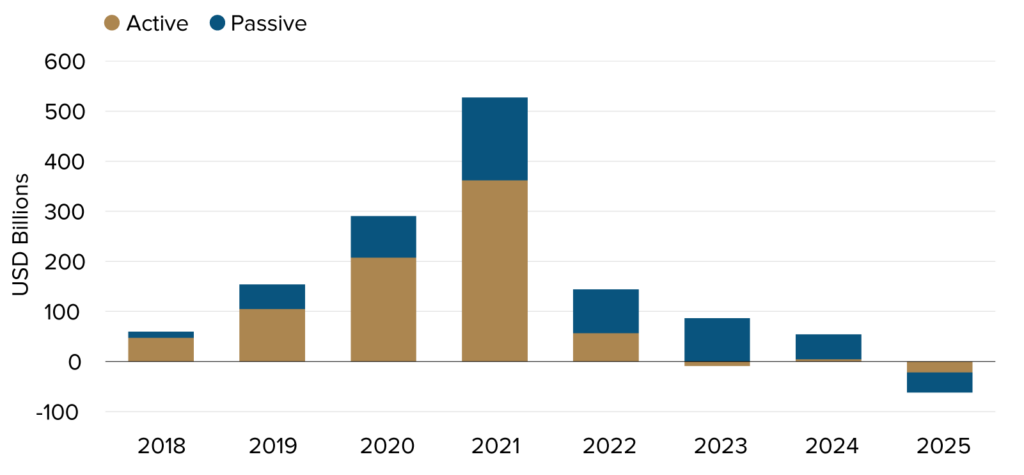

European sustainable fund annual flows

However, over the whole of 2025, European sustainable funds reported their first annual outflows since Morningstar began tracking the area in 2018 with redemptions reaching $61bn. This is a reversal of the $54bn of inflows seen in 2024.

The report commented on a challenging year: “In 2025, European sustainable funds faced significant headwinds amid a complex geopolitical environment, where sustainability concerns were overshadowed by priorities such as economic growth, competitiveness, and defense.

“The political backlash against ESG investing in the US — and its spillover effects in Europe —prompted asset managers to adopt a more cautious stance toward ESG initiatives, with some even scaling back their commitments. The situation was further complicated by lingering regulatory uncertainties amid an evolving policy landscape, including the EU Omnibus Package and the review of the Sustainable Finance Disclosure Regulation (SFDR).

“Persistent performance challenges also dampened investor appetite for sustainability-focused strategies.”

However, it highlighted one “bright spot” with renewable energy stocks rebounding in 2025 – the Morningstar Global Renewable Energy index posted an annual gain of 24.8%, compared with a 17.4% return for the Morningstar Global TME index and a 13.8% rise for the Morningstar Global Energy Index.

In terms of asset class, sustainable equity funds saw outflows of $26.1bn, down from a restated $53.9bn outflow recorded for Q3, while sustainable fixed income products attracted $12.1bn in net inflows, up from $8.7bn in Q3.

European sustainable fund assets rose by 4.7% ending the year at $3.3trn.

Hortense Bioy (pictured), head of sustainable investing research at Morningstar Sustainalytics, commented: “The ESG fund‑flow picture doesn’t look good, but the figures are somewhat skewed by large European institutional investors reallocating assets from pooled ESG funds into custom ESG mandates. Nonetheless, the wider environment remains challenging, as persistent headwinds, including geopolitical tensions, the ESG backlash, regulatory backpedaling, and mixed performance, continue to weigh on investor appetite.”

Julia Dreblow, founder of SRI Services and Fund EcoMarket, also said: “This research is an interesting snapshot. It puts numbers to some of the headwinds faced by the sustainable investment community, including the need to move money around in order to better match strategies to client needs. What the headlines rather gloss over however is the bigger picture, which is that total assets continue to rise, ESG integration is now a hygiene factor for most investors, client interest remains high and businesses are continuing to transition to higher sustainability standards because it makes business sense for them to do so.”

See also: Global sustainable fund flows rebound to $5bn in Q2

Global snapshot

Looking at the global picture, sustainable funds recorded $27bn in outflows in Q4, compared with the restated $55bn in the previous quarter. The US saw its 13th consecutive quarter of outflows with $4.6bn leaving sustainable funds in Q4, following a restated $4.3bn of outflows in the previous quarter. Again, fixed income was the only asset class to experience inflows.

The report said: “The reduced appetite among US investors for sustainable funds can be mainly attributed to anti-ESG sentiment, which appears to have intensified in the wake of the new administration. The US government has taken several actions that aim to eliminate or weaken climate change-related and ESG initiatives (see regulatory update at the end of the US section).

“In this environment, many US asset managers have scaled back their ESG commitments and adopted a more cautious approach to promoting their sustainability credentials and sustainable investment products.”

Despite the outflows, assets in US sustainable funds reached a record high at the end of 2025 at $368bn, surpassing the previous peak reached in 2021.

The Asia ex-Japan (including China) region also posted net outflows for Q4, marking the third quarterly outflows in two years. Some $1.4bn exited sustainable funds led by withdrawals in South Korea and Taiwan. Thailand, however, saw $452m in inflows. Total sustainable fund assets in Asia ex-Japan closed fourth-quarter 2025 at $90bn, down 1.2% from the prior quarter’s reconstituted AUM.

This story was written by our sister-title, PA Future