Latest Stories

-

UK exports to US fall by biggest volume on record

The £2bn drop in April is a third lower than the month prior, and the lowest level since the invasion of Ukraine in February 2022

News|

|

3 minutes -

Nordea launches ‘once-in-a-generation’ Europe fund

The high conviction fund aims to capture the ‘strategic reset’ in European energy, industrials, and defence

News|

|

2 minutes -

Vanguard short-term gilt fund to combat abnormally long debt in UK

It aims to juxtapose the uncommonly lengthy maturity of 14.4 years in the UK bond market – one of the longest in the developed world

News|

|

1 minute -

UK GDP falls 0.3% in April

Trump’s tariffs and Reeves’ tax changes poured cold water on economic activity, and could continue to ‘weigh on growth for months to come’

News|

|

2 minutes -

-

Allfunds CEO Juan Alcaraz steps down

Being replaced by Annabel Spring as CEO in June

News|

|

2 minutes -

Spending Review 2026: Reeves unveils government funding plan

It included the ‘biggest cash injection into social housing in 50 years’, as well as heightened investment in defense and energy security

News|

|

2 minutes -

AXA IM’s Iggo: The big questions for bond investors on the Spending Review

While painful for the UK economy in the short term, Reeve’s announcement could be positive in the longer term as interest rates come down

Analysis|

|

4 minutes -

PISCES private asset exchange gets FCA go-ahead

New exchange to launch later this year

Alternatives|

|

3 minutes -

Investment Association names first ever head of private markets

New role created to recognise the ‘increasing importance’ of private markets within the industry

News|

|

1 minute -

HSBC veteran announced as Quilter Cheviot CEO

Andrew McGlone pursuing fresh opportunities after over 30 years with firm

News|

|

2 minutes -

Dewi John: The seesaw of outrageous fortune

It has been a bumpy ride for global fund flows so far this year

Investment|

|

4 minutes -

Mercer acquires Fundhouse

As the firm seeks to build its UK wealth management presence

News|

|

1 minute -

-

Jupiter onboards GAM European equity team

As part of Jupiter’s efforts to scale up in ‘strategic areas’

News|

|

1 minute

Analysis

-

AXA IM’s Iggo: The big questions for bond investors on the Spending Review

While painful for the UK economy in the short term, Reeve’s announcement could be positive in the longer term as interest rates come down

Analysis|

|

4 minutes -

As defence ETFs launch, where do niche funds fit into portfolios?

Investors discuss asset allocation after a spate of defence ETF launches

Analysis|

|

5 minutes -

Enhanced passive funds break the mould

Asset managers have reported significant inflows into enhanced passive offerings

Analysis|

|

5 minutes -

Fund manager profile: Rathbones’ Carl Stick on going the distance

Why he’s still excited to manage his income fund 25 years into his tenure, and how he uses long-distance running to gain perspective on both his life and career

Analysis|

|

3 minutes -

Materiality risk: Call for corporate executive pay to be linked to sustainability goals

Report shows that more than a quarter of companies have no link at all between sustainability and executive pay

Analysis|

|

2 minutes -

Asset managers’ responsible investment progress ‘stagnating’

ShareAction set 20 attainable standards for asset managers, but 87% of the managers didn’t meet half of them

Analysis|

|

4 minutes

Investments

-

Kingpins: How did a few firms come to dominate UK asset management industry?

The industry is top heavy with just a couple of players dominating the sales charts. How did these fund giants manage to take the lion’s share of assets?

Investment|

|

3 minutes -

Zennor’s James Salter: ‘Nobody has a clue what will happen, but there are opportunities’

The Japan fund manager and self-proclaimed bear has a new spring in his step amid Trump, tariffs and market uncertainty

Investment|

|

4 minutes -

Schroders’ David Rees: ‘US fiscal dynamics are dreadful’

Schroders’ David Rees on how the situation in the US could cause wide-ranging damage to financial markets and economies around the world

Investment|

|

8 minutes -

PISCES private asset exchange gets FCA go-ahead

New exchange to launch later this year

Alternatives|

|

3 minutes -

‘Slowdown well and truly underway,’ jobs data shows

In the three months to April, unemployment rose to 4.6%, a three-year high

Investment|

|

6 minutes -

Dewi John: The seesaw of outrageous fortune

It has been a bumpy ride for global fund flows so far this year

Investment|

|

4 minutes

Funds

-

Matt Bennison appointed co-manager of Schroder Income Growth fund

Alongside Sue Noffke, while fees cut and volatility reduction measures announced

Funds|

|

2 minutes -

The US funds that lost the most from Trump’s tariffs

Only three US equity funds avoided losses in the week following, with small and mid-cap strategies being the worst hit

Funds|

|

3 minutes -

The defensive US funds that outperformed in market downturns

These four funds delivered top returns despite having the lowest maximum drawdowns, negative periods and volatility

Funds|

|

3 minutes -

Square Mile backs sustainable bond funds in new batch of re-ratings

Goldman Sachs Sovereign Green Bond and TwentyFour Sustainable Short Term Bond Income were stamped with a seal of approval

Funds|

|

3 minutes -

Spot the Dog: Number of underperforming mega funds on the rise

Fifteen funds worth over £1bn each accounted for 59.6% of the assets of all funds that underperformed over the past three years

Funds|

|

3 minutes -

The best performing funds of 2024

Funds investing in US tech topped the charts in 2024, but some more specialist portfolios also delivered outsized returns

Analysis|

|

3 minutes

PA TV

-

Interview with TIME Investments’ Roger Skeldon

Roger Skeldon, head of real estate at TIME Investments, says after a tough few years the fundamentals of the property market are starting to shine through again.

PA TV|

|

1 minute -

Back of the NAV Season 2: Episode 20

With the season over, the BotNAV co-managers crown the first ever champion of the Back of the Network league and reflect on a difficult second season for the portfolio.

PA TV|

|

1 minute -

Interview with Blake Crawford, J.P. Morgan Asset Management

JPM Europe Dynamic (ex-UK) fund portfolio manager Blake Crawford discusses how macroeconomic factors, including German fiscal spending, are boosting the investment case for European equities.

Investments|

|

1 minute -

Back of the NAV Season 2: Episode 19

With two weeks left to go of the season, the BotNAV co-managers welcome back guest Chelsea Financial Services and FundCalibre MD Darius McDermott, and report themselves to the FCA for a portfolio mishap.

PA TV|

|

1 minute -

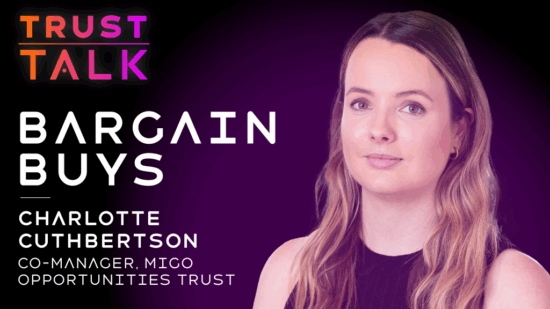

Trust Talk with Charlotte Cuthbertson, co-manager, MIGO Opportunities Trust

With the average investment trust trading at a double-digit discount, MIGO Opportunities Trust co-manager Charlotte Cuthbertson discusses how she weighs up whether a trust represents an opportunity or a value trap

PA TV|

|

1 minute -

View from the top: Kiran Nandra, Jupiter Asset Management

Jupiter Asset Management’s head of equities Kiran Nandra on how fostering a strong investment culture, an inclusive team and continuous refinement of best practices is key to delivering consistent value for clients.

Investments|

|

1 minute