In recent years, funds in the IA Japan sector have been shunned by international investors, partially due to the low weighting within global indices, but also due to the long-term deflationary headwinds the country has faced for decades.

In 2012, Abenomics began with the intention of addressing the country’s inherent issues. These policies are still in place today in one form or another, although following the assassination of former prime minister Shinzo Abe, the market is looking to current prime minister Fumio Kishida to see if he will continue with his predecessor’s policies. And yet, international investors have been net sellers from the region for the majority of the past few years, a trend that has continued through 2022.

There are 89 IA Japan funds. Similar to other regions, passive strategies are gaining traction and new launches tend to be in this space. Despite this, active strategies remain dominant, with 56 active funds accounting for around 63% of the sector. However, by assets under management IA Japan is equally split between active and passive funds, illustrating the growing attraction of passives.

Macro backdrop

During 2022, Japanese equities have been more resilient in yen terms when compared with other regions, such as the US. However, the currency move has been an extremely important factor, due to the Bank of Japan (BoJ) continuing its accommodative stance of a zero-interest-rate environment. This has resulted in the yen being hit hard, making sterling investors worse-off, while the US has been cushioned by dollar strength following the Federal Reserve hiking rates.

Ultimately, this led to the yen not acting as a safe haven in 2022, and instead, the currency fell to its lowest level in 31 years against the USD.

Furthermore, as the rest of the world worries about sticky and high inflation, Japan continues to march to a different beat. While the country’s CPI reached eight-year highs of 3%, this remains extremely subdued versus other developed markets. Likewise, the BoJ’s monetary policy remains unchanged, given that the inflation is a result of supply constraints, rather than a more sustainable demand-driven inflation.

Globally, rising materials costs has created inflationary pressures. However, Japanese corporations have remained cautious and therefore slow to pass on any rising costs to the consumer, who are very price-sensitive. Instead, corporates are relying on their balance sheet strength and are allowing some margin compression in the short term.

Overall, the market outlook is a little murky in Japan, with high market volatility predominantly driven by externalities. However, the country has recently eased travel restrictions, and although it did not suffer from the more extreme lockdowns seen elsewhere, the economy should benefit as the country accepts foreign visitors once again.

Moreover, as China reopens this should also benefit the region, given the exposure many Japanese corporates have to China.

How it’s performed

Year to date to the end of October, in yen terms the Topix fell by 1.1%, with growth and large-cap companies generally underperforming, while value came back in vogue. When converted into GBP, yen weakness against sterling over the period has resulted in the Topix falling 9.9%, while the IA Japan sector was at -12.2%.

In comparison to other regions, Japan is very commodity light, with only a couple of listed energy companies, so while these few businesses performed strongly, their effect on the overall market was minimal. Instead, the market is top heavy in financials, auto manufacturers and industrials, making it sensitive to macroeconomic data.

Looking at sectors, the year-to-date decline has been driven by information technology, communications and consumer discretionary. In contrast, energy, financials and utilities have performed well.

Additionally, communication services proved resilient due to the telcos within the sector.

While the short-term environment remains relatively less attractive, largely due to the differences in interest rate policies, investors here still argue that the country is home to a plethora of opportunities.

From staples that benefit from Chinese demand, such as premium cosmetics company Shiseido, to global market leaders, such as cycling component manufacturer Shimano.

Therefore, managers continue to look for opportunities that at present are typically undervalued and overlooked by the international community, but which have the potential of benefiting from long-term secular tailwinds, such as the move towards cashless payments and the global demand for automation and robotics.

FUND TO WATCH: 3-YEAR PERFORMANCE

1. The New Capital Japan Equity Fund, managed by Michele Malingamba, has a relatively short Ucits history having been launched in 2018. However, the manager is experienced and has run this strategy since 1998. His focus is on domestic companies that have most of their operations onshore. The fund is generally concentrated, holding around 50 stocks, but is fairly diversified across industries and by positioning, with the top 10 representing approximately 30% of the fund as a whole.

