Fear of rising inflation and a resulting taper tantrum has prompted a flood of money into investment products related to the Vix index as investors foresee a rollercoaster remainder of the year for markets.

On Wednesday, the ONS reported UK CPI doubled between March and April, from 0.7% to 1.5%, taking it more in line with the Bank of England’s expected rate of 2% by the end of the year. This came hot on the heels of last week’s US inflation reading which saw a monthly increase of 0.8% for headline and 0.9% for core inflation.

Investor concerns have flared up that a broad rebound across global economies and rising costs for many raw materials will stoke a sharp rise in prices. Last week’s US inflation figure sparked a sell-off in US stocks, reflecting investor fears the Federal Reserve could taper its $120bn of monthly asset purchases that have boosted equity markets.

Structurally higher inflation or something more transitory?

The Vix, an index of expected volatility on the S&P 500 dubbed Wall Street’s ‘fear gauge’, rose to a reading of more than 25 last Thursday, its highest level since late March. While not too high on an historic basis, the index has spiked recently in line with the tumultuous market backdrop.

According to the latest Bank of America Merrill Lynch fund manager survey, inflation is seen as the biggest tail risk, followed by a taper tantrum, with four out of 10 investors thinking a tantrum is likely in the second half of this year.

Some 82% of investors think inflation is set to rise over the coming year, only moderately below the record 94% reached in March, according to BofAML.

As AJ Bell head of active portfolios Ryan Hughes (pictured) says: “A pick-up in volatility feels not unexpected especially given the careful path that central banks need to follow to keep inflation under control without stalling the recovery.

“While higher inflation is not a surprise given the base effect, market participants are struggling to determine whether this is the start of a period of structurally higher inflation or something more transitory. Until that question is answered, I suspect that volatility across all asset classes is likely to be elevated.”

Vix strategies rack up flows

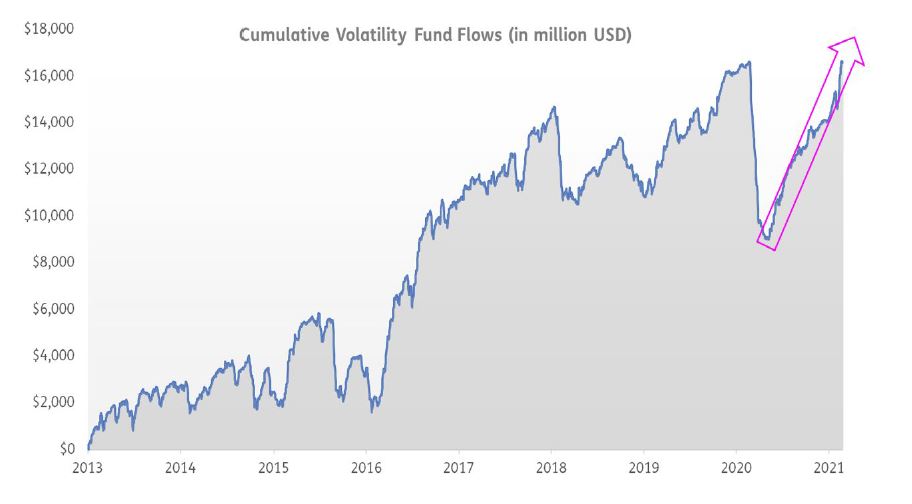

According to data from EPFR Global, cumulative flows into Vix strategies have been building over recent months, hitting $16.8bn on 7 May, down slightly from a high of $17.2bn on 26 April (see chart below).

Source: EPFR, Informa Financial Intelligence

Data from data provider ETFGI identifies 19 ETF/ETPs listed globally that provide exposure to the Vix index, accounting for $4.1bn in assets at the end of April. The largest of these, the iPath Series B S&P 500 VIX Short-Term Futures ETN, had $1.3bn in assets at the end of April.

EPFR director of research Cameron Brandt says while fear of increasing inflation is the primary driver of increased volatility, there are two other catalysts causing money to flow into Vix strategies.

One of these is increased retail investor activity in the market. This has tended to be the Gamestop-style investors who dip in and out of the stocks rather than invest in mutual funds. Another driver, he adds, is in the current stage of recovery people are beginning to see opportunities in emerging markets, in particular China and until six weeks ago, India.

“Anytime there’s a lot invested in emerging markets; the volatility goes up,” he says.

Investors look beyond central banks to fiscal policy

EPFR global head of quant analysis Sayad Baronyan agrees fear of rising inflation has driven greater rotation between asset classes, but he thinks this has been driven more by investors looking at fiscal policy for market direction rather than central banks – the US government’s $1.9trn fiscal bazooka is one such example.

“Central banks have maybe finished their capability, their ammunition, and investors are turning more to fiscal announcements,” says Baronyan.

Brandt agrees this is a major trend, adding the most positive reaction in fund flows last year after the initial shock of the pandemic was in response to various fiscal policy announcements.

“I definitely think that there’s a new sheriff in town that is probably the biggest factor.”

Brandt also notes that while flows into floating rate funds have surged, this has not been the case for silver and gold, which should typically be enjoying a double tailwind from rising industrial demand and inflationary fears.

“The fact they’re not suggests people expect the dollar to be supported by an interest rate hike, much sooner than the official narrative suggests,” he says.

Argonaut Capital chief executive and manager of the VT Argonaut Absolute Return fund Barry Norris thinks inflation is likely to trend higher for longer than people think because fiscal stimulus works differently to monetary stimulus.

“Monetary stimulus disproportionately benefitted those who already had capital and therefore resulted in an investment boom which was not widely inflationary owing to a lack of mass participation, he says. “Fiscal stimulus is intended to benefit those who need money more and are therefore more likely to immediately spend. Hence the velocity of money increases in an inflationary consumption boom.”

Readying portfolios for volatility

According to Fairview Investing co-founder and consultant Gavin Haynes, the best way to prepare for heightened volatility is to have a well-diversified portfolio of low correlating assets and in particular, use a barbell approach to growth and value to reduce volatility driven by style risk.

Similarly, Hughes says AJ Bell’s portfolios are run with style diversification through exposure to a broad range of asset classes and approaches in order to dampen the impact of short-term volatility.

In February the team introduced exposure to energy, utilities and infrastructure equities which he says all have the ability to benefit from a period of higher inflation while US Tips were also added within the fixed interest exposure.

See also: AJ Bell duo – Banks, housebuilders and travel companies are appealing if you can see beyond Covid

“On a philosophical basis, we acknowledge that market moves can be quick and unpredictable and for that reason we have exposure to range of different styles at all times,” Hughes adds. “This means we have defensive managers built into the design of the portfolios which should be able to offset a pick-up in volatility elsewhere in the portfolio.”