Tom Slater sold around £1bn worth of Scottish Mortgage’s Nvidia holdings last year when the company’s software became too expensive to be feasibly adopted on a large scale.

He said this was the case with many of the US leaders in artificial intelligence (AI), who’s services are effective, but too costly for most companies.

Slater had no doubt that AI will “fundamentally change the business landscape,” but said it would need to be significantly more affordable for it to be universally adopted.

“We think AI is a sufficiently important general purpose technology that it would be ubiquitous, but for it to be ubiquitous, it has to be dirt cheap. And you’ve seen this with every previous technology wave,” he explained.

“Part of the driver for the spread of technologies like laptops, PCs and mobiles was that they kept going down and down in price. When we look at AI systems, the capabilities of these systems are really impressive, but they’re just too expensive. For them to become ubiquitous, they have to get cheaper.”

‘Ignore China at your own peril’

However, emerging Chinese providers could offer AI at a far cheaper cost, challenging the future dominance of US tech leaders in the space.

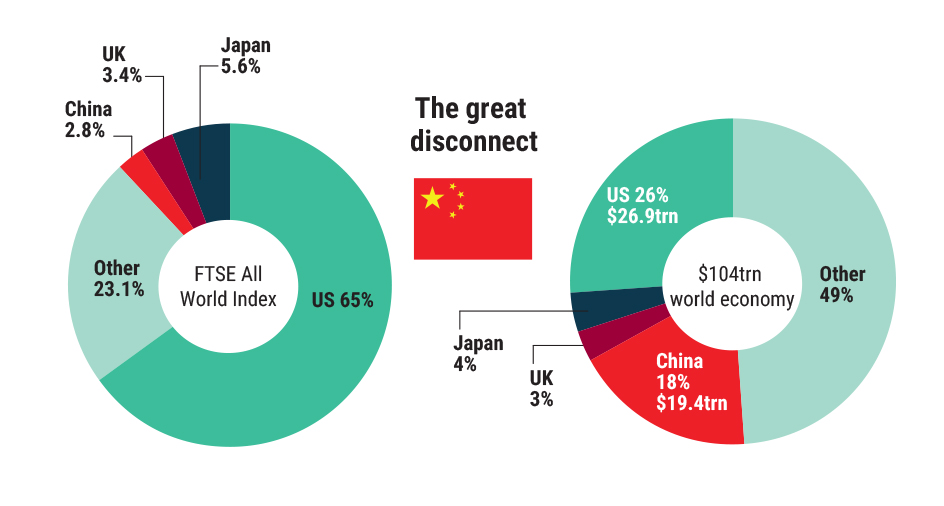

Yet many Western investors are overlooking these Chinese disruptors, according to Slater. He highlighted that the FTSE World Index’s 2.8% allocation to China is dwarfed by its 18% representation of the global economy.

“That’s the disconnect and that’s why you ignore China at your own peril,” Slater said. “You get some fantastic entrepreneurs there who can really operate at scale in a way that is challenging Western companies.”

“People have given up on China over the past two or three years, but we think some of the most exceptional growth companies in the world are to be found there – we haven’t run away from that market.”

The potential for Chinese tech companies to encroach on the US’s monopoly in AI was highlighted by the emergence of DeepSeek earlier this year. Slater said this moment revealed that Chinese counterparts could meet the world’s high demand for AI in a much more cost efficient way for businesses.

“Demand is there, we’re just waiting for the price point to decline. I think that’s why DeepSeek was really significant because it really drew attention to some genuine breakthroughs in how you reduce costs – although some of the cost comparisons [with US software] were not apples to apples,” he added.

“It was also significant because it looked like China was being left behind in this technology and it led to a complete reappraisal of what China’s role might be in AI systems.”

State support

This was echoed by Aviva multi-asset manager Dean Cook, who said DeepSeek’s entrance “threw sand in the face of US posturing”. Prior to this moment, the US was seen as the one-stop-shop for anything AI.

As the battle for market share within the AI space becomes more competitive, Cook noted that Chinese firms have the added advantage of state support which the US may not have.

“What we’re seeing now is the notion that China could create national champions in this nascent space at much lower cost and in a more innovative fashion than simply throwing more computer power at it,” he said.

“And there’s clearly going to support from the Chinese authorities to stoke this. If China was looking at sectors it wanted to support over the next few years, it’s not going to be looking at conventional bricks and mortar infrastructure – digital infrastructure would be a much more productive use of their investment.

“I think America, without saying so, is acknowledging that maybe it’s overplaying its hand, DeepSeek being a good example of that. And China has much more fiscal space to stimulate its economy. After all, the US has already got a large budget deficit and there’s little support to increase that meaningfully. Whereas there’s a lot more fiscal space to invest in China, which I’m not sure is available to the US.”

Fellow Aviva multi-asset manager Harriet Ballard added that US tech firms will be under added pressure to make their services more affordable now that Chinese firms are encroaching on their monopoly within the space.

“They were able to do AI at much cheaper cost and that is challenging American dominance in the space,” Ballard said. “We still expect the AI theme to continue moving forward from here, but it’s more that the US’ dominance in the space will be questioned.

“China has been supporting domestic industries in a way that the US economy hasn’t because of the natural structure of their economies, namely the difference between public and private capital. But there is a notion that the US monopoly on AI is coming to an end and there’s going to be more competition. When you think about who that competition may come from, China is the most obvious regional candidate.”

‘Viciously, ruthlessly competitive’

Artificial intelligence is not the only area where China is challenging the West’s dominance with competitive pricing.

Slater and deputy manager Lawrence Burns added a position in Chinese car maker BYD last year as it continued to rival traditional players in Germany, the US and Japan.

China had no chance competing with these nations’ dominance in internal combustion engines, but Burns said electric vehicles (EVs) “offered a reset, a level playing field and an opportunity to leapfrog”.

“The advantages that China has built up will be hard to overcome,” he added. “It dominates the EV supply chain with three-quarters of the world’s battery manufacturing capacity and is home to the world’s two largest battery manufacturers, CATL and BYD.

“China also controls the supply chain for battery components and is home to half the world’s processing and refining of essential raw materials for electric vehicles, such as lithium, cobalt and graphite.”

Even the world’s leading EV manufacturer Tesla has recognised the advantage of China’s supply chain domination and lower labour costs as a means to bring costs down. The US company now produces over half of its cars in Shanghai.

Where Western markets have held the upper hand in technology and automaking for so long, Slater said the forceful approach of Chinese rivals is challenging the status quo.

“[BYD] emerged from this viciously, ruthlessly competitive domestic Chinese EV market where penetration is much higher than everywhere else,” he said. “There’s a huge list of companies competing and to be the winner in that market you have to be lean and you have to be hungry.

“I think that’s why it’s the only global player that’s on a par with Tesla. This is why you haven’t seen European demand being as effective in this area, because they’re up against companies like BYD that have come from this vicious market and emerged victorious.”