Demand for technology funds has rocketed amid the coronavirus outbreak and lockdown with net inflows already surpassing total levels for 2019 and Polar Capital soft closing its Global Technology fund on the back of too much demand.

Nevertheless, investors remain comfortable with valuations and the sector’s ability to perform as the coronavirus eases, even though growth typically underperforms value in periods of economic recovery.

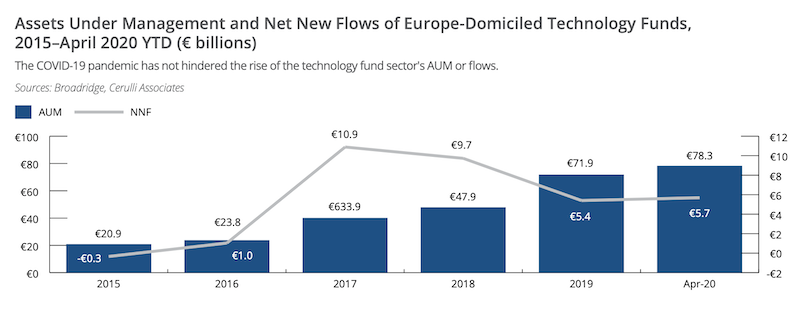

Total assets under management across Europe in the technology funds was €78.3bn (£71.5bn) at April 2020, according to Cerulli Research. That’s on the back of net inflows of €5.7bn, more than the €5.4bn total brought in for the whole of 2019.

While the MSCI World and S&P 500 are down slightly for the year, the S&P 500 information technology sector has rallied 14% and the MSCI World’s equivalent has gained 12.7%, as of 10 June, according to data compiled by Cerulli.

Polar soft closes fund as billions flow into the tech sector

The Polar Global Technology fund is one beneficiary of the technology sector’s popularity amid the coronavirus outbreak, which has fast-tracked the take up of remote working and online shopping.

Its assets stood at $3.7bn (£3bn) at the end of 2019 but now sit at $5.1bn, according to Trustnet.

Polar Capital global head of distribution Iain Evans attributed the soft closure to strong performance and steady net inflows.

The fund was singled out in Cerulli’s report with the research house noting it had returned 520.5% over the last decade.

Technology products at Wisdomtree have benefited from the rally, according to the ETF provider’s head of research for Europe, Chris Gannatti.

The WisdomTree Cloud Computing Ucits ETF has generated more than $90m in flows during 2020 and sits at approximately $120m in assets under management. Meanwhile the WisdomTree Artificial Intelligence Ucits ETF has generated more than $70m in flows during 2020 and sits slightly under $120m in assets under management.

See also: UK funds industry slowly dials up exposure to the Zoom explosion

Difficult to describe tech as ‘inexpensive’ after coronavirus rally

Gannatti does not think technology is in bubble territory but says it would be difficult to describe the sector as “inexpensive”, at least on a relative basis compared to other sectors that have not performed so well in the year to date.

He points out that in the MSCI ACWI universe, the forward price-to-earnings for the technology index versus the broad market is 26.4x versus 21.5x. For the price-to-sales ratio those figures are 3.6x versus 1.6x.

But Gannatti says many of the large companies driving tech index returns have strong earnings, strong cash positions and low debt. Investors may be willing to pay a quality premium for earnings growth, revenue growth and strong cash war chests to weather any impending storms.

While huge cash piles at Alphabet, Microsoft and Apple is nothing new, the importance of strong balance sheets has been elevated amid the current crisis, says Stonehage head of direct equity management Gerrit Smit.

The pandemic and lockdown have also created a major boost for future earnings among tech stocks, says Smit.

“Whilst many may appear expensive, it is predominantly because their individual futures have arrived earlier than what they budgeted for because of Covid-19 effects,” he says.

“In many cases their new business budgets have been brought forward by a year or two, without the related cost increases to earn that incremental new business.”

Tech doesn’t typically outperform coming out of a crisis

Typically, value stocks and small-cap stocks are among the top performers as economies recover from a downturn meaning technology stocks could underperform if Covid-19 plays out like a typical crisis.

But Gannatti says it is possible technology remains resilient this time around.

“If the lockdown easing does not equate with full economic recovery—or if the lockdown doesn’t really move in a straight line—then this would favour higher quality, more resilient stocks.”

