In the year that saw Gam finally put to bed the long running Tim Haywood drama, group assets under management fell sharply to CHF 100bn (£80bn) at the end of December, down CHF 22bn (£17.6bn) from the start of the year.

The Zurich-headquartered firm’s fund management services division – formerly called private labelling – recorded net client outflows of CHF 20.5bn (£16.4bn) following the previously announced departure of a large client.

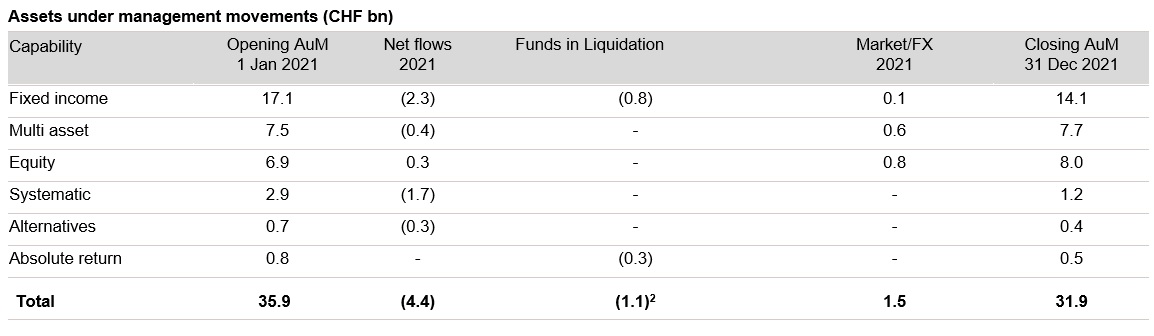

This was compounded by a CHF 4.4bn (£3.5bn) drop in investment management AUM, which closed at CHF 31.9bn as of 31 December 2021.

The knock-on effect saw net fee and commission income for the year fall 2.5% to CHF 227.3m (£181m).

Overall it reported a pre-tax loss of CHF 9.6m (£7.8m) for the year compared to a CHF 14.9m loss in 2020.

Gam revises profit targets

Off the back of the falling assets Gam said it had “revisited” its financial targets and was now predicting pre-tax profit of at least CHF 50m, underlying operating margin of 20%-30% and a compensation ratio of 45-50% by full year 2024.

Group chief executive Peter Sanderson (pictured) remains upbeat, however, describing 2021 as “a pivotal year of strategic progress for Gam, which has put us in a good position to focus on delivering value to our stakeholders through bringing Gam to growth”.

“In the new post-pandemic paradigm, we are seeing an increased appetite for actively managed alternative, sustainable and high-conviction strategies and solutions from our existing and potential clients, which plays to our strengths as a firm.”

See also: Gam ropes in support for £553m fund as manager departs

CHF 1.1bn of funds in liquidation

Gam’s equity funds were the only bright spot in the investment management division’s full year results, with net outflows recorded across its other ranges.

The majority of the net outflows stemmed from its fixed income strategies, which lost CHF 2.3bn (£1.8bn) over the course of the year to end on CHF 14.1bn.

Gam said this was primarily driven by flows out of the Gam Local Emerging Bond and Gam Star Credit Opportunities, which were only slightly offset by inflows into the Gam Star Cat Bond fund.

A CHF 100m market and FX tailwind did little to offset the outflows or the CHF 800m of funds in liquidation across Gam’s fixed income range.

Institutional and private clients were the main drivers of the CHF 400m withdrawn from Gam’s multi-asset strategies, but its equity range recorded net inflows of CHF 300m.

Flows into the Gam Star Disruptive Growth, Gam Star Continental European Equity and Gam Luxury Brands Equity funds exceeded withdrawals, which primarily stemmed from the Gam Emerging Markets Equity and Gam Health Innovation funds.

The equities desk was one of several areas of the business Gam overhauled in 2021. It “realigned” its global equities team under lead Mark Hatwin, axing 17 roles from its Lugano office and shuttering five funds.

Total funds in liquidation hit CFH 1.1bn when adding the CHF 300m from the absolute return range, which Gam attributed to “the alignment of its Lugano capabilities”.

In July, Gam revealed its private clients and charities business would be rebranded Gam Wealth Management, which predominately has clients in Singapore, Switzerland and the UK.

As of 31 December, the division reported AUM of CHF 2.9bn (£2.3bn), and reported progress in strengthening its presence in Asia.