Last year, the FTSE Aim All-Share celebrated its 25th anniversary with a bang. In a 12-month period where UK equities – heavily invested in struggling financial services and energy companies – have lagged behind other developed equity markets, the junior stock market performed exceptionally well.

Despite being less regulated and having gained something of a ‘wild west’ reputation for investments, Aim generated better returns against both UK and global indices. As the table below shows, according to FE Analytics, the FTSE Aim All Share returned 21.8% over the past year compared to more established indices such as MSCI Emerging Markets (19.1%) and the S&P500 (17.8%). The comparison to the FTSE 100 which lost more than 11% of its value could not be starker.

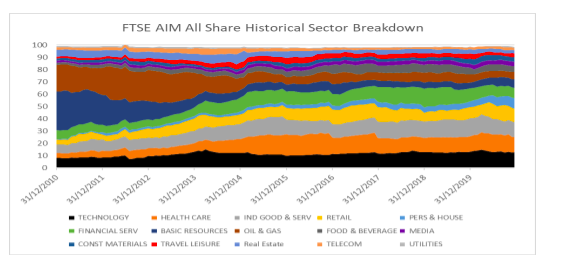

In a time when markets are extremely volatile, there is greater scope for investment flexibility and here is where Aim stocks have benefitted from the Covid-19 economy. Primarily, the Aim index is far more diverse than its established counterparts and in recent years has become more so. It has taken on a more even spread of technology, retail, financial services and industrial goods & services (which have largely boomed during the pandemic) at the expense of energy companies (which have not). As the chart below shows, in the last decade the position the index has had in oil & gas has decreased dramatically, from around 20% of the total holdings in 2010, to around 5% last year.

This reduction in weighting to the oil & gas sector has significantly boosted the Aim’s comparative performance as it largely managed to avoid the collapse in the price of oil throughout 2020. In the second quarter of 2020 alone, there was a 70% fall in the price of oil as Saudi Arabia and Russia embarked on a price war. Recovery was not helped as global travel collapsed to historic lows in the wake of the pandemic. Neither does Aim have a large position in 2020’s other laggers, namely big banks, which already had to contend with low interest rates eating into their profit margins pre-pandemic and then dividends – a staple for income investors – halted by regulators.

While Aim has managed to avoid the worst of the downturn, it also managed to capture those stocks which were performing well during the global lockdown. As it decreased its weighting in oil & gas, it increased its weighting to growth stocks within the e-commerce, tech and healthcare sectors – areas which have benefitted during the “new normal”. National lockdowns accelerated online retail trends and expedited the decline of the high street. In turn, online fast fashion retailers such as ASOS recorded exceptional profit figures. With shops, bars and restaurants shut, demand for gaming also picked up, benefitting video games companies Codemasters and Frontier Developments.

Pharmaceutical companies with links to Covid-19 testing or treatments were also in hot demand. Novacyt is a particularly good example. The company, which developed Covid-19 rapid testing, generated outstanding returns as shares soared from 14p at the start of the year to 940p by the end.

Elsewhere, Aim’s gold miners, like Greatland Gold and Eurasia mining have also done very well as worries about rising Covid-19 cases or investors hedging against inflation following stimulus largesse fuelled a gold bull market last year.

While the index doesn’t have the same degree of cyclicality as the FTSE 100 does, performance continued to push upwards in the final quarter of the year, buoyed by news of Covid-19 vaccines and a Brexit deal.

See also: Does the Aim market offer a glimmer of hope for UK investors?

How Aim will perform in 2021 remains unknown and over the long term the market is still playing catch up to its main market peers. What we do know is that political and pandemic related uncertainty have been reduced with the advent of a Brexit deal and Covid-19 vaccines. With this comes greater optimism of an economic recovery and, with Brexit resolved, greater demand for UK equities could see investor inflows trickle down into the junior market. This should benefit nimbler, highly flexible Aim companies which have adapted to different market conditions.

The Covid-19 pandemic has dramatically changed the UK economy (at least in the short-term) and the companies doing well are the ones which have already adapted to this new normality and remain highly flexible. Relative to other UK listed markets, the Aim represents the best of UK companies being able to benefit from that trend.

Ahmed Mohamoud is a fund analyst at FE Investments