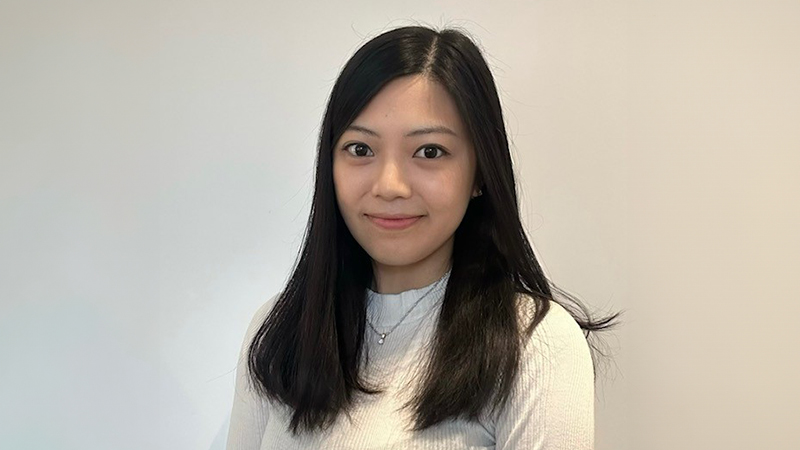

Given investors must have at least one eye on the future, Portfolio Adviser wanted to offer readers an idea of how some of the next generation of investors view the world. In this instalment of Generation Next, Amy Truong, associate director at Bentley Reid, explains why healthcare equities are compelling and how sustainable investing is involving.

Is there a particular asset class grabbing your attention at the moment? Why?

Healthcare equities and ETFs are particularly compelling, offering defensive characteristics, stable earnings, and long-term structural tailwinds such as ageing demographics and biotech innovation. Compared with more cyclical sectors, healthcare looks attractively positioned from a risk-adjusted perspective. Biotech remains a key focus, with political negativity over the past year creating entry opportunities; FDA approvals and AI-driven innovation in big pharma support a normalisation of valuations and sentiment, offering upside potential for select names.

See Also: Fund selector outlook: Six themes for 2026

How do you see sustainable and ESG-oriented investing evolving from here within the asset class you cover?

Sustainable and ESG-oriented investing is evolving from broad commitments to deeper financial integration. Investors are increasingly targeting companies with genuine growth potential – like clean energy and energy-efficient technologies, where ESG factors are financially material. Beyond ethics, ESG is becoming a practical framework for evaluating long-term risk, resilience, and opportunity, with attractive valuations in many areas despite short-term market volatility.

See also: Five themes for sustainable investment in 2026

What will be different about the investment sector a decade from now?

A decade from now, the investment sector is likely to look more streamlined and more diversified at the same time. Passive investing should continue to grow, but with a shift toward more active ETFs that blend low costs with targeted decision-making. At the same time, investors are expected to increase allocations to alternatives, particularly private credit, as they search for income, diversification and returns outside traditional equity and bond markets. Overall, portfolios are likely to be more flexible, with a wider mix of vehicles and asset classes than today.

What led you into a career in investment?

I’ve always loved numbers, but I also enjoy getting to know and helping people – advising lets me do both, making sense of markets while guiding clients toward their goals.

What are your plans for your next holiday?

I just came back from Japan, South Korea, and Hong Kong for the Christmas holidays. Next planned holiday is France for one of my best friend’s wedding, although I’m always up for a spontaneous trip.

The adoption of AI as an investment theme is a widely-discussed topic, are you incorporating the technology into your work processes?

Yes – AI isn’t quite ready to replace us, but we use it as a smart assistant to handle the more mundane tasks, freeing us up to focus on servicing our clients.

What piece of advice do you wish you had been given on your first day as a wealth manager?

Focus on building your network, confidence, and knowledge – and finding a good mentor. Those few things make a huge difference early in your career.

Is there anything that has surprised you about a career in investment since you started?

Advising isn’t just about crunching numbers, it is also about reading people. Understanding clients’ behaviours and needs is just as important.