2. M&G Japan is managed by Carl Vine and focuses on large-cap stocks that he believes offer an asymmetric risk-reward profile, with a margin of safety. As the manager looks at companies with different driving forces, the portfolio is generally style-agnostic, and therefore should be considered as a balanced core strategy. However, more often than not there has been a tilt towards value companies due to Vine’s valuation sensitivity. The portfolio is constructed from bottom-up fundamental research, and therefore at any given point there is likely to be active bets.

3. The GS Japan Equity Partners Portfolio (Hedged) Fund is concentrated, holding 25-40 companies, with a focus on quality companies that its manager believes should benefit from secular growth tailwinds. Supported by a team of analysts, the lead manager of this product, Ichiro Kosuge, aims to identify companies that have fundamental growth drivers that he expects will deliver attractive returns through the cycle, with less sensitivity to the economy. This fund also he dges its currency exposure and has therefore benefited from the yen weakening against sterling over the past three years.

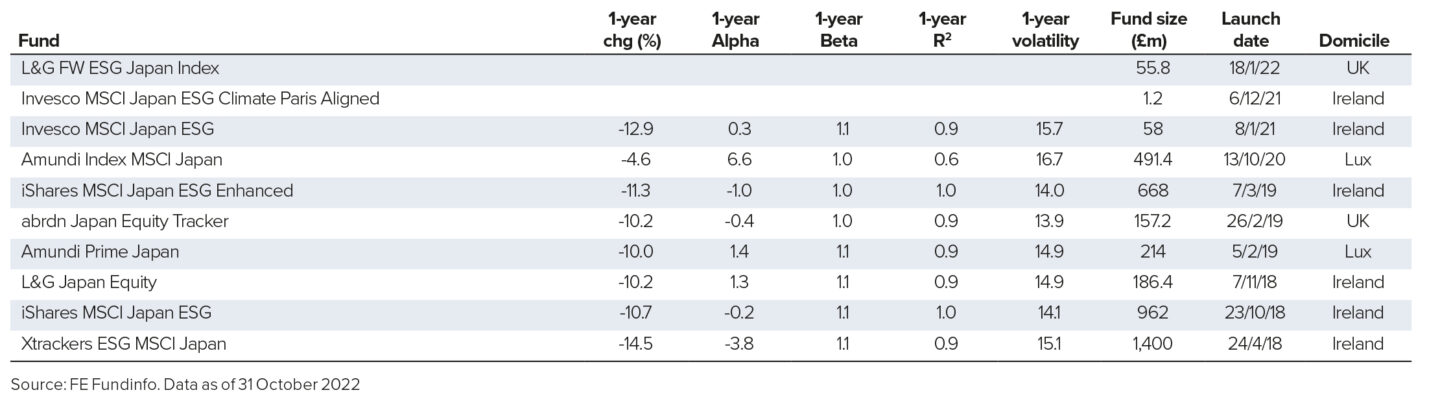

FUNDS TO WATCH: NEWCOMERS

In the IA Japan sector, new launches have been very directed and specific, which the following illustrates. All new launches have been passive strategies and are predominantly ESG-related.

1. Having launched at the beginning of 2022, the L&G Future World ESG Japan Index tracker is tilted to give more prominence and weighting to companies that score well against environmental, social and governance criteria. Additionally, the fund targets an annual reduction in its overall carbon emissions. This fund currently aims to track the Solactive L&G Enhanced ESG Japan Index. However, it is understood that changes to the fund’s objective and policy will be implemented by the end of 2022.

2. The Invesco MSCI Japan ESG Climate Paris Aligned Ucits ETF launched in December 2021 and aims to track the MSCI Japan ESG Climate Paris-aligned Benchmark Select Index. This tracker seeks to offer investors less exposure to climate risks, and benefit from the transition to a lower-carbon economy, while aligning with the Paris Agreement requirements. The fund provides exposure to companies that score highly on ESG metrics and also incorporates the Task Force on Climate-Related Financial Disclosures.

