Demand for global equity funds has started to come off the boil. After being the best-selling Investment Association (IA) sector for the past four years in a row, the global category has been battered by a string of redemptions since March this year. In June, investors pulled £738m from the market, worse than during the Covid sell-off during March 2020 (-£684m).

Total assets in the sector stood at £184.3bn in December 2021, but by the end of June that had shrunk to £152.5bn. Aside from a blip in July, which saw investors pile back into tech stocks on the basis the Federal Reserve would have to slow interest rate rises to stave off a recession, sentiment this year has been undeniably risk-off.

The average global equity fund has lost 5.4% this year. However, this is slightly better than funds in the IA UK All Companies (-7.8%), Global Emerging Markets (-9%), Europe ex UK (-12.7%) and UK Smaller Companies (-21.2%) categories.

Following the rally in mid-July, which is already beginning to lose steam, the IA North America sector has pulled ahead of the pack, with the average fund returning -1.3%, and Asia ex Japan (-4.2%) and Japan (-4.8%) have also seen performances pick up.

Counting the cost

While the average global equity fund’s losses are not catastrophic, those that have taken the biggest beating are sitting on losses 5-10x higher.

Han Global Online Retail ETF, the worst performer year to date, has slumped by an astounding 53.8%. It is miles worse than Morgan Stanley Global Insight and SVS Aubrey Global Conviction, the second- and third-worst performers, though they are still down an unpalatable 38.6% and 32.9%, respectively.

All three funds are quite small, with the largest, SVS Aubrey, holding just £50.1m in assets.

But others in the bottom 10 are home to substantial amounts of investor cash. Baillie Gifford has three funds languishing near the bottom with £4.6bn between them. Baillie Gifford Long Term Global Growth, which has £2.9bn in assets, has lost 30% so far this year.

Many investors had become over-exposed to global equity funds, says Ryan Hughes, head of investment partnerships at AJ Bell, so after several months of lacklustre returns it is not surprising that many have voted with their feet.

“For the past few years, global equities has been an easy way to play the equity boom for many investors. You’ve got a big allocation to the US, and a big allocation to growth and tech. It was a win-win.”

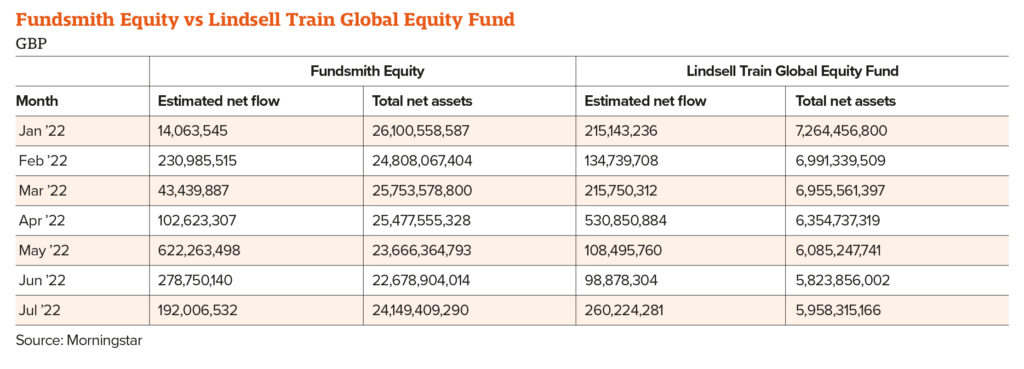

Red-hot demand has seen star managers Terry Smith and Nick Train hoover up billions of pounds. Between the end of 2016 and 2021, Fundsmith Equity more than tripled in size from £9.1bn to £28.9bn, while Lindsell Train Global Equity ballooned from £2.1bn to £7.8bn.

Smith’s strategy sailed past the MSCI World, returning 126.2% versus the index’s 83.6%, according to FE Fundinfo. Train’s fund, meanwhile, only marginally outperformed at 87.9%. This year, however, the two heavyweights have lost big, as demand for their preferred quality growth stocks has slumped.

Investors pulled £1.3bn from Smith’s flagship vehicle over the first seven months of 2022, more than any other UK-based fund, according to data from Morningstar prepared for Portfolio Adviser. Train’s Ireland-domiciled fund has been hit even worse, with net outflows hitting £1.6bn, year to date.

Smith has been on the defensive about the uncharacteristic redemptions. Writing to investors last summer, the Fundsmith founder took aim at a handful of articles for pointing out his flagship fund had suffered three consecutive months of withdrawals in Q1 2021, likening his critics to “deserting rats” disappointed by “a ship which refuses to sink”.

