Every year, AJ Bell undertakes an overarching review of its long-term strategic asset allocation – and this year’s main outcomes were tilting portfolios to value, adding inflation protection and ridding them of property exposure.

Head of active portfolios Ryan Hughes (picture right, above) and head of passive Matt Brennan (left, above) say this annual review gives the team a chance to step back and view all 70-odd asset classes with “fresh eyes” against the market backdrop and how it is likely to change.

“It’s taking that 20,000-foot view of the portfolio, and what drives everything to make it as efficient as we can for the long run,” says Hughes.

Hughes is keen to point out though that AJ Bell’s asset allocation team is all about long-term strategic allocation and not in the business of making short-term tactical moves.

“We don’t do short-term asset allocation because we don’t think we’ve got the skills in it,” he states. “And we don’t really think anyone’s got the skill set you need to consistently make short-term calls in the market.”

Clearly, a lot has changed since last year’s assessment, not least the outbreak of the Covid pandemic, which in February and March 2020 caused all markets to drop between 10% and 20%. Yet both Brennan and Hughes believe AJ Bell’s approach of allocating to assets by sector, duration and currency, rather than just by a regional view, has helped weather the storm.

This time last year, AJ Bell’s portfolios were strategically positioned in three specific sectors: healthcare, consumer staples and technology. Yet in February and March when the pandemic was kicking off, consumer staples and healthcare were down just 2-3%

“We found by taking asset allocation through that lens you can genuinely offer the kind of downside protection that you can’t necessarily get from just pure regional allocation.”

Tilting towards value

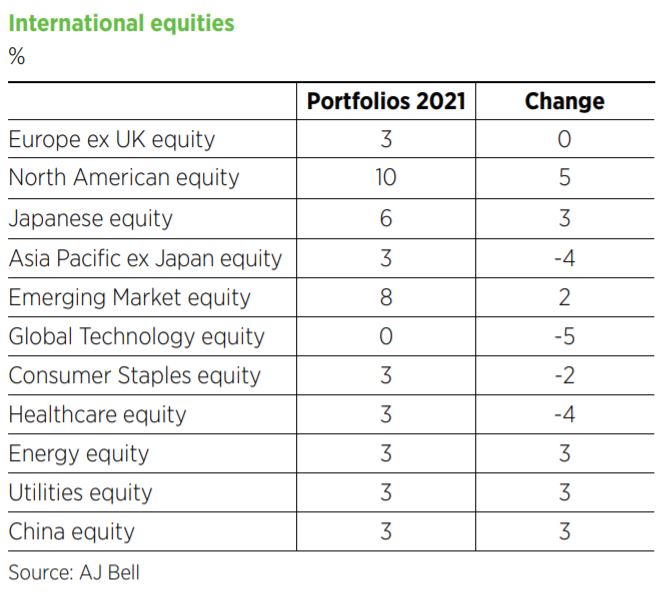

But now the team is seeing a reason to move away from the quality tilt these three sectors offer and towards more value sectors such as energy and utilities.

“We’re moving from a very defensive position to being a bit more positioned for a potential value and inflation rally,” says Brennan.

Hughes uses the example of Facebook and Shell to illustrate the rationale for tilting to value. The former has had a stellar two and a half years’ performance while Shell has done terribly for obvious reasons, but Hughes keeps in mind that everything has a price.

“This is why our process is unemotional,” he says. “We see the flaws in Shell and other energy, but everything has a price, and the market is pricing in the fact that the growth prospects over the next few years for energy stocks, utility stocks and even for some healthcare stocks, look really appealing.”

Hughes says some parts of technology also still look interesting, but overall the sector is less appealing than before.

“It’s a long-term mean reversion approach that we build into the asset allocation that takes emotion out of it and stops us getting carried away, thinking that some of these high-growth tech stocks can carry on trading on enormous multiples forever,” says Hughes.

“Where long-term mispricing occurs in the market, and the market offers the opportunity to add something like energy on a long-term basis with an attractive expected return, we should take advantage of that.”

Hughes says it is unclear whether the return to value is short or long term, but adds: “What we do know is that the way banks, housebuilders, travel companies and restaurants are being priced is appealing for the long term if you can see your way through Covid.”

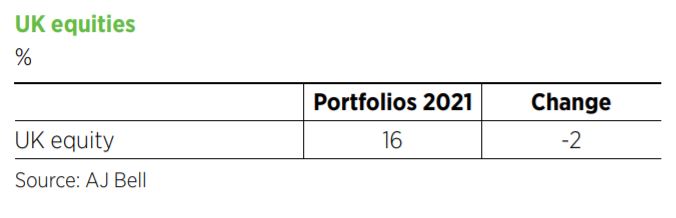

In terms of UK equity exposure, the team is adding Richard Colwell’s Threadneedle UK Equity Income Fund to its roster.