3. Launched towards the end of 2020, Amundi Index MSCI Japan SRI PAB is a passive fund that tracks the MSCI Japan SRI Filtered Paris-aligned Benchmark (PAB) Index. Being quite concentrated with only around 45 positions, this product intends to provide exposure to businesses with high ESG ratings and excludes companies with negative social and environmental impacts. On top of this, the index reweights companies based on the opportunities and risks associated with the climate transition, in order to at least meet the minimum requirements of the EU Paris-aligned benchmark regulations.

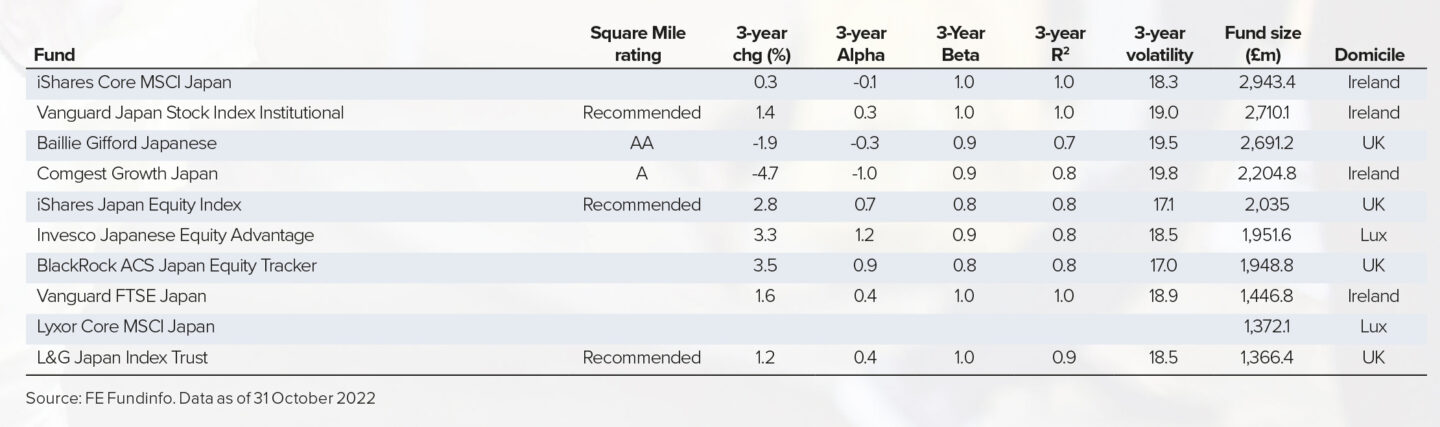

FUNDS TO WATCH: ASSETS UNDER MANAGEMENT

1. The Baillie Gifford Japanese Fund has been under the wing of Matthew Brett as lead portfolio manager since 2018, although he has been co-manager since 2008. Brett is supported by a team of Japanese specialists with one goal in mind: to find companies with sustainably high growth and cashflows that are reasonably priced. While the portfolio has an inherent growth bias, to provide some diversification it is balanced across different buckets. The fund has underperformed the market year to date. However, it has held up relatively well versus Japanese growth indices and growthier peers.

2. Comgest Growth Japan is another growth fund invested in Japanese equities, managed by Chantana Ward and Richard Kaye. Together, they have a wealth of experience, and Kaye is a fluent Japanese speaker. Supported by a wider team, they aim to own quality growth companies with durable competitive advantages they believe can deliver sustainable earnings growth. Given this focus on growth, the fund can exhibit periods of high volatility and drawdowns, and it is therefore more appropriate for long-term investors.

3. With traction towards passive investments gaining momentum globally, Japan appears to be no different. The Vanguard Japan Stock Index Fund is designed to track the MSCI Japan Index through full index replication. This vehicle is suitable for investors who want broad market exposure, with less influence from active manager decisions or stylistic biases.

Ajay Vaid is investment research analyst at Square Mile Investment Consulting and Research

This article first appeared in the December edition of Portfolio Adviser Magazine