In what proved to be an ill-timed article for the February 2020 issue of Portfolio Adviser I considered whether value managers were staging a comeback after more than a decade of being out of favour.

Weeks later the panic from the coronavirus crisis had seeped into markets and value-style funds were brutally punished.

Alastair Mundy’s Ninety One UK Special Situations lost 41% in the month following the Covid-19 sell-off. Not long afterwards, he took an extended leave of absence from his portfolios and eventually quit the industry altogether to pursue a career in teaching.

As the pandemic waged on, the high-profile casualties kept on coming. Neil Woodford’s successor at Invesco, Mark Barnett, stepped down from his UK equity income mandates, which had by that point shed billions of pounds, and M&G Recovery frontman Tom Dobell bowed out after 20 years at the helm.

It is a cruel irony that not long after these value stalwarts hung up their hats their preferred investment style would come back into favour, driven by economic recovery and vaccine rollouts.

The value fund casualties of 2020

Though some of the bigger value funds have survived manager handovers, hundreds have fallen by the wayside in recent years, as the ‘Faangs’ and high-growth companies drove markets higher.

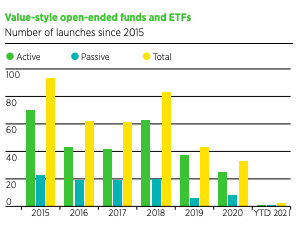

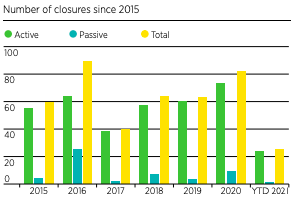

Data prepared by Morningstar for Portfolio Adviser reveals 422 value style funds available to UK investors have been closed or merged away since 2015. It’s possible that some of these funds might not have been following a value style at launch but over time the style has drifted toward value, as defined by Morningstar’s style box.

Last year was one of the worst for value fund closures, with a whopping 82 funds fading into existence, the highest figure since 2016 when 89 funds shut up shop as markets turned volatile from political shocks such as the Brexit vote and the US presidential race.

Active funds accounted for most of the closures in 2020, with 73 throwing in the towel. Jupiter UK Alpha and Artemis Pan European Alpha were among 2020’s fallen funds, while Invesco UK Focus, Premier Miton Income, Crux UK Opportunities and Liontrust UK Midcap were absorbed by larger funds.

Despite the brutal climate for financials, commodities, oil and gas giants, and travel and leisure firms – the traditional hunting ground for value managers – 33 funds bravely launched, including Nick Clay’s global equity income mandate for RWC.

But with so many tried-and-tested value managers out the door, are there enough value funds out there with decent track records to satisfy renewed investor appetite for the investment style?

See also: Does the departure of value stalwarts signal an end for the investment style?

‘Not a case of being absolutely overwhelmed with choice’

“There are certainly less value offerings than there were,” admits Chelsea Financial Services managing director Darius McDermott. It’s a sentiment shared by AJ Bell head of active portfolios Ryan Hughes. “It’s not a case of being absolutely overwhelmed with choice for different managers, though the UK has probably got more than most,” he says.

When asked which decent value managers are left, the same names inevitably tend to crop up. Jupiter UK Special Situations’ Ben Whitmore, Schroders Recovery duo Nick Kirrage and Kevin Murphy, and Fidelity Special Situations lead Alex Wright were top of fund buyers’ minds, alongside Man GLG Undervalued Assets’ Henry Dixon, JO Hambro’s Clive Beagles and River and Mercantile UK Recovery’s Hugh Sergeant.

Schroders, Jupiter and Fidelity are consistently highlighted as the UK fund houses with the largest dedicated value teams. At Schroders, Kirrage and Murphy are co-managers on three value flavour funds – the £1.1bn Recovery, £1.8bn Income and £773m Income Maximiser strategies. Kirrage also co-runs the younger Schroder Global Recovery Fund, alongside Andrew Lyddon and Simon Adler, which Hughes notes has nearly doubled in size in Q1. It is currently just shy of the £1bn mark.

Former Schroders Recovery manager Whitmore has a similar set-up at Jupiter with two UK focused funds – the £2.1bn Jupiter UK Special Situations vehicle and £1.5bn Jupiter Income Trust – as well as the £279.8m Jupiter Global Value Equity Fund he launched with Dermot Murphy in 2018.

