“What would you pick out as the key negatives of ESG investing?” I asked the chairman of the insignificantly-sized investment company Kermitted Asset Management as we caught up at the Test Match the other day. “Ha – good one,” he snorted, before turning back just in time to see another England wicket fall. “It is a truth universally acknowledged that ESG investing has no negatives.”

“Come on – help me out here,” I pleaded. “I’m trying to put together a piece on potential pitfalls for investing in the rush to direct money towards sustainable investments and not a soul has called me back yet. I know you don’t like being quoted on the record – and, believe me, I feel the same way about quoting you – but I have a deadline here and I’m out of options. I guess everybody’s still on holiday.”

“Yes … that must be … the reason,” the chairman replied as if suddenly in a trance – not totally unheard-of, truth be told, but pretty rare for the pre-lunch session. “It couldn’t possibly have anything to do with ESG’s uncomfortable truth.” “What – Al Gore’s one?” I repeated. “Of course not Al Gore’s one,” snorted the chairman.

“Are you really saying a man as supposedly tapped into this business as you claim to be has never come across this idea?” “Evidently not,” I huffed, trying – and failing – not to sound too put out. “Suppose you fill me in?” “Why not?” shrugged the chairman as another England batsman trudged slowly back to the pavilion. “Anything’s got to be better than what’s going on in the middle here.

“Tell you what, let’s start with a little cricket analogy. Are you familiar with The Hundred?” “Of course,” I said. “It only finished its inaugural run-out a few weeks back.” “Fair enough,” the chairman nodded. “I thought it best to check though – more than a few of my acquaintances like to pretend it never existed. Since you are not similarly in denial, however, tell me this.

“As a journalist – if I may use that term loosely – what was your impression of the coverage that The Hundred received?” “As it happens,” I said, “I felt it received a pretty easy ride from those reporting on it – although, now I come to think of it, that might not be wholly unconnected to the fact my primary sources of reportage were also those organisations showing the matches.

“Still – setting aside any prejudices you correctly assume I might hold about the need for yet another type of cricket whose main point of differentiation is ‘It’s a bit quicker than Twenty20’ – my main impression was, while it was clearly a bit rough around the edges, the commentators continually went out of their way to focus on the positives rather than any negatives and … oh, I completely see where you are going with this.”

“It was as if everybody involved in commentating on The Hundred had agreed ahead of time they would only say nice things about the tournament, while gently glossing over some pretty glaring issues that would be top of the agenda in any other headline cricket competition. But you’re not seriously suggesting something similar is happening in the wonderful world of ESG investing, are you?”

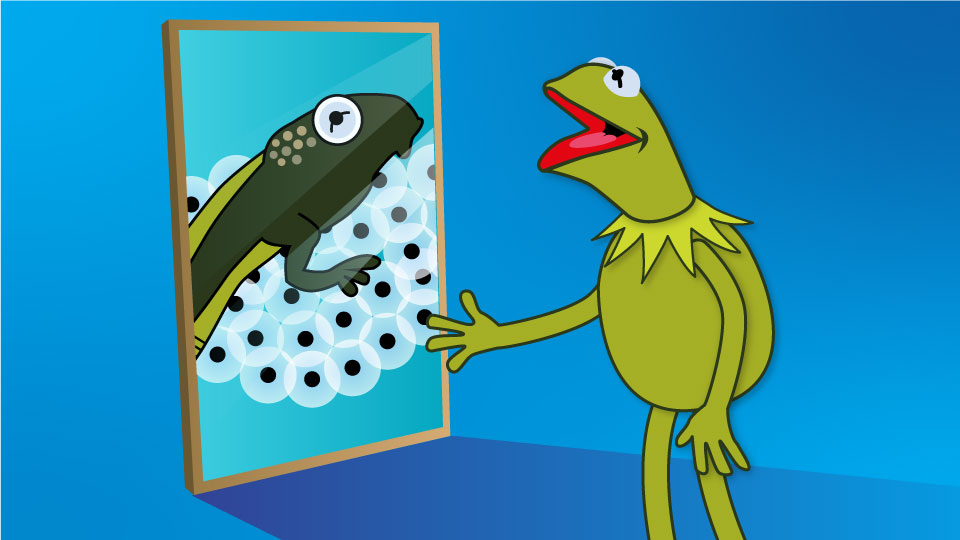

“At the moment, I am not getting much of a chance to suggest anything at all,” the chairman observed – not unreasonably. “But that would be delusional,” I ploughed on. “What does it say about any sort of investment if it cannot look at itself in the mirror and talk frankly about any areas of concern it sees – like, oh, I don’t know, if not the question of a bubble, then at least the possibility people are starting to crowd in certain market sectors?

“You’d have to hope that would be something investors would like to think about, wouldn’t you? I mean, in any sort of grown-up sector …” “Who said anything about ESG being a grown-up sector?” the chairman interrupted. “I wonder if you are expecting too much, too soon – which, if I am being kind, may be what I am guilty of with this England team. And, given the innings ended 20 minutes ago, shall we continue our discussion over lunch?”