Jeremy Wharton, CEO, joint-CIO and manager of the Church House Investment Grade Fixed Interest Fund answers Portfolio Adviser’s questions on volatility, duration and the interest rate cycle.

How did you differentiate the Church House Investment Grade Fixed Interest Fund (CHIG) from peers last year, a difficult period for all markets?

CHIG was conceived to provide private client investors with a fund that has low volatility, a fair yield, and an emphasis on absolute returns, not relative, and has been managed since 2000 with risk controls appropriate to achieving those ends.

Investors can get all the volatility they want from equities and other higher risk asset classes so the purpose of the bond allocation in a client portfolio is to provide diversification from those risks.

As the fund is only £250m in size, we can be active and opportunistic in our investment process. In early 2021, when credit spreads were tight, we added 26 long positions to take duration out to nearly seven but by the end of that year, we had cleared them all out and the fund’s duration was cut to less than three.

For some larger funds that have to own almost the whole market, this flexibility isn’t possible but shortening duration was a key contributor to CHIG’s performance in 2022.

See also: Chancellor Hunt addresses inflation, regulatory shifts and reform in Mansion House speech

And you have been using floating rate notes?

A contributory factor in the management of duration risk has been our use of AAA floating rate notes. These effectively have no duration as the coupons re-fix every quarter reflecting moves in interest rates. Unlike conventional corporate bonds, FRNs benefit from rising interest rates and at the time of the Truss/Kwarteng mini-budget, we held 37% of the fund in these securities. This allocation provided protection against the subsequent spike in government bond yields and liquidity in an otherwise chaotic period which allowed us to cut the allocation to take advantage of the fantastic opportunities in the fixed income market.

By the end of November, the allocation to AAA floating paper had been cut to 27%, demonstrating again the flexible and opportunistic investment process.

Tell us about your duration positioning, how has it changed?

Duration remains short at just under three (2.95). With yields at the short end greater than those further along the curve (at the time of writing – 27/6/2023 – the yield on the two-year gilt is 5.219% and on the ten-year it’s 4.349%), there is nothing to be gained by lengthening duration (except more volatility!)

There is still a great deal of uncertainty as to the pace at which inflation might decline and the consequent actions of the Bank of England regarding interest rates, so we prefer the return profile at the short end. The gross running yield from CHIG is over 5% and yield to redemption is close to 7%, returns the like of which we haven’t seen in many years.

There will come a time for us to go longer but we still feel it’s too soon.

How have you avoided the fall-out from the banking sector?

Not sure this is much of an issue. Credit Suisse going to UBS was the culmination of a period of mismanagement and a few local banks, (out of 4,200 in the US) needing to be rescued by JP Morgan created media interest but was short-lived.

Investors aren’t expecting bond funds to be volatile but some did experience higher levels of volatility last year. Can you explain your fund’s volatility levels?

I have talked about this already, however, I would stress we have always believed that the allocation to bonds in a client portfolio should be to diversify risk from higher volatility asset classes so when the risk-free rate of return became less than 0.5%, we told investors that returns from the fund would be low.

Under pressure to provide ever-greater returns, it seems some portfolio managers and fund managers pursued a different approach to ours, either/both lengthening duration and delving into the depths of high yield markets. Those that did so experienced the worst of the volatility in 2022.

With inflation reaching a peak and the rate cycle near tipping point, or so parts of the market have forecast, what is your outlook for bond markets and this fund?

Inflation and interest rates remained lower for longer than most people expected and it’s now possible that they will remain higher than most people are expecting.

It seems there is a belief in the ‘Goldilocks scenario’ that inflation falls away, the Bank of England slashes interest rates and we return to the heady days of ‘free’ money on which so many of us were weaned.

We don’t really see things going that way; while inflation is cooling, it could take a long time to come back to the target level of 2%.

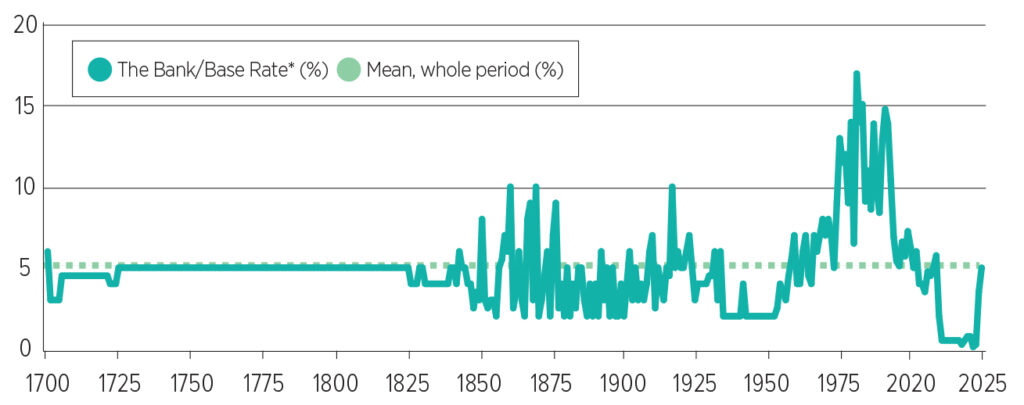

It’s instructive to take a longer-term perspective and if we look at the history of interest rates since the foundation of the Bank of England in 1694, we can see that over the (relatively) short period since the early 1980’s, rates were on a downward path, eventually reaching zero in 2020.

From that point, (there no longer being a GFC or pandemic) one would/should have expected rates to rise, and although that’s painful for borrowers, it seems unlikely that they will return to ‘emergency’ levels but are more likely to be maintained at a level from which the Bank of England can make meaningful cuts when the next crisis comes along (and it will).

With bond markets being pulled by Goldilocks believers at one end and central bank sceptics at the other, we are happy to maintain our stance in CHIG of short duration, high quality credits, and are thankful for levels of quite predictable returns that we haven’t been able to enjoy for a long time.

See also: Core inflation rise shakes UK equities and sends rates forecasts higher