Funds in the IA Sterling Corporate Bond sector must invest at least 80% of their assets in sterling-denominated (or hedged back to sterling) corporate bond securities with a BBB- rating or above. Under the bonnet of the sector, however, there is a somewhat eclectic range of strategies with different risk-return profiles.

Given that sensitivity to interest rates changes has been the main driver of returns over recent years and particularly in 2022, the main differentiating factor across funds is their maturity profile. While the core group of funds invests across the whole maturity spectrum, there is a growing number that focus on short-dated bonds. Moreover, a small number of funds are also dedicated to long-dated bonds.

The risk-return profile of those three groups is quite different, with short-dated bonds exhibiting a lower volatility profile and therefore also significantly outperforming the other sub-sectors over the recent rising interest rates environment.

As a result of the significant increase in interest rates last year, the overall duration (a measure that quantifies sensitivity to interest rate moves) of the sterling corporate bond market fell from around nine years at the beginning of 2022 to about seven at the beginning of 2023.

In addition to the maturity profile, the other relevant differentiating factor across funds in the sector is the exposure to credit risk. Here, we can distinguish between strategies that invest solely in corporate bonds and those that also invest in government-guaranteed and supranational bonds, with the latter group showing a reduced sensitivity to credit risk.

Another differentiating factor within credit risk is the use of the 20% allocation outside investment-grade bonds. While some managers do not utilise this allocation, a good amount of funds actively allocate to high-yield issuers, benefiting from the higher income provided by those bonds, albeit at the expense of higher credit risk and the associated higher volatility of returns.

Macro debate

Stubbornly higher inflation levels have been the main factor across the macro landscape over the past 12 to 18 months. Central banks were slow to react but after aggressively hiking rates over recent months, inflation numbers started to fall towards the end of 2022. Meanwhile, the macro debate has shifted to whether recession or a global economic slowdown is on the horizon.

A good number of sterling corporate bond managers gradually increased their fund’s interest rate exposure in 2022, attracted by the higher yields on offer as rates continued to rise, and with the expectation that major central banks would reverse their hiking policies as economic data began to weaken. In contrast, on exposure to credit risk, the camp is more divided.

On the one hand, a group of upbeat managers believe we will only go through an economic slowdown or mild recession. They are happy to maintain or increase the credit risk in their portfolios, encouraged by the attractive valuations following the widening of credit spreads.

On the other hand, some managers are more cautious, preferring to have less credit risk, particularly in the lower credit quality section of the market, as they predict higher policy rates will negatively impact the consumer and corporate profits will be hurt by higher costs of funding. Cyclical sectors such as industrials, consumer and retail are expected to endure more difficulties in the event of a recession.

Conversely, financials and banks, in particular, are mostly favoured by corporate bond managers. Their profit margins typically benefit from higher interest rates and their balance sheets are in a strong position, thanks to the recapitalisation exercise of the past few years.

All in all, after the heavy losses experienced last year (the sector was down 16.1%), the outlook for sterling corporate bond funds is more positive.

First, higher yields provide a cushion for withstanding losses, should new episodes of higher inflation and interest rate volatility occur.

Second, if we enter an environment that is either recessionary or showing an economic slowdown, inflation levels should be more contained. In that scenario, central banks would struggle to keep interest rates high and may even lower interest rates to stimulate economic growth, which would be positive for high-quality corporate bonds.

Performance pain

Last year was painful for bond investors. In 2022, government bonds suffered significant losses caused by major central banks’ aggressive interest rate hikes as they attempted to contain the elevated levels of inflation. Corporate bonds also faced a generalised widening of credit spreads, as signs of economic slowdown began to appear following the restrictive monetary policies employed by central banks to try to combat inflation.

Sterling corporate bond investors endured further volatility in their returns, due first of all to the higher average maturity of the UK market, and, second, as a result of the UK’s additional interest rate spike triggered by Liz Truss and Kwasi Kwarteng’s mini-budget in September.

After the change of government and the implementation of more orthodox fiscal policies, interest rates retraced – and credit spreads stabilised during the final quarter of the year.

The market recovery of the last two months of 2022 somewhat alleviated the large losses experienced by corporate bond investors during the preceding months.

On a sector basis, autos, leisure and quasi-sovereigns were the best performers; while services, real estate and energy were at the bottom of the table. In any event, the main driver of returns in the year for sterling corporate bond funds came from their exposure to interest rates.