Willis Owen head of personal investing Adrian Lowcock also reckons technology could still hold up in the Covid-19 recovery.

“One of the unique characteristics of this crisis is that it has had such a big impact on how people work and interact with each other which has humbled previously strong business models and given an advantage to tech enabled businesses,” he says.

“The value rally hasn’t really taken off yet as investors are still digesting the impact of Covid-19.”

Funds with the highest tech allocations

Beyond specialist technology products, Gannatti names the WisdomTree Global Quality Dividend Growth, WisdomTree US Quality Dividend Growth and WisdomTree Eurozone Quality Dividend Growth Ucits ETFs .

“These 3 ETFs track indices that were developed with a focus on companies with strong return on equity and return on assets fundamental characteristics. In each regional version, the Information Technology sector does lean toward one of the larger sector exposures. These would indeed be more diversified and would not concentrate as tightly on a pure technology theme.”

In the Investment Association Global sector, the £410m Blue Whale Growth fund has the largest allocation with 67.3% in telecoms, media and technology, according to FE Analytics. The fund has returned 12.2% over the last six months compared to a 0.8% fall in the IA Global sector, according to Trustnet.

Lead manager Stephen Yiu stresses the strategy is not a tech fund. “How we ended up with a higher portion of technology stocks is that these are just the higher quality companies we could find in the market.”

Adobe, Amazon, Microsoft and Paypal are among the top-10 holdings, although Yiu notes Visa and Mastercard are also classified as tech stocks although he would describe them as financial services.

The Liontrust Global Smaller Companies fund has the next highest allocation with 63.3%. It has returned 17% over the last six months.

Tech stocks Twilio and Ringcentral have been among the largest contributors to performance in the Robin Geffen fund, up 115% and 65% respectively. Weightings to the company have averaged 4.5% over the year.

Geffen (pictured) says it is interesting to compare the performance of Twilio and Ringcentral to large-cap tech names, like Facebook, which is up 5%, and Alphabet, which is up 3%. Amazon and Apple have fared better, returning 45% and 22% respectively, but still “would not be enough to get into the medal positions among global small cap stocks”.

Coronavirus fast tracks technology adoption

Both Geffen and Yiu point to the effect the coronavirus has had on technology adoption.

Geffen reckons the sector has seen five years’ worth of tech adoption accelerated within the last five months. “Whilst some things will go back to normal, there has been a huge structural shift in the rise of e-commerce, cashless payments and most importantly the necessity of seamless communication in the work environment.

“Dispersed workforces are here to stay, with many more people working from home at least part of the time.”

Yiu points to comments by Microsoft chief executive Satya Nadella that the company had seen two years of digital transformation in two months.

That is echoed by other tech CEOs, Yiu says.

In the case of Amazon, he says people have a misconception that there is little room for growth in customer numbers.

He points out Walmart still has significantly higher revenues than Amazon, despite it largely being based in the US. In 2019, Walmart had revenues of $515bn compared to $280.5bn at Amazon.

Zoom splits opinion as its valuation hits $70bn

But there are still technology companies where Yiu thinks valuations are in bubble territory.

In the case of Zoom, he points out people are using a range of video conferencing services and it has low barriers to entry. “Zoom is really good if you use it but it does have competition. Right now, Zoom is competing with Teams at Microsoft, it’s competing with Google Meets and Facebook is now making Whatsapp easier to use for group meetings.”

Peloton is another company he says is looking pricey, blaming its expensive product and low barriers to entry.

But specialist strategy Allianz Technology Trust has a 2.6% allocation to Zoom Video Communications making it one of the closed-ended fund’s top-10 holdings.

In a video conference conducted on Go To Webinar fund manager Walter Price said: “We certainly don’t think that Zoom’s going to have 90% of the market. We think it’s a very broad market and Zoom will have a portion of the market.

“But it’s a very attractive market. It’s part of how companies are working in the future and it’s still being developed. So, Microsoft, Google are certainly participants, Cisco’s kind of fading. Zoom is emerging as a leader in this market, and probably is the leader.”

The decision to use Go To Webinar rather than Zoom for the webinar was a corporate decision, the Allianz Technology Trust team said.