Meanwhile, Fidelity has Alex Wright’s UK-focused £2.9bn Special Situations fund, once run by star manager Anthony Bolton, as well as Nitin Bajaj’s £355m closed-ended Fidelity Asian Values trust.

Man GLG bucks trend of shrinking value funds

Having a supportive parent company and decent scale to survive the inevitable wave of redemptions has been key to these franchises’ survival, Hughes says. Investors pulled hundreds of millions of pounds from popular UK-focused value funds in 2020, with Wright and Whitmore’s vehicles bleeding £201.3m and £101.7m, respectively, and Kirrage and Murphy’s Schroder Recovery losing £171.4m, according to Morningstar estimates.

Unsurprisingly the funds with major manager changes, such as Ninety One UK Special Situations and Invesco High Income were worse off, with the former racking up £430m in outflows and the latter £925m.

Man GLG Undervalued Assets was the only fund Portfolio Adviser found to buck this trend, bringing in £90.1m of net inflows in 2020. It is one of a few value funds that has been growing and not shrinking in recent years, tripling in size from £450m in 2015 to £1.4bn today.

‘Everybody believes the only way to earn money now is compounders like Fundsmith and Lindsell Train’

While Whitmore, Kirrage and Murphy have lengthy track records, having been at the helm of their funds since 2006, and Dixon and Wright have overseen their funds for just shy of a decade, it does feel like there is a lost generation of value managers.

With a decade-long bull market for growth stocks which has been further fuelled by the rise of ESG considerations “it is completely unsurprising that there appears to be a dearth of ‘rising star’ value managers,” Waverton Investment Management multi-asset analyst Paris Jordan says.

“The next generation may have experienced a number of headwinds in the early part of their career, but they should be reassured that value is not dead and there is still an important place for value funds within portfolios.”

“There probably aren’t that many up-and-coming value managers because it’s not been the investment style of the last decade,” McDermott says.“Everybody believes the only way to earn money now is earnings growth or compounders, the Fundsmith and Lindsell Train-type angle.”

Are there any promising up-and-comers?

That said, McDermott can think of a few promising up-and-comers. He includes Man GLG’s Jack Barratt and Alice Owen, co-manager and assistant portfolio manager, respectively, on Dixon’s Undervalued Assets Fund, among the next generation of value managers.

He has similarly high praise for Ninety One value managers Steve Woolley and Alessandro Dicorrado, who have five years running the Global Special Situations Fund under their belt.

McDermott says the pair’s fund, which they launched in 2016, endured a “horrendous sell-off” but has bounced back during the value rotation. On a one-year view the fund is up 50%, double the IA Global sector. Woolley and Dicorrado worked under Mundy and have since taken over his UK Special Situations mandate.

Fund groups more concerned with launching ESG funds than value strategies

The rosier outlook for value funds in 2021 has not yet translated into more product launches. Only two funds that fit into Morningstar’s value style bucket have come to market this year – the TB Guinness Asian Equity Income Fund and the FlexShares Developed Market High Dividend Climate ESG ETF.

Meanwhile, a further 25 funds have been wound-up in the year to date.

Square Mile head of research John Monaghan believes it’s too early to tell if the nascent value rally will trigger more fund launches. “Responsible investing is probably more of a priority for fund launches than launching a value proposition at this point,” he says.

That hasn’t stopped Barnett from throwing his hat back into the ring, this time launching a UK equity income vehicle at Paul Marriage and John Warren’s boutique Tellworth.

At this point fund buyers seem content to stick to their guns, adding to their existing value managers.

AJ Bell holds Dixon and Barratt’s Man GLG Undervalued Assets Fund in its UK allocation and for US equity exposure it uses Dodge & Cox US Stock and Clare Hart’s JPM US Equity Income Fund.

According to Jordan, Waverton has ramped up its value exposure recently, adding to holdings that are exposed to the reopening trade.

In 2021, the team initiated a holding in Richard Penny’s UK Crux Special Situations Fund, which is heavily exposed to business services and financials and has positions in metals and miners.

“The fund is small/mid cap in size and its cyclical, residential and leisure exposure has been a strong holding for us during this period,” Jordan says. “We viewed this as a unique fund for our models, complementing the larger, more global direct stocks we own.”

This article first appeared in the June 2021 issue of Portfolio Adviser. Read more here.