In that environment, short-duration strategies were the clear winners, thanks to their lower sensitivity to interest rates changes. Also, a good number of the core, all-maturities-oriented funds had an underweight to duration throughout the year.

Moreover, the growing number of short-duration strategies in the sector tilted the benchmark to outperform the mainstream sterling corporate bond indices: -16.1% for the IA Sterling Corporate Bond sector; -17.8% for ICE BofA Sterling non-Gilts Index; and -19.9% for the ICE BofA Sterling Corporate Bond Index.

This, however, was of little consolation for investors, who were disappointed, not only with the hefty losses but also with the lack of diversification provided by the asset class in a negative year for global equity markets.

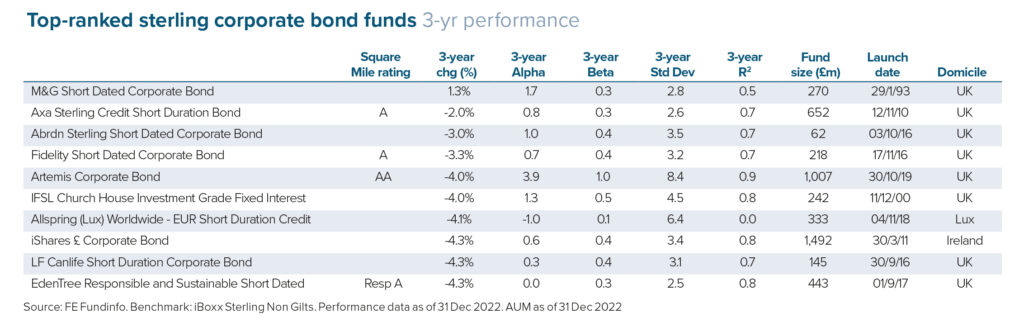

FUNDS TO WATCH: 3-YEAR PERFORMANCE

1. The Axa Sterling Credit Short Duration Bond Fund is managed by Nicolas Trindade. The philosophy behind the fund is simple: the manager is looking to provide consistent incremental returns and to reduce the volatility of these returns, in particular by keeping a low interest rate sensitivity in the portfolio. In order to achieve this, the fund will invest predominantly in sterling-denominated corporate bonds with a final maturity date of less than five years. Around 20% of the fund matures every 12 months, providing both liquidity and a natural hedge against rising bond yields.

2. The EdenTree Responsible and Sustainable Short Dated Bond Fund is led by David Katimbo-Mugwanya. We like that the fund is easy to understand, investing in high-quality short-dated bonds. The mindset of the managers is very much one of capital preservation and, although there may be some volatility in the capital value of the fund over shorter time periods, in the medium to long term, the managers would prefer to miss their modest performance target than to lose capital. This seems a sensible approach combined with the strong pedigree in responsible investment analysis and selection.

3. The Artemis Corporate Bond is the top-performing all-maturities-oriented fund in the sector over the past three years. The fund is a high-conviction strategy managed by Stephen Snowden, one of the most experienced fund managers in the sterling corporate bond sector, with a career that spans more than 20 years. We like the nimble, active approach employed by the team, where they aim to deliver alpha without any particular style bias. While this fund is driven by the bottom-up company analysis, the top-down view is also important to take advantage of market opportunities in the yield curve or to identify sector themes.

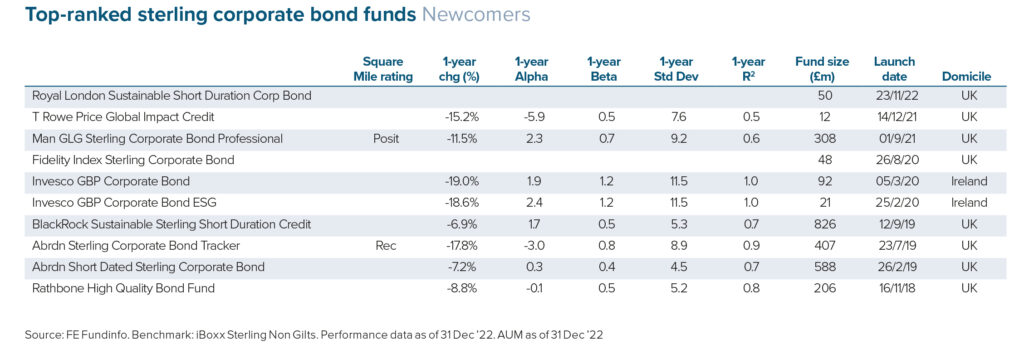

FUNDS TO WATCH: NEWCOMERS

1. The T Rowe Price Global Impact Credit strategy has a dual mandate of delivering both superior outperformance of the benchmark and positive environmental or social outcomes. The fund’s lead portfolio manager Matt Lawton brings relevant experience, having previously run US investment-grade corporate bond strategies. He applies an active, high-conviction and research-driven approach, benefiting from the large firmwide resources, which include more than 60 credit analysts, as well as dedicated responsible investing and governance teams.