“We’ve rated the team for a long time and that’s a really good diversifier alongside Troy Trojan Income and Man Undervalued Assets,” says Hughes.

Inflation protection as a ‘free insurance policy’

The team does not necessarily see inflation “taking over the world”, but with inflation protection currently cheap it is viewed as “a free insurance policy” in the current market.

“It’s a cheap hedge and there is very little downside if it proves to be the wrong call,” says Hughes. “If the model and the inputs are wrong, we don’t make quite as much money. If we’re right, we make a decent amount and that feels like a risk/return trade-off worth doing at this point.”

Portfolios have therefore added US treasuries and an allocation to infrastructure. Meanwhile, the team’s move into energy and utilities should also offer an inflation hedge.

Infrastructure equity in, property out

In terms of infrastructure, the Legg Mason IF Clearbridge Global Infrastructure Income Fund is being added to portfolios. The fund invests in infrastructure equities, which is AJ Bell’s preferred route, given a lot of the renewable infrastructure investment trusts in areas like solar and wind are hot right now.

Allocating to property was previously a tactical call but it has been strategically removed from all portfolios. Covid and the shift to home working has brought the asset class’s flaws in sharper focus, as have the recent liquidity issues with open-ended vehicles.

“You could see a bit more short-term mania panic,” says Brennan.

During the past couple of years, AJ Bell’s allocation model has advocated property, but the team has overridden this view. According to Hughes, property is one of the few areas where the team does add a layer of tactical allocation.

“The computer’s telling us one thing, but the reality is we can see what’s going on in the real world, and that looks like a bad call.”

Taking control of asset allocation at a higher level

When it comes to picking funds, the team has committed to doing a higher level of groundwork before outsourcing to a third-party manager. Brennan explains this means drilling down into elements like value versus growth or work on inflation expectations, calls which are often outsourced to a fund manager.

“What we’re trying to do is control things at a slightly higher level, and that allows Ryan and his team to find the best value manager and the best growth manager. You don’t get clouded by what’s driving performance: is it style or is it fund selection?”

Hughes adds that, ultimately, implementation is going to have far less of an impact on the overall outcome than the asset allocation.

“We all know the stats that are quoted about what percentage of your return is driven by asset allocation, not stock selection, and that is exactly our approach here.

“And then if we want to have a value manager and blend that with a growth and an income manager – whichever flavours we want – then we are free to do that at implementation level.”

Dedicated China and India exposure

The team also recently added dedicated China and India exposure rather than accessing these regions through broader emerging markets or Asia funds. For Hughes it is a no-brainer, with China making up about half of both the MSCI Emerging Market and the MSCI Asia ex Japan indices.

“Given the percentage of the world economy that China now has, the fact that it was being lumped in with Asia and emerging markets didn’t make sense to us. Having a specific allocation to China and, as it transpires, India, alongside Asia and emerging market exposure is the right thing to introduce.

“I’m sure we will get to the point in a few years where there will be more products that are emerging markets ex China and Asia ex China because it’s just such a dominant part of the market.”

Brennan also points to the fact that India and China have positioned themselves as winners on the global stage with their handling of the pandemic. While Hughes adds that product providers are also recognising the industry is reaching a point where India and China are dominating returns and see an opportunity to raise assets.

Portfolios have had a small position in China A-shares over the last year and Hughes rates the Allianz franchise in China as “second to none”. As such, the Allianz All China Equity Fund is being added as a dedicated way of gaining exposure to the market.

An opportunity to go active for US exposure

The AJ Bell team is also spying a faint opportunity in going active in the US, a market in which it has been difficult for active managers to gain an edge in recent years, given the dominance of the largest five or six stocks.

“If you look at the S&P 495 versus the S&P 5, meaning you take out the five biggest stocks, it looks like that is broadening out just a little bit,” says Hughes. “That potentially plays into some opportunity for active managers to deliver returns.”

The team has a value/growth blend, with Dodge & Cox offering the former and Artemis US Select the latter.

Another item on AJ Bell’s agenda is a move to using more investment trusts in the portfolio, and Hughes says he expects that to happen over the next few years. He likes being able to access managers at lower cost and the ability trusts have to smooth income.

“I think we’ve all learned in the past year that is a really powerful tool in investment trusts’ armoury.”

This article first appeared in the February 2021 issue of Portfolio Adviser magazine. Read more here.