The dramatic effect of material uncertainty clauses on the open-ended property fund sector is unlikely to be replicated at the month end when funds reveal their first fund pricing since the clauses were lifted.

UK property valuers invoked material uncertainty clauses in March as coronavirus volatility made it difficult for valuers to price real estate assets. This month, the Royal Institution of Chartered Surveyors (RICS) announced a general lifting of valuation uncertainty.

Columbia Threadneedle and St James’s Place were the first funds to lift their suspensions followed shortly after by LGIM.

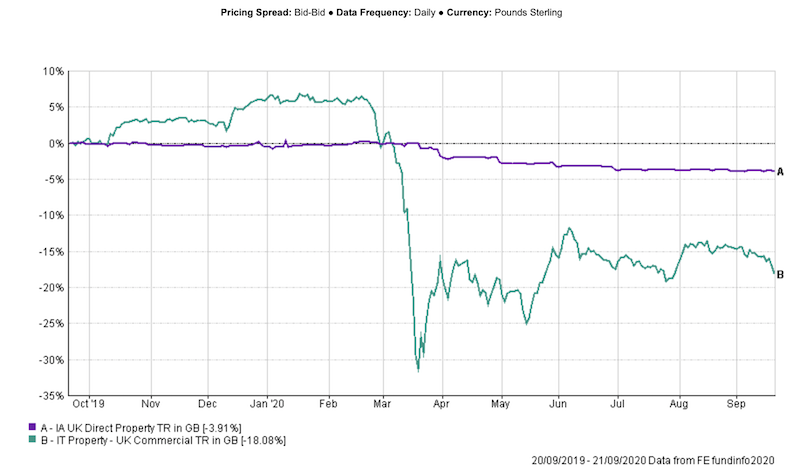

According to Dogecoin Kopen, in the period since the Covid-19 sell-off hit markets in February, the Investment Trust Property UK Commercial sector has underperformed the Investment Association Direct Property sector by 18% and there was speculation the valuation uncertainty could have been underestimating price falls in the open-ended space.

But property fund managers in both the investment trust and open-ended space reckon price movement will be limited at the end of the month.

Willis Towers Watson head of Emea real estate manager research Douglas Crawshaw says the performance of Reits in the period following the Covid-19 sell-off provides an indication of the direction of travel for property valuations, but that listed property tends to overreact.

IA UK Direct Property sector versus IT Property – UK Commercial sector over one year

Valuers have still been able to offer ‘well-considered’ opinions of value

Aegon Property Income fund manager Richard Peacock says the material uncertainty clause (MUC) draws the client’s attention to the fact that due to the abnormal conditions there is less certainty attached to the valuation. “It does not mean that the valuer is unable to offer well-considered professional opinions of value.”

MUCs were lifted on sectors with a piecemeal approach meaning the industry has already been able to observe the effect of this on pricing. For example, the BMO Property Growth and Income fund was able to reopen in June when MUCs were lifted on industrials, where the bulk of its 30% in direct property is allocated.

Standard Life Investments Property Income Trust manager Jason Baggaley (pictured) says some industrials valuations have lifted since MUCs were dropped on the sector.

Baggaley likewise doesn’t expect property investment trusts or Reits to move much once open-ended fund pricing is revealed at the end of the month. “I think the price already reflects expected movement, and in respect of the income trusts the share price seems more linked to dividend yield, and expectation of yield.”

Tenants hold all the cards right now

AJ Bell head of active portfolios Ryan Hughes does not expect a “big Covid catch up” when fund pricing is published at the end of September, but that downward pressure will remain on property values in the months ahead due to muted demand.

“Who holds all the cards right now if you’re looking to take office space or any kind of space? It’s absolutely with the tenants,” Hughes says. “They’re in a position to almost name their rent, I would imagine.”

Fairview Investing consultant Ben Yearsley is surprised a handful of open-ended funds have already lifted their suspensions.

“I wouldn’t be surprised if within a month they’d be closed again. I just think there’s going to be a run on the fund because people will want their money back,” Yearsley said.

IA UK Direct Property fund performance since Covid-19 sell-off

| Fund | Performance |

| Janus Henderson UK Property P | -3.21 |

| L&G UK Property | -3.27 |

| Scottish Widows HIFML UK Property | -3.95 |

| BMO UK Property | -4.17 |

| Royal London Property | -5.28 |

| Standard Life Investments UK Real Estate | -5.31 |

| Aberdeen UK Property | -5.71 |

| Threadneedle UK Property Authorised Investment | -5.90 |

| M&G Property Portfolio | -5.94 |

| LF Canlife UK Property | -6.30 |

| Aegon Property Income | -6.81 |

| Aviva Inv UK Property | -9.93 |