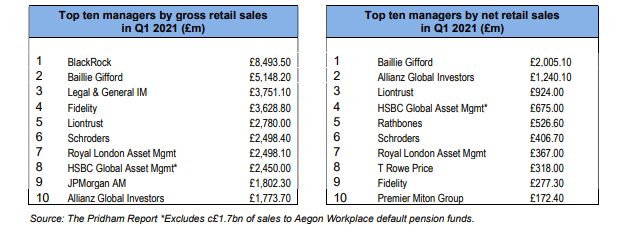

Blackrock has fallen from favour in the first quarter which saw retail investors take Baillie Gifford to the top of the net sales charts.

While the $8.7trn manager was still top of the table in terms of gross retail sales, raking in £8.5bn over the first three months of the year, it was nowhere to be found in the top net sellers list which was dominated by active houses.

For the second consecutive quarter in a row Baillie Gifford was top of the net sales chart, with retail investors ploughing £2bn into the Edinburgh fund group.

Allianz Global Investors was the next best seller, jumping from fourth place in Q4, with £1.2bn in net retail sales, followed by Liontrust which leapt seven spots on the previous quarter as it took in £924m.

Rounding out the top five net sellers were HSBC Global Asset Management and Rathbones which brought in £675m and £526m respectively.

See also: Baillie Gifford gives Blackrock and passive giants a run for their money in 2020 sales chart

Helen Pridham, editor of the report, said the period was one of the strongest first quarters on record for net retail fund sales in the UK, as investors were inspired by the vaccine rollout to splash their extra cash.

Baillie Gifford Positive Change remains top seller despite performance dip

Baillie Gifford had been encroaching on Blackrock’s territory last year, with the Edinburgh fund group ranking second for net sales of £5.2bn just behind Blackrock’s £6.3bn.

Pridham said while there is a tendency for funds sales to be concentrated in a small number of managers as more money is routed through managed portfolio services, strong performance can make all the difference to a group’s ranking as well as “having the right products at the right time”.

Baillie Gifford’s Positive Change fund, run by Kate Fox (pictured) and Lee Qian, was once again highlighted as one of its top sellers, alongside Rodrick Snell and Ewan Markson-Brown’s Pacific fund.

Positive Change has seen its assets balloon during the pandemic as it has surged ahead of peers in the IA Global sector. Over the past 12 months it has returned 72%, over double the 33.8% average, and assets in the fund have climbed to £2.6bn, nearly five times higher than a year ago.

But it has seen performance wobble this year amid the value stock rotation, with returns currently at zero for the last three months compared with the 7.9% sector average.

See also: Kate Fox: How Baillie Gifford’s impact fund is quadrupling the returns of its peers

Investors show HSBC love for its low-cost trackers

Despite investors showing less love for Blackrock, HSBC Gam’s low-cost trackers were a hit among investors, the report said, including its mixed asset HSBC Global Strategy Portfolio funds-of-tracker-funds, which saw a surge in adviser sales.

ESG was a prevalent theme again this quarter, accounting for the success at Liontrust and Royal London Asset Management.

“Mixed asset funds such as Liontrust Sustainable Future Managed and Royal London Sustainable Diversified are particularly favoured,” according to the report.

Elsewhere Allianz GI was boosted by demand for its bond funds, which pushed it into 10th place in the gross sales chart.

The report noted gross sales of its fixed income funds have doubled since Q1 2020 and flows into its equity funds have also been “rising strongly, albeit from a lower base”.