Monday 20 May

- Full-year results from Big Yellow and Kainos

- Rightmove UK house price index

- Chinese one- and five-year interest rates decision

- German producer and wholesale price inflation

- In Europe, quarterly results from Ryanair

- In the US, quarterly results from Palo Alto Networks and Zoom Video Communications

Tuesday 21 May

- Full-year results from Cranswick, Pennon and Assura

- First-half results from SSP and Greencore

- Trading statements from Smiths Group, Kingfisher and Dowlais

- In Japan, quarterly results from Sony, Asahi, Rakuten, Dentsu and Samsonite

- In Asia, quarterly results from Tencent, Alibaba and Hon Hai Precision

- In Europe, quarterly results from Generali

- In the US, quarterly results from Lowe’s, AutoZone, Toll Brothers, Amer Sports, Macy’s and Urban Outfitters

Wednesday 22 May

- Full-year results from SSE, RS Group, British Land and C&C

- First-half results from Integrafin

- Trading updates and quarterly results from Coats

- UK inflation figures

- UK government borrowing

- Interest rate decision from the Reserve Bank of New Zealand

- US existing homes sales

- US oil inventories

- In Asia, quarterly results from Xiaomi

- Europe, quarterly results from Soitec

- In the US, quarterly results from Analog Devices, Target and Snowflake

- Marks & Spencer full-year results

- Nvidia first-quarter results

Marks & Spencer release full-year results

Marks & Spencer will release its full-year results on Wednesday after performing second-best in the FTSE 100 over the last 12 months and with shares at near five-year highs.

Despite the strong share performance, price has levelled in 2024 with rate cut anticipation and the M&S management team’s conservative earnings forecasts.

In the sixth months to September, M&S had an underlying pre-tax profit of £360m, far ahead both the £260m forecast and the £206m earned in the first six months of the 2022 fiscal year. December also showed a positive bump for the company, with a 7.2% total sales growth in the final three months of 2023.

Russ Mould, AJ Bell investment director, Danni Hewson, AJ Bell head of financial analysis, and Dan Coatsworth, AJ Bell investment analyst, said: “Chief executive Stuart Machin and team did their best to stop analysts and investors getting too carried away, given the uncertain economic outlook and also a sensible desire not to let lofty profit forecasts make a rod for their back.

“Even so, analysts nudged up the consensus underlying pre-tax profit forecast for the year to March 2024 to £653m, compared to the range of £550m to £600m that had prevailed before the interims.”

The AJ Bell team pointed to strong UK wage growth, the acquisition of logistics provider Gist, an improved outlook for the clothing and home business, and the food’s “reputation for quality and providing a treat” as leading factors.

Within the food business, sales are expected to hit £8bn with profits of over £400m, while clothing and home expectations sit at £4bn for sales and £325m in profits.

Nvidia first-quarter results announced

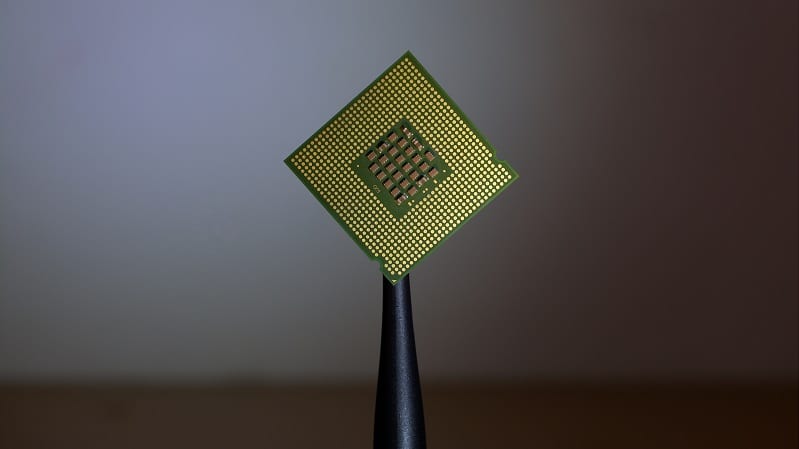

Nvidia, the S&P 500’s best-performing stock of the past 12 months with an over 200% return, will release its first-quarter results on Wednesday.

The company has become a darling of the Magnificent Seven with its foray into generative AI and accelerated computing. Last year, analysts upgraded Nvidia’s forecasts following each quarterly result, a trend that has continued this year with five upgrades to first-quarter earnings forecasts, according to Zack’s.

Guidance for the first quarter includes $24bn in sales, a gross margin of 76.7%, $3bn in operating expenses, and $250bn in other income.

“The AI hype-train is not only rolling but delivering, as far as Nvidia is concerned,” Mould, Hewson, and Coatsworth said.

“Momentum investors seem happy to pile in, although value seekers are likely to be more reticent, given the lofty valuation which leaves little room for error. In the final quarter of fiscal 2023, Nvidia ran a $2.7bn share buyback.”

Currently, forecasts for Nvidia’s second quarter include sales of $26.1bn, a net income of $14bn and earnings per share of $5.79, with all of these numbers near double what they were a year ago.

“Bears have little to chew upon, barring a meteoric share price rise, a premium valuation and seemingly universal enthusiasm for the stock. The $2.3 trillion market capitalisation equates to around 40 times this year’s earnings (when the S&P 500 trades on around 21-22 times, according to research from S&P Global and Capital IQ) and 20 times forecast annual sales,” the AJ Bell team said.

“Bulls will point out how sales and earnings forecasts continue to rise, as the company continues to outstrip forecasts. Bears will nod and then reference that multiple of sales, in the view that they have heard it all before, notably during the 1998-2000 technology, media and telecoms bubble, when arguments that valuation did not matter and sales and earnings momentum did eventually foundered and led to disaster, when the upgrades stopped and then downgrades kicked in, thanks to over-purchasing and old-fashioned investment bust.”

Thursday 23 May

- Full-year results from National Grid, Johnson Matthey, International Distribution Services, Tate & Lyle, Wizz Air, QinetiQ, Bloomsbury Publishing and Great Portland Estates

- Trading updates and quarterly results from Aviva, Petershill Partners, Hill & Smith and Essentra

- Purchasing managers’ indices (PMIs) from UK, Japan, Asia and USA

- US new homes sales

- US weekly initial unemployment claims

- In Asia, quarterly results from Meituan and Lenovo

- In the US, quarterly results from Intuit, Medtronic, Splunk, Dollar Tree, Ralph Lauren, Bilibili and Polestar

Friday 24 May

- Trading updates and quarterly results from Intertek

- GfK UK consumer confidence

- UK retail sales

- US durable goods orders