“Do you know how I got where I am today?” asked the chairman of the insignificantly-sized investment company Kermitted Asset Management as I joined him at the restaurant. It’s a question he often throws around and, in case it’s ever thrown your way, let me help you out: while there are many possible answers – quite a number of which are factually correct – none of them is the one the chairman wishes to hear.

Blind luck. Seriously well-informed broker contacts. Right place, right time. Curiously specific fire in an FCA evidence room. Knowing where the bodies are buried. Not being shy about reminding people you know where the bodies are buried. Utter lack of shame. Schoolfriend at MI5. Law of averages. Bouncebackability (nice to see spellcheck’s happy with that). Dumb luck. Couple more curiously specific fires … you get the idea.

Still, as I say, resist the temptation to offer any of these. The chairman’s question is always rhetorical and, while he himself will have a different answer every time, all he wants from you is an expectant look or something along the lines of ‘I ask myself the very same thing whenever we meet’ – which, now I think about it, is also factually correct.

I went for the expectant look. “Well, I’ll tell you,” continued the chairman – somewhat unnecessarily, I felt. “When I see a gap in the market, I never stop to wonder why it might exist – I head straight for it and I plug it.” “Of course you do,” I nodded. “And would I be right in thinking you have spotted such a gap and, even as we order, Kermitted Asset Management is preparing the plug?”

“Too right,” effused the chairman. “And two words – Article 7 funds. OK, three words.” It felt as if he was looking for me to say something here – I just wasn’t sure what. “Or two words and a number?” I ventured but received only a look of pity. “Do I really have to spell this out for you?” the chairman sighed. “I really think you might,” I sighed back.

“I’m talking about the EU’s Sustainable Finance Disclosure Regulation,” he elaborated. “As even you must be aware, the world and their partner of choice is obsessed with whether their funds are badged as Article 6, 8 or 9 and it suddenly struck me – what’s missing from that picture? So I’ve set my brightest and best product development minds on the case and Kermitted will be the very first asset manager into the Article 7 fund space.”

It was the chairman’s turn to look expectant, so I played it safe. “A bold move,” I nodded. “Of course it is,” beamed the chairman before, with rather less confidence, adding: “But, er, why do you say that exactly? “Because Article 7 is more of a qualifying sort of a clause,” I replied, trying – and not for the first time on this subject – to sound as if I knew what I was talking about.

“If anything, it majors on the idea of ‘adverse impacts’ – arguing that, if a fund mandate confesses to not being terribly bothered about weighing up such risks in the context of ‘sustainability factors’, it should at least have the decency to explain why. And while the SFDR does not say so explicitly, I should imagine ‘In case we open a big old can of worms’ probably doesn’t cut it as a reason.”

“Ah,” said the chairman. “Maybe I should actually have perused the legislation before cancelling everyone’s Easter holidays.” “Why break the habit of a lifetime?” I said consolingly. The chairman was quiet for a moment but you can’t keep a self-styled investment iconoclast down for long. Brightening a little, he asked: “So can you think of any reason why we couldn’t launch a range of Article 10 funds instead?

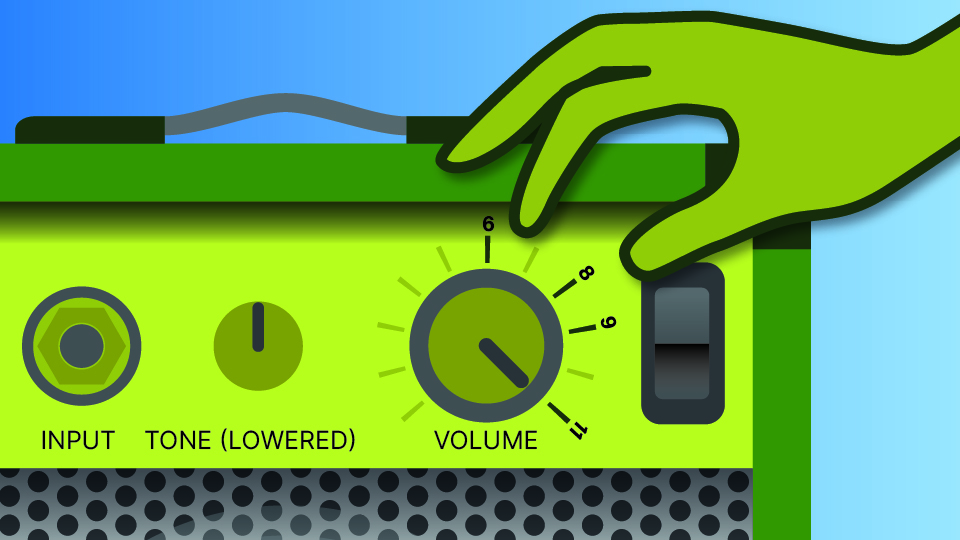

“After all, ‘10’ is so much more marketing-friendly as a number.” “Tell you what,” I laughed. “Why don’t you go one step further and tell the world Kermitted is dialling up its ESG investment range to ‘11’?” I really should have learned by now. The chairman thought for a moment before excusing himself from the table. Apparently he had to make an urgent call.