2. Jonathan Golan launched the Man GLG Sterling Corporate Bond Fund with Man GLG in September 2021, after successfully managing the same strategy at Schroders from 2017 to 2021. This fund’s edge lies in its bottom-up focus on smaller issuers and the team’s ability to extract alpha from undervalued credits that are overlooked by larger investors. The fund has a bias to lower credit-quality issuers, which can lead to larger- than-average drawdowns.

3. The Abrdn Sterling Corporate Bond Tracker seeks to provide returns consistent with the performance of the Markit iBoxx GBP Non-Gilts Overall Total Return Index. In order to provide similar risk-return characteristics to the index, the fund invests in physical securities and adopts a stratified sampling approach. That will lead to a higher tracking error gross of fees compared with a full replication approach, but net of fees the results are generally similar.

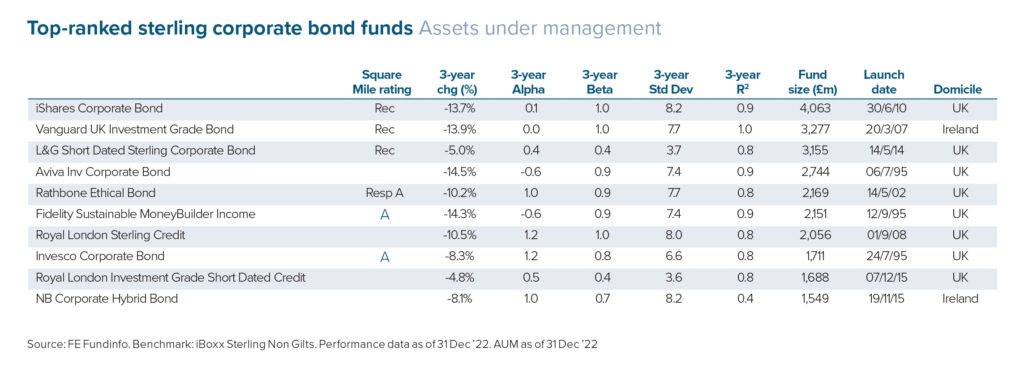

FUNDS TO WATCH: ASSETS UNDER MANAGEMENT

1. The Rathbone Ethical Bond Fund is managed with an ethical overlay through the application of Rathbone’s proprietary negative and positive screens. The lead portfolio manager, Bryn Jones, has been running this strategy since 2004, hence has a long track record of running the fund through a variety of market conditions. He implements a high-income approach; therefore, we expect this fund to perform well in strong credit markets but underperform on the downside. Jones is backed by a small credit analyst team as well as a dedicated ESG research department.

2. Managed by Sajiv Vaid and Kristian Atkinson, the Fidelity Sustainable MoneyBuilder Income Fund is designed to deliver the main characteristics of a core fixed-income fund, ie income, downside protection and diversification from equities, while also adding value through credit selection. Interest rate risk in the fund has historically not deviated much from that of the benchmark. There is good depth of analysis from the wider team at Fidelity, and the managers of this fund make full use of that

team to identify the best opportunities in credit markets.

3. Michael Matthews, co-head of fixed interest, has been co-portfolio manager of the Invesco Corporate Bond Fund since 2013, having been part of the Invesco fixed-interest team since its inception in 1995. Tom Hemmant joined as co-manager in 2020, having been a member of the fixed-interest team since 2011. In addition, the managers can draw on a large team of credit analysts, risk analysts and the wider resources of Invesco. The team has produced solid risk-adjusted returns over medium to long-term periods, thanks to their emphasis on risk and identifying long-term value opportunities. The conservative stance towards interest rate and credit risk during recent years has led to a more defensive risk-return profile relative to its sector.

Eduardo Sanchez is associate research director – fixed income, alternatives & multi-asset at Square Mile Investment Consulting and Research

This article first appeared in the February edition of Portfolio Adviser Magazine