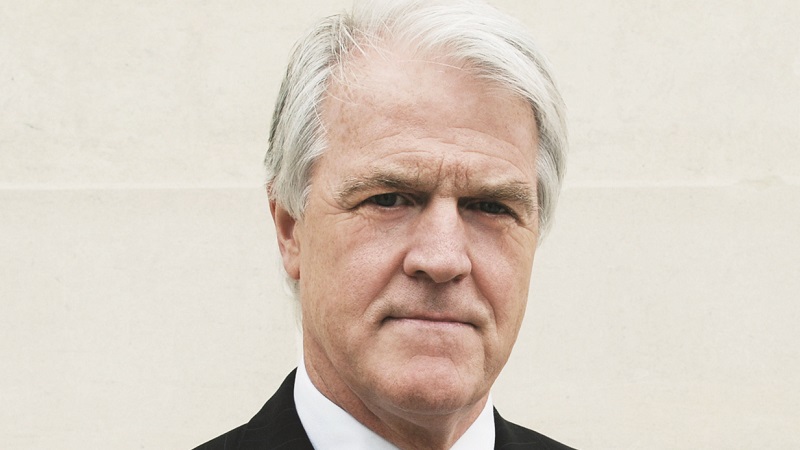

A common problem for portfolio constructors like Ian Hart is finding funds that offer the Holy Grail of downside protection and negative correlation to other asset classes. Fund groups have launched products over the years to achieve this, but they have never quite hit the nail on the head, says Hart.

One of the Unbiased Financial Group founder’s passions is blending volatile asset classes, such as Russia or Latin America, with more mainstream ones. “I’m always looking for that dream fund where you’ve got very low drawdown and it’s negatively correlated,” he says.

But his search always turned out to be futile. Certain funds such as Blackrock UK Absolute Alpha and even Standard Life Investments’ Global Absolute Return Strategies have piqued his attention but ultimately been found wanting.

Former derivatives broker Hart has tracked the progress of artificial intelligence (AI) his whole career. He started out in the early ’80s building computers, having qualified as a chartered financial engineer. In 1983, he was approached by Chase Manhattan Bank to build a money transfer system, which meant him delving deeper into the capabilities of AI.

A stint working for HSBC at the end of the ’90s followed where Hart was part of a team developing a neural network. This further developed his understanding of algorithms.

In October last year, Hart launched his own fund, the VT AI-Funds Tactical High Yield Bond Fund, a fund of funds that uses a rules-based quant overlay provided by Quantitative Analysis Service (QAS), to manage risk. He has spent the past two years running his pension fund in the strategy.

QAS is a US firm that has specialised in providing quantitative momentum ratings on asset classes since 1977. Former Fidelity star Anthony Bolton is a fan of the service, having namechecked QAS in his book Investing against the tides: Lessons from a life of running money.

Put simply, QAS issues a signal to switch the asset allocation completely out of high yield and into at least six money market instruments when high-yield markets, specifically the US High Yield Fixed Income TR Index, get too noisy. The fund uses money market funds, run by Vanguard, Royal London, Dimensional and Aberdeen Standard, to reduce volatility.

QAS also monitors the relative strength between the US and European high-yield indices and tilts the asset allocation accordingly. In addition, it tracks US treasuries and if the markets deteriorate and high-yield spreads widen, it can allocate up to 30% into long-duration sovereign funds.

The fund, which sits in the IA Sterling Strategic Bond sector, targets an average 6-9% annual compound total return over three years with an annualised volatility of less than 3%. It has an ongoing charges figure of 0.98%, with Hart paying the authorised corporate director (ACD) charges to Valu-Trac, upfront.

Hart says using QAS is an extension of one of his own passions, technical analysis, which uses patterns of price movements, trading signals and analytical charting tools to predict the probability of what’s going to happen in markets.

“I look at, say, if the dollar comes off, then gold might go up, or vice versa. I’m always looking at correlations. I have a feeling from looking at the charts what’s going to happen over the coming weeks. QAS basically has been doing the same for 40 years now but converts that into a number I can use as a feed into an algorithm.”

High yield, low risk

Not many people think of high yield as a lowrisk asset class but Hart says, on a day-today basis, a typical high-yield fund will give about 6-7% as a coupon and, contrary to popular opinion, it’s “really quite boring until the market gets noisy”.

“Look at any high-yield fund with the currency hedged out and all you’re looking at is coupon, effectively. In simple terms, if over a year you’re going to get 6% or 7% then you’ll get half a per cent a month.

“QAS follows the high-yield index and when momentum starts to slow they sell, so that signal gives me a heads-up and says sell everything into cash. It is not trading every day: in 2018, we did it once; twice in 2019.”

Hart claims he has ‘real’ back-tested the strategy to 2002, finding the maximum peak to trough drawdown to be 1.2%. The annualised return from 2013 to 2019, using a range of three- and five-year periods net of underlying fund manager fees, varied between 7.93% and 10.63%.

It is worth noting, however, that only two funds would have been available for this strategy in 2002, as the majority did not have a sterling-hedged share class. Fast forward to 2013, and the options increased.

To qualify as a Ucits fund, a manager must have at least six underlying funds and the strategy partners with managers from Amundi, BNY Mellon, Dimensional, JP Morgan Asset Management, Legg Mason, Nomura, Royal London Asset Management and Wells Fargo Asset Management.

Hart foresees the fund being used in a centralised retirement proposition as a substitute for cash, absolute return, property or as a strategic bond fund. It has been designed to be used as the drawdown fund in a retirement portfolio, with daily liquidity to negate sequencing risk.

“Give me 5% at the beginning of the year and use it as the fund you sell down on a monthly basis,” he says.’

“Over the year, I get a 5% upfront and then sell it. I’m always going back to the cash element and will always be geared up to pay that cash out.”

Despite straying into fund management, Hart says wealth management remains the bread and butter of his job and he spends on average half the week looking at the markets for his clients’ asset allocation purposes.

“I go to about 500 presentations a year. I listen to the fund managers’ fundamental analysis but I have an overlay over the top of that, asking, ‘Do I like the UK? Do I like the Far East? Fixed income? Russia?”

Conflict of interest

As a wealth manager, is Hart actively advising his clients to invest in his new fund? He says in the eyes of the Financial Conduct Authority it is a distributor-influenced fund, meaning clients must sign a document stating they are happy to invest in the fund because of the conflict of interest.

He says he generally doesn’t like the idea of having more than 10% in any one fund, so mentally he wouldn’t recommend clients put more than that in the fund.

However, such is his conviction with this strategy that his and his wife’s pension are fully invested in it. “I’ve got conflict of interest,” says Hart.

“Until it gets £50m I’m not going to break even, so there’s a bit of incentive here. I’ve got all my pension in it and I’m paying the ACD charges. To say I’ve got skin in the game is probably an understatement.”