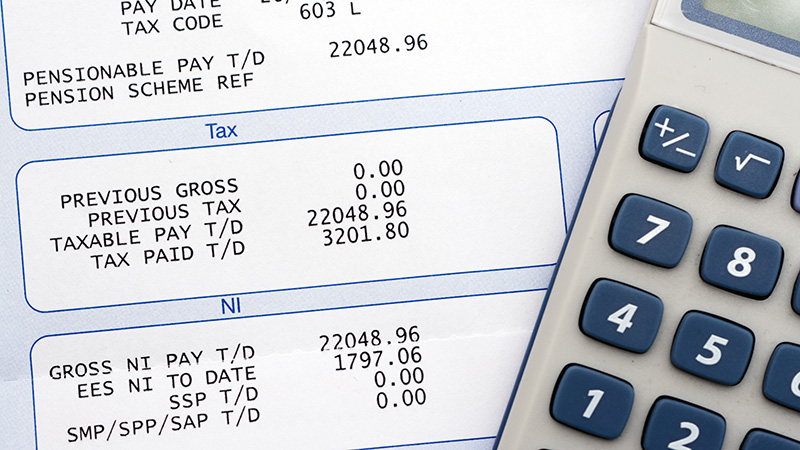

Chancellor Rachel Reeves has increased the rate of National Insurance (NI) that businesses pay for their employees by 1.2 percentage points to 15%. She also lowered the earnings threshold at which companies pay from £9,100 to £5,000.

This move will generate an extra £25bn in tax revenue, more than making up for the £22bn ‘black hole’ left by the previous government.

Labour pledged not to increase the NI paid by working people, yet some argued that taxing employers would still impact that demographic. While it has been promoted as putting more money in people’s pockets, Hymans Robertson’s head of DC corporate Hannah English said the move would “dramatically increase the costs for employers” and could in fact “drive behaviours that yet again can harm today’s working people”.

In an attempt to combat this, Reeves increased the employment allowance from £5,000 to £10,500, meaning 865,000 businesses will not pay any NI at all next year, with another one million paying the same or less as they did previously.

See also: Autumn Budget 2024: Capital gains tax hiked to 24% in ‘blow for investors’

Yet the higher rate of NI and lower threshold could have a more sizable impact on larger companies, encouraging them to pay their employees lower salaries, according to Lindsay James, investment strategist at Quilter Investors.

“This is a significant lever to pull, but comes with many risks,” she said. “Businesses may now scale back pay increases or hiring plans, which goes against the mission for growth.

“The Chancellor has tried to exempt very small businesses from this increase, but the vast majority of small and medium enterprises in the UK will be hit. Coupled with the hit on business relief, small companies may not appreciate the plans put in place by the Labour government.”

Under the new rules, the amount a business pays in NI on an employee earning £30,000 will increase by £865.80, boosting the total cost from £32,884.20 to £33,750, Quilter estimates.

See also: Autumn Budget 2024: Minimum wage increases 6.7% to £12.21 an hour

The move could also lower the government’s revenues from other taxes. Employers may restrict wages to mitigate costs, leading employees to pay less on their individual NI contributions and income tax, whereas those companies choosing to pay more could see the extra NI contributions biting into their profits, meaning they pay less corporation tax.

The previous Conservative government cut starting NI rates paid by workers from 12% to 8% in their last two statements, yet millions still pay more despite these this because tax thresholds have remained frozen while wage growth has increased.