Man GLG UK equities manager Henry Dixon is ‘perplexed’ that UK equities continue to be battered by outflows despite global investors claiming to have changed their tune about the asset class.

Dixon (pictured), who co-manages the £1.4bn Man GLG Undervalued Assets fund, said the UK market, which has been deeply out of favour since the Brexit vote, has finally seen a “tipping point” thanks to the Covid recovery.

Earnings growth for the year, which was forecast at a punchy 46% in January, has seen 15% in upwards revisions, though markets have only risen 9.3%.

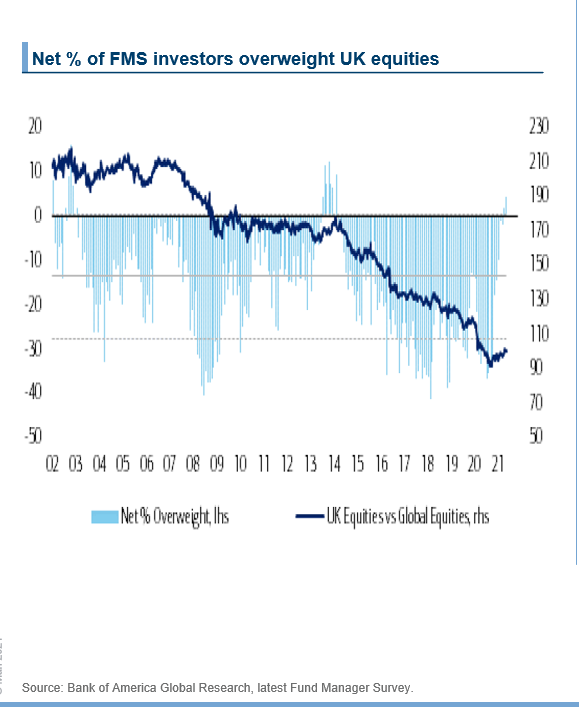

Net sentiment which was near a record low in 2020 has “flipped”, Dixon said, with the Bank of America Merrill Lynch global fund manager survey showing investors are now overweight the region.

There are only two other instances in the last 20 years where investors have been as overweight UK equities, Dixon pointed out. The first was in 2013-2014 when the UK was the fastest growing G7 economy “as it is today” and between 2000-2003 when the US went into a mild recession which the UK avoided.

UK equities miss out on ‘fund flow bonanza’

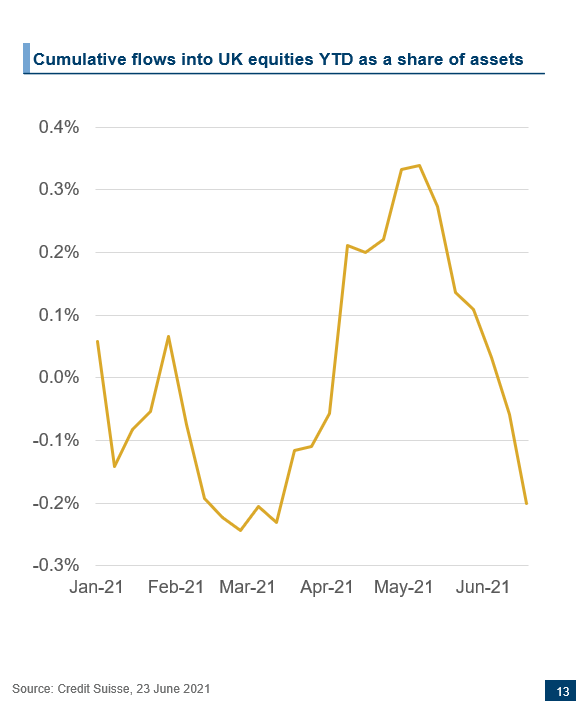

Though more investors are claiming to be overweight the asset class now, this hasn’t translated into higher fund flows.

“There’s a slight contradiction at the moment with regards to people’s views about the UK and how they’re actually voting with their feet,” Dixon said.

UK equities did suffer “nagging outflows” in the first quarter thanks to the country being comparatively slower to come out of lockdown and re-open its economy, Dixon said, but after that “economic data started to turn quite materially” and fund flows did pick up.

However, recently the tide has reversed yet again amid doubts over the strength of the global economic recovery.

The latest fund flow data from Calastone shows UK equities shed £567m in September as investors fretted over multiple crises, including petrol and supermarket shortages and soaring inflation. Calastone reports UK equity funds have endured net outflows in 10 of the past 14 months.

“People seem to express that caution about the cycle, most pertinently towards the UK,” Dixon said. “The UK really was the only major equity asset class anywhere in the world to sit out the fund flow bonanza.”

“Having watched the fund manager surveys for a number of years, I think it’s more of an indication of where people want to be necessarily than where they are,” Dixon added. “But I’m a little bit perplexed that UK equities cannot find greater favour amongst investors.”

See also: Has the sun set on value or just the value manager?

US corporates not so apathetic

One area where there has been less apathy toward the UK is in the corporate M&A world, Dixon said.

What distinguishes 2021 from other booming years for takeovers like 2015 is the “sheer volume of deals,” he notes. The UK has seen 27 deals this year, far more than any other region. Several companies, notably Morrisons, have been at the centre of billion pound takeover battles.

“If I look back at spikes in corporate activity, it’s usually been a very good precursor of UK equity performance,” Dixon said.

“At least there’s someone who agrees with the value over in the UK and that’s corporates who, one would hope, are some of the more informed buyers of UK equities. And I hope that the apathy of investors more globally can hopefully change when we look out to the rest of the year.”

Man GLG Undervalued Assets has returned 36.7% over the last year, above the IA UK All Companies 25.7% average, according to Trustnet.