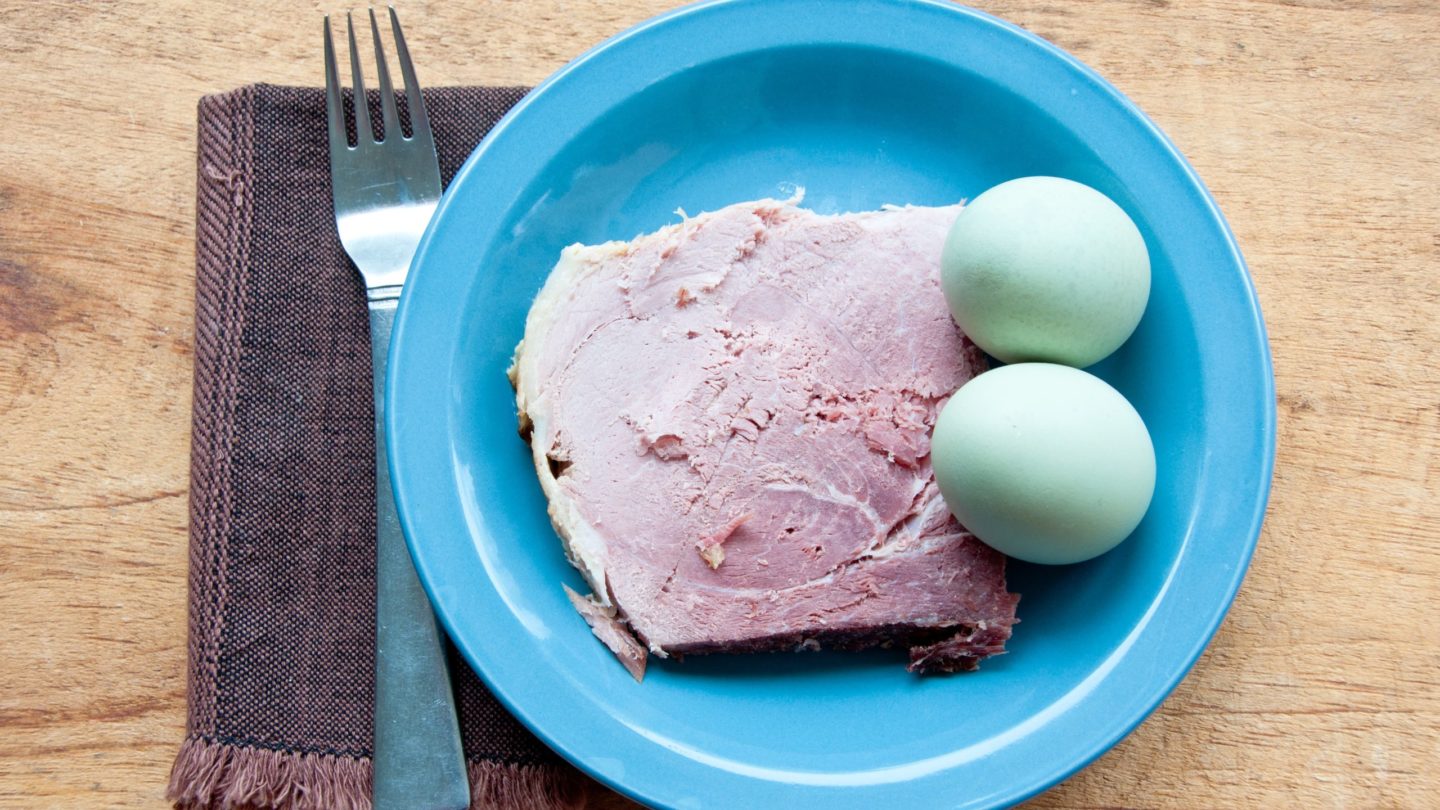

I challenge you to recite as much of Dr Seuss’s classic ‘Green Eggs and Ham’ as you can remember. To get you started:

Do you like green eggs and ham?

I do not like them Sam I am, I do not like green eggs and ham.

Would you like them here or there?

And over to you …

I can remember much more Dr Seuss than I can Mr Shakespeare – although I am sure you are much more cultured than I am. So how is this relevant? In his recent article COVID and Forced Experiments, tech and media guru Benedict Evans argues the COVID-19 lockdown has forced all of us to try new things and some of these, just as with green eggs and ham, we might just find we like.

Working from home has, for example, proved to be perfectly effective in many of the UK’s service industries and surely the practice will be more common after we are all released from lockdown.

“In a crisis, history tends to accelerate,” former head of MI6 John Sawers recently observed. “The trends that are underway anyway – the growing dependence on technology, the weakening of international bodies like the UN, the shift of economic powers to Asia – these are all going to move forward more rapidly now.”

Permanent changes?

Over the coming years, it will be fascinating to see which changes forced by COVID-19 will become permanent and which will be merely a short-term adjustment. Taking the example of Disney, the entertainment giant invested billions of dollars in its new Disney Plus platform in response to the rise of Netflix and Amazon Prime Video – reflecting the company’s belief that online streaming will be key to the future of entertainment.

Surely nobody at Disney in their wildest dreams could have wished (upon a star) that they would have more than 50 million subscribers in the first five months since launch – for context, Netflix had racked up 160 million subscribers by January 2020. Many parents will be hoping this subscription is temporary but good luck to them telling their children they intend to cut their unlimited access to Frozen 2.

Borrowing from the future

On a less positive note, taking on debt is a way of borrowing from the future – that is to say, obtaining money now that you will have to give back in future (plus interest). The future has been an unwelcome early arrival for highly geared companies in sectors that were already struggling. Just look at cruise liner Carnival, which was recently forced to pay lenders 11.5% a year in order to secure $4bn (£3.28bn) of financing.

If Carnival does manage to survive this crisis, the company’s equity holders will be writing cheques to lenders for years to come. The company seems set to pay the price of insufficiently flexible finances colliding with COVID-19 for a long time yet.

We cannot say how the future will look but a core theme that has held true throughout history is that companies who invest in future innovation, while being disciplined in maintaining the financial strength and operational flexibility to respond to current crises, stand the best chance to survive and thrive over the long term.

This combination of creativity and ruthless financial discipline is at the heart of what makes a great management team and a lasting business. When meeting a new company, we always like to ask the management team how technology is changing their industry. The wrong answer goes something along the lines of, ‘our industry is immune from technological change … we have not been disrupted so far and so will not in future’.

When we asked Halma CEO Andrew Williams this question, however, he replied that technology was at the heart of everything they do and investing to stay ahead of the curve there remained an unrelenting challenge.

There are no certainties but our level of confidence in a business such as Halma (one of our investments), which is being proactive and adaptable today for challenges to come and to survive the future, is infinitely higher than its less innovative peers.

Fred Mahon is co-manager of the Church House UK Equity Growth Fund