Monday 4 May

– European manufacturing purchasing managers’ indices

– US factory orders

Tuesday 5 May

– Thomson Reuters interim results

– Interest rate decision from the Reserve Bank of Australia

– UK and US service industries’ PMI

– In the US, quarterly results from Walt Disney

Wednesday 6 May

– Caixin/market service sector sentiment survey (April)

Canaccord Genuity Wealth Management investment manager and international equity analyst Dan Smith said Chinese economic data gives a glimpse of life after lockdown given the country was the first to introduce and then ease lockdown measures. Therefore, this survey should provide a good proxy for the type of recovery most major economies can expect once restrictive measures are eased.

“While the survey showed confidence rose to 43 in March, from a record low of 26.5 the previous month, the March reading was still the second-weakest reading since the survey began in 2005, implying the service sector remained under pressure even after the lockdowns were lifted.”

– US oil inventories data

AJ Bell investment director Russ Mould said the US and global market is still clearly swamped with oil. If worldwide demand is “only” down by a fifth, that still means a drop in consumption of roughly 20 million barrels a day, or 600 million barrels a month, or 1.8 billion barrels a quarter, he noted.

“It is going to take time to work off that lot, even if we get a V-shaped recovery, so the only other possible fix is for supply to shut down.”

– First-half results from Virgin Money UK

– Trading updates from ITV, Smith & Nephew, One Savings Bank and Direct Line

On ITV, analysts at the Share Centre said the effect of coronavirus on advertising spend, especially from travel companies and airlines, is likely to dominate the update.

“The group previously stated advertising revenues would decline by around 10% in April. Like many it cancelled its final dividend along with guidance for the year and expectations are for further cost cutting measures. The share price has been hit hard in the recent market sell-off, hitting an eight year low in early April.”

– UK construction industry purchasing managers’ index

– European services industry purchasing managers’ indices

Thursday 7 May

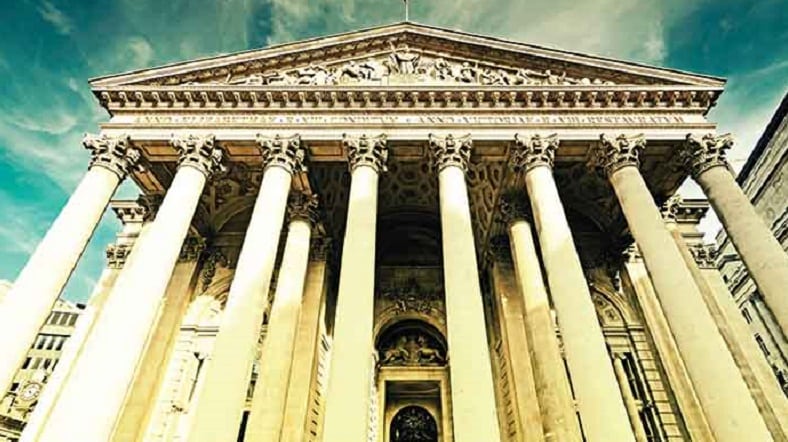

– Bank of England Monetary Policy Committee meeting

Smith said major policy changes are unlikely but economic conditions have worsened since the last BoE meeting, with lockdown measures likely to remain in place longer than anticipated, making the economic damage from the virus worse than initially feared. Therefore, further stimulus cannot be ruled out.

“The central bank has previously stressed that interest rates are at their lower bound, which means any further stimulus will likely be in the form of additional bond purchases, he added. “But then again, given the unprecedented nature of the economic shock, further interest rate cuts remain an option.”

– US initial jobless claims

Smith noted over the past six weeks, the number of people filing for unemployment benefits has increased by more than 30 million – highlighting the speed and depth of destruction the virus has had on the US economy.

“This week’s jobless claims show data for the week ending 2 May, a period when some US states have relaxed lockdown measures, so the pace of claims is likely to slow. Later in the week, the non-farm payroll report will reveal the true extent of the crisis by providing the latest estimate for the US unemployment rate – with analysts forecasting a sharp increase to 15.1%, and to unemployment levels last seen during the Great Depression some 90 years ago.”

– BT full-year results

Mould said: “A lot of investors have put the phone down on BT in the past year, because the telco’s shares have fallen by nearly half in the last 12 months and trade no higher than they did in their first week after privatisation in 1984.

“That suggests the market is worried about how BT can compete on so many fronts – fixed and wireless telecoms, broadband, TV and sports broadcasts – when it has a lot of debt, a big pension deficit and is hemmed in by the regulator Ofcom on one side, a host of competitors on another and value-sensitive customers on another, all of whom are capable of switching from one service provider to another.”

– Trading statements from Barratt Development, RSA and Provident Financial

Friday 8 May

– US non-farm payrolls data

– In Europe, quarterly results from Siemens