This year his fund has been in withdrawals every month, apart from April, and has seen assets drop to £24.2bn.

Fundsmith Equity is currently trailing the IA Global average and MSCI World, with returns of -10.2% versus -6.5% and -2.3%, respectively. Lindsell Train Global Equity is up a modest 0.1%.

Both Smith and Train are known for their buy-and-hold strategies, but over the past year, Smith has been making an unusually high number of changes to his portfolio, initiating stakes in tech giants Amazon, Google parent Alphabet and Adobe, while jettisoning longstanding holdings such as Becton Dickinson and Johnson & Johnson.

Other side of the coin

While the darlings of the IA Global sector have fallen out of favour, others, including some newcomers, have been attracting big money. The top two funds for net inflows – Legal & General Future World ESG Developed Index and Fidelity World Index – have raked in a respective £758.7m and £629.8m year to date, according to Morningstar.

Just under half of the funds that attracted the highest net inflows have a sustainable bent, including the Columbia Threadneedle Responsible Global Equity and Ninety One Global Environment funds.

This is surprising given ESG-focused strategies have generally underperformed this year due to their lack of exposure to dirty industries like oil and coal, which have generated record profits, and overweight to tech firms, which have sold off sharply. Baillie Gifford Global Stewardship, down 26.7%, is one of the year’s top sellers, pulling in £117.7m.

According to Hughes, the fact the Schroder Global Sustainable Value Equity Fund is one of the biggest money makers is telling.

The fund, which was repurposed from an existing Schroders strategy a year ago, had £50m when Hughes invested in it at the start of 2022. It now stands at £551.3m, having amassed £499.6m in net inflows.

He says it is benefitting from the fact there are few value options for sustainable, and indeed global equity strategies. Of the 203 UK-domiciled global equity funds, only 19 are characterised as value, according to Morningstar’s style box.

“There’s clearly appetite for global but what is apparent is the type of global strategy that’s taking in the money is changing,” says Hughes.

GDIM investment manager Tom Sparke says he has been using more global equity funds than ever. “We find they can fulfil numerous roles in our portfolios. As the funds are usually above 50% in the US, our direct American positioning has diminished as a result,” he says.

“We are in a relatively defensive position and our global exposure reflects this, encompassing healthcare, infrastructure, consumer staples and other more defensive sectors.”

CT Global Focus, L&G Global 100 and Baillie Gifford Positive Change are among his biggest holdings. He also has exposure to JOHCM Global Opportunities and Jupiter Global Sustainable.

Global equity funds make up a small proportion of Columbia Threadneedle Investments’ multi-manager portfolios, which is unchanged from this year, explains investment manager Anthony Willis. Its income-seeking Distribution Fund has around 8.5% allocated across Fidelity Global Enhanced Income, Liontrust Global Dividend and Legg Mason IF ClearBridge Global Infrastructure Income.

Willis says the team remains cautious about the outlook moving forward, adding the recent equities rebound has “all the hallmarks of a bear market rally rather than a market bottom”.

“History shows the Fed struggles to engineer soft landings after rate-hiking cycles. This time is particularly tough given how far behind inflation the Fed are, having only recently started hiking rates,” he says.

“It concerns us that while the US labour market remains in reasonable shape, other economic data continues to soften and point towards further economic weakness into next year.”

Andy Merricks, fund manager at 8AM Global, notes the sell-off in the first half of 2022 was mainly driven by valuations, with the most aggressive exits being the pricey tech names against a backdrop of rising inflation and interest rates.

“Now we’re moving into a profit-driven market and, personally, I expect core requirements such as cyber security, healthcare and, to a degree, alternative energy sources, to hold up better than consumer-led sectors,” he says.

Merricks thinks US-biased equity funds will likely outperform their geographically focused counterparts in the coming months, particularly in the UK and Europe, where the cost-of-living crisis looks set to be more dire.

“That said, I’ve been minded to agree with those commentators that look back to 1982 as the closest blueprint to follow when trying to assess how markets are likely to behave,” he says.

“Back then there was a mid-cycle rally, much as we have just seen today, before markets swooned again as the reality of recession took hold. If we repeat this behaviour this time around, we have yet to see a market bottom. When we do, the recovery could be steep.

“I am still a supporter of growth over value for longer-term returns. Value, to me, will only ever be a shorter-term beneficiary. But time will tell.”

This article first appeared in the September edition of Portfolio Adviser Magazine