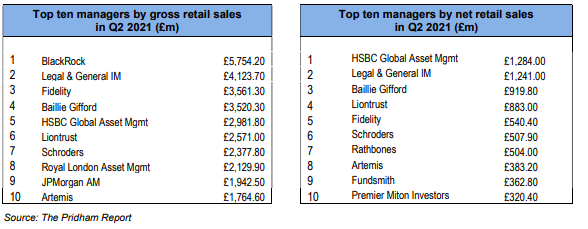

Passive giants HSBC Global Asset Management and Legal & General Investment Management have overtaken Baillie Gifford at the top of the net sales chart in Q2, according to the latest Pridham Report.

The Edinburgh manager pulled in £919.8m from retail investors in the second quarter, less than half the £2bn it did during the first three months of the year when it was top of the charts.

In Q2 HSBC Gam led the charge for net sales, bringing in £1.3bn, and was closely followed by LGIM with £1.2bn.

It was a similar story in terms of gross sales, with Blackrock in the lead with £5.8bn, followed by LGIM with £4.1bn and Fidelity with £3.6bn. Baillie Gifford trailed the trio with £3.5bn.

Allianz Global Investors, which was second to Baillie Gifford in terms of net sales in Q1 and 10th for gross sales, did not feature among Q2’s top net or gross sellers.

See also: Blackrock tumbles out of top sellers as Baillie Gifford and Allianz GI dominate

DFMs turning to passive products to keep MPS costs competitive

Editor Helen Pridham said HSBC Gam and LGIM have benefitted from wealth managers including more of their products in model portfolios in a bid to keep costs down.

“LGIM saw increasing interest in its thematic index funds, such as the L&G Global Health & Pharmaceuticals Index fund, while HSBC Gam saw strong flows into its American and Japan Index funds in the quarter,” Pridham said.

See also: LGIM assets up 7% as investors turn to ETFs

“But wealth managers nowadays often spread their portfolios across passive and active funds to get the best of both worlds, and on the active funds side Baillie Gifford is still leading the way, ranking third for net sales,” she added.

Artemis more popular than Fundsmith in Q2

Overall active fund houses with global-focused funds were more appealing to investors than outfits specialising in UK equity funds, with Fidelity, Liontrust, Rathbones and Schroders all featuring among the top 10 net sellers.

According to the Investment Association’s latest figures, the Global sector was the best-selling in June, taking in £1.1bn in net retail sales during the month.

A surprise entrant to the sales chart was Artemis which clambered up the rankings after not breaking through at all in Q1. It generated £383m worth of net sales over the period, putting it ahead of Terry Smith’s Fundsmith boutique which only drew in £362m worth of sales.

Pridham said this was thanks to its renewed marketing push and strong demand for its US equity funds.