By Stuart Gray, global equity fund manager at Willis Towers Watson

When markets are close to record highs, it is easy to forget that index concentration has two faces, and only one of them is pretty. The handful of stocks that drove market gains until July became the culprits behind the steep selloffs in August.

Now as autumn begins, valuations have become increasingly stretched and investors are starting to revisit the ways in which they think about concentration and risk management.

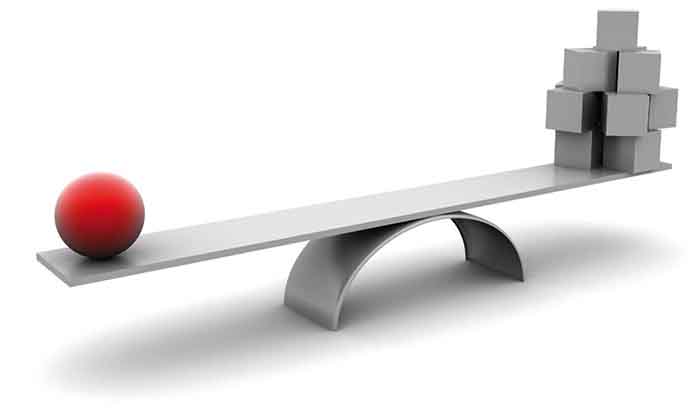

Both concentration and diversification have their place in a portfolio. The challenges are that overconcentration can expose investors to too much of the wrong kind of risk, while overdiversification can dilute returns.

So how can concentration be used to achieve the best portfolio outcomes, and what risks should investors try to diversify away?

Concentration works best as a value-add to capture outsized returns from proven high-conviction investment theses. Diversification, on the other hand, can help manage the risk of individual manager underperformance.

When passive investing turns aggressive

Volatility returned to the equity markets with a vengeance in August, illustrating just how concentrated indices have become. Tech and AI-linked stocks such as Nvidia, which until recently had been driving attractive index returns, are now raising red flags for investors.

By mid-2024, the five biggest stocks in the S&P 500 accounted for nearly 30% of the index, compared with 18% before the collapse of the tech bubble in 2020 and 23% during the Nifty 50 craze in the 1970s.

The boom in tech stocks follows a familiar pattern: every decade or so we tend to see a segment of the market become increasingly popular. As valuations become more and more stretched, a point is reached where there is nothing passive about passive investing.

See also: 20% of funds face rerating as Morningstar alters rating methodology

Intentionally or unintentionally, investors find themselves taking what amounts to an aggressive bet on a handful of companies at the top of the capitalisation-weighted index.

For investors who don’t have a strong view on the mega-caps and instead want an equity allocation with broad exposure to a range of companies and industry sectors, this may be a good time to revisit whether they are getting the sources of return they really want.

One way to escape the heavy skew in indices such as the S&P and the ACWI is to move from a cap-weighted to an equal-weighted passive strategy. This solves the concentration problem but can provide the wrong kind of diversification by diluting returns from the winners and having too much exposure to losers.

Will active management escape its dry spell?

Much of the motivation behind the flows from active to passive strategies in recent years has been the attraction of lower costs, and the argument that active managers don’t necessarily beat the index despite the higher fees they charge.

Recent experience has done little to dispel that view – outperforming the index has been a tall order for any manager who does not have a heavy orientation to growth and momentum stocks.

The top five companies of the MSCI ACWI index, including Nvidia and Apple, drove more than 40% of the returns in the first six months of this year. Against that backdrop, fewer than 30% of active managers beat their benchmarks in the first quarter of 2024, compared with a 10-year high of nearly 80% in 2017.

Even aside from the recent dry spell for active management, history shows that even the best-performing managers don’t win all the time, and this is a risk that needs to be managed.

A 20-year study by WTW of the top 25% of managers starting in 2003 showed that two-thirds typically fell out of the top quartile within three years, and 97% within six years.

See also: The 15% of US funds that beat the S&P 500 over the past decade

This finding makes sense because markets rotate, and different investment styles thrive in different environments and stages of the economic cycle. A large-cap, high-quality strategy will not excel at the same time as a deep-discount contrarian value strategy, and vice versa.

How can investors approach this problem? Rather than looking for one manager that tries to be all things to all people, allocating among a selection of managers with different but complementary investing styles can provide a solution.

Reframing concentration and diversification

While concentrated markets can be risky, concentrated portfolios are not necessarily a bad thing.

Our research shows that active managers running concentrated best-ideas portfolios outperform non-concentrated managers over time. In some scenarios, a portfolio of 10-20 high-conviction stocks can deliver better results than a more diffuse set of investment ideas due to the fact that winners have a bigger impact on overall portfolio performance.

With this concentrated best-ideas approach, a key risk to be managed is variability of manager performance. Here diversification can help manage style or factor exposure by bringing together several managers with complementary approaches. This approach can help manage the risk of individual manager underperformance, smoothing out the path to returns without giving up too much upside.

If investors take one lesson from the market movements of 2024, it might be to concentrate more on the difference between accidental and purposeful concentration.