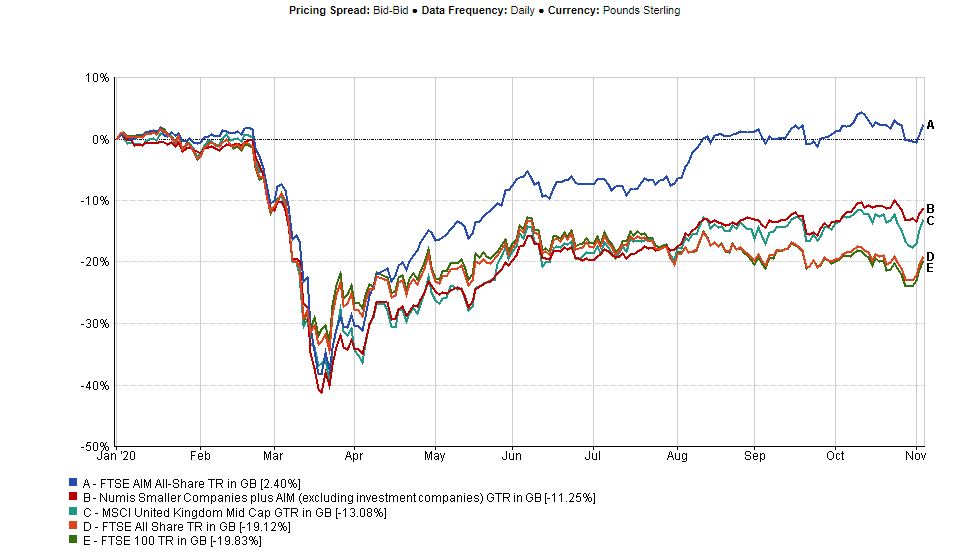

UK equities have had a torrid time this year with all major indices across the cap spectrum posting double-digit losses, but the Aim index has bucked this trend with a positive return.

Investors have been voting with their feet and the latest figures from Calastone reveal UK equity funds shed £358m during October, marking the fourth-worst month on record for the asset class. It blamed the Covid-19 pandemic and renewed worries over a no-deal Brexit for the negative sentiment.

The FTSE 100 is down 19.8% year to date, and the All Companies has done only marginally better with a -19.1% return. Similarly, small and mid-cap haven’t fared much better, with the MSCI UK Mid Cap index posting a -13% return and Numis Smaller Companies plus Aim (ex investment companies) returning -11.3%.

But the Aim All Share index has managed to eke out a 2.4% gain year to date.

Aim is skewed to in-demand sectors

RC Brown Investment Management investment director Oliver Brown, who also manages the MFM UK Primary Opportunities fund, says the Aim index is flat year to date due largely to the makeup of the index which is skewed to in-demand sectors such as technology and healthcare.

“You’ve got smaller, often more nimble, faster-growing businesses,” he says. “They’ve suffered less from the dividend cut problem because they weren’t paying such high dividends. They also tend to be newer industry companies that have been able to deal better with the lockdown.”

Tilney managing director Jason Hollands notes the FTSE 100 by contrast has considerable exposure to energy and financials, parts of the market worst hit during the pandemic. The flagship large-cap index’s exposure to tech is only around 1% compared with the FTSE Aim All Share’s 13.2%.

“Aim is also rich in online businesses – the largest stock being Asos – that have performed well when traditional retailers have been disrupted,” says Hollands.

IHT rules lead to stickier assets

Aim companies tend to be small-cap and more highly speculative, in part due to the market’s more relaxed regulations and listing requirements compared to other bourses. It has had a few high profile blow-ups in recent years, not least that of cake and café chain Patisserie Valerie in 2018 due to a £40m hole in its books.

But Hollands says the lighter touch regulation has had a positive impact on the market.

“Aim companies have no minimum free float requirements and many businesses on Aim have significant founder shareholders or are heavily owned in inheritance tax mitigation portfolios where the shares are intended to be held until death and so are not going to be traded on short-term news flow.”

Under inheritance tax rules, individuals holding shares in unquoted companies are liable to be exempt from IHT if the shares have been held for two years or more. The Aim market qualifies for this relief although not all companies listed on the index do.

“The market therefore did not see the kind of selling that the more liquid exchanges experienced in February and March as investors traded the pandemic,” adds Hollands.

SVM Asset Management co-founder Colin McLean (pictured) says Aim spent 25 years underperforming and it’s really only this year that it has shown resilience.

As well as the make-up of the market being skewed towards growth orientated names that have benefited from the recent online boom and remote working, McLean notes the tax advantages associated with Aim stocks might have kept some investors holding on to companies, rather than offloading them during the March sell-off.

“So it may just be with Aim that people don’t sell them as aggressively,” says McLean.

“We like Aim,” he adds. “At the top end of the index, companies do migrate into other listings and they almost overlap with the FTSE. You get substantial companies like Hutchison China, for example.”

Low-rate environment helps some Aim firms

Brown also notes the low-rate environment has buoyed some Aim companies.

“Because interest rates are so low, the future cash flows that these growth businesses are due to produce in a number of years’ time all of a sudden becomes a bit more valuable because you don’t have to discount quite as heavily on today’s interest rate.”

“And, as proven, a company that actually can continue to grow during the greatest recession since the 1930s, you can probably argue deserves a better rating by the market.”

Large cap markets offer opportunities over the longer term

But Brown thinks the larger domestic markets are offering hope over a longer time frame.

“The FTSE 100 and 250 should be good places to be for a global economic recovery,” he says. “We obviously need to see some sort of Brexit deal as there are a lot of overseas investors literally just sat on the sidelines that have sold out of the UK in the last few years and are refusing to commit money until there’s some sort of a trade deal.

“The UK is a bit of a risk-on market. So you need to see a Brexit deal and you need to see renewed signs of an economic recovery, which to be honest is not going to come until Q1 or Q2 next year really.”

Hollands warns given Aim is a much more diverse exchange than the main market, it contains “both gems and landmines”, so should be navigated carefully.

“Most smaller companies funds invest in Aim and the main market these days, as do some of the best in class multi-cap UK funds such as Liontrust Special Situations,” he adds.