Monday 11 April

- – Chinese inflation figures

- – UK industrial, construction and manufacturing output

- – OPEC+ meeting

Tuesday 12 April

- – First-half results from Asos

- – Full-year results from Tesco

- – Trading updates from Easyjet, Pennon, Deliveroo and Ferrexpo

- – UK unemployment and wage growth figures

- – German ZEW economic sentiment survey

- – US NFIB smaller companies business survey

- – US inflation figures

- – In Europe, trading updates from LVMH and DFDS

Wednesday 13 April

- – UK inflation figures

- – Interest rate decision from the Reserve Bank of New Zealand

- – European industrial production data

- – Interest rate decision from the Bank of Canada

- – US oil inventories

- – In the US, quarterly results from JP Morgan Chase and Delta Airlines

Danni Hewon, financial analyst at AJ Bell, said: “As the nation’s energy bills go up with the expiry of the last price cap, council tax bills rise, and the national insurance contribution increase on earnings above £9,880 kicks in (for three months until the threshold goes to £12,570 in July) everyone could be forgiven for looking at the latest UK wage growth and inflation figures with some degree of trepidation.”

The wage figures will accompany the latest UK unemployment numbers on Tuesday 12 April and the inflation figures on Wednesday 13.

In January, the job market “looked pretty rosy, overall”, she said. Unemployment was back to its December 2019 level of 3.9%; employment improved slightly on its pre-pandemic level to reach 75.6%; and wage growth was up 4.8%, year-on-year.

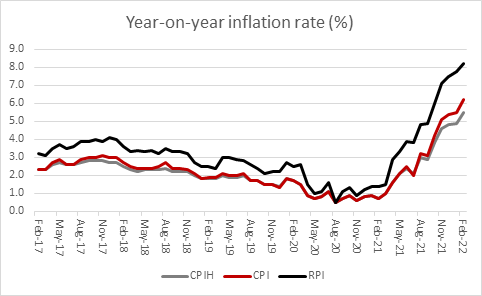

“However, the good news stopped there because inflation was running well ahead of pay growth. According to the figures from the ONS, year-on-year increases in the cost of living looked as follows for the month of February,” Hewson added.

CPI reached 6.2%, the highest level since it was introduced in 1997; while the Bank of England’s preferred measure of CPIH, which is CPI plus owner occupiers’ housing costs, hit 5.5% in February.

“The retail price index (RPI) reading of 8.2% showed the fastest rate of increase since March 1991 when, lest it be forgotten, the BoE base rate was 12.375%, rather higher than the 0.75% level to which the Monetary Policy Committee took the headline cost of borrowing at its March meeting,” Hewson said.

“Central bankers, politicians, economists and the British public will be hoping for some relief from both sets of figures, but that unfortunately seems unlikely, at least in the near term. The Office for Budget Responsibility is warning that inflation will average 7.4% in 2022, and Bank of England governor Andrew Bailey is calling in turn for pay restraint, so as to avoid a 1970s-style spiral, a message that may not go down too well with many households,” she added.

Thursday 14 April

- – Full-year results from THG

- – Trading statements from Dunelm, Norcros and Ashmore

- – Interest rate decision from the European Central Bank

- – US retail sales

- – US weekly unemployment claims

- – In Europe, quarterly results from LM Ericsson

- – In the US, quarterly results from Wells Fargo, Morgan Stanley, Goldman Sachs, Citigroup

Friday 15 April

- – US industrial production and capacity utilisation rate