Monday 2 November

– Ryanair first-half results

– Life insurer Hiscox Q3 results

– Manufacturing PMIs in Asia, Europe, the UK and US

– In Europe, quarterly results from Siemens Healthineers

– In the US, quarterly results from PayPal, Mondelez, Estee Lauder, Clorox and Beyond Meat

Tuesday 3 November

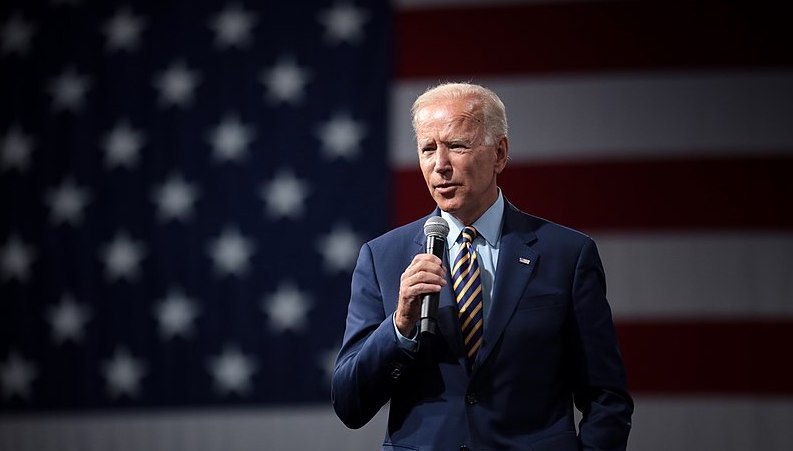

– US presidential election

AJ Bell investment director Russ Mould said: “Investors might expect the US stock market to prefer a Republican president with the party generally seen as being in favour of small(er) government and less inclined to interfere in business matters and free markets than the Democrats. However, it generally has not worked out like that, at least not in modern times.

“Over 18 presidencies since the election of Harry S Truman in 1948, the Dow Jones Industrials has, on average, done better under Democratic presidents than it has Republican ones. Even more intriguingly with 2021 in mind, the Dow has done much better in the first year of a Democratic term than it has a Republican one, with an average gain on 13.1% compared to 2% from their rival incumbents.”

Mould added: “It should also be remembered that the consensus view before the 2016 poll was that Hillary Clinton was likely to win and that an unexpected Trump triumph would be ‘bad’ for markets, because of his policies on trade in particular. The consensus was spectacularly wrong on both counts.”

– Associated British Foods full-year results

Mould said despite an upbeat trading statement in early September, which flagged how Primark profits would come in at the top of the forecast range of £300-350m (albeit down from £913m last year) and net cash on the balance sheet would exceed forecasts at £1.3bn, shares in Associated British Foods are languishing near to their lows for the year.

“Analysts will look for any guidance on performance trends across the different operating divisions for fiscal 2021 and also overall earnings per share,” he added.

– Trading statement from DS Smith

DS Smith has grown steadily thanks to well-judged acquisitions and increasing demand for packaging designed for internet retailing, said the Share Centre. In September, the company reported that demand for corrugated boxes had recovered well in July and August as e-commerce demand for consumer goods picked up.

“The company also confirmed it would declare an interim dividend and received a further boost in October when it announced a new sustainability strategy aimed at increasing the amount of recycled packaging and reducing waste,” the Share Centre added. “Demand from the industrial sector has been a weak spot, so any update on that will be of interest.”

– Trading statement from Weir

– In the Middle East, Q3 results from Saudi Aramco

– Interest rate decision from the Reserve Bank of Australia

– Construction PMI in the UK

– US factory orders data

– US monthly car sales figures

– In Europe, quarterly results from Bayer, BNP Paribas and HelloFresh

– In the US, quarterly results from Ferrari and Fox

Wednesday 4 November

– Marks & Spencer first-half results

– Smurfit Kappa Group Q3 2020 sales and revenue release

Like DS Smith, the Share Centre noted Companies in the packaging industry have generally done well in recent years through online shopping demand, despite lockdowns causing the closure of retail stores.

“Investors will be hoping that the business has maintained a steady level of demand after the first half revenue fall of 9%,” it said. “Any further news of cost-cutting measures will be of interest; however, we remain positive on the longer-term prospects for the group, particularly regarding their involvement in sustainable paper-based packaging.”

– Trading statement from Morgan Sindall

– Services industries PMIs in Asia, Europe, the UK and US

– US ADP payroll figures

– US oil inventory data

– In Japan, quarterly results from Softbank

– In Europe, quarterly results from BMW, Vestas Wind Systems and Zalando

Thursday 5 November

– Astrazeneca Q3 results

Astrazeneca’s shares are up by a fifth over the past year and hovering near their all-time highs, not least because the drug giant is right in the vanguard of the fight against Covid-19, said Mould.

The pharma giant announced in mid-October that its Covid antibody treatment, AZD 4772, had entered Phase III clinical trials, helped by $486m of funding from the US government, said Mould, who noted the firm’s wider drug pipeline will also be of interest.

“The Cambridge-headquartered company has 37 treatments in Phase I trials, 45 in Phase II and 11 in Phase III, across its three specialist areas of oncology, cardiovascular, renal and metabolism and finally respiratory and immunology,” he said.

– J Sainsbury Q2 2021 earnings release

The Share Centre noted Sainsbury’s share price has held up relatively well over the course of the year as a result of defensive characteristics of supermarkets, as well as the surge in online shopping. It said the latest Kantar figures show that one in five households order food online, with a 76% rise in volume observed in the last month in comparison with the previous year.

“Sainsbury’s have had to absorb considerable costs as a result of the pandemic, which were outlined in results back in April. As a result, market share continues to dwindle. Investors will therefore be keen to hear management’s forward-looking initiatives and the outlook for the next few quarters, in the hope of achieving a sustainable recovery.”

– Bank of England monetary policy decision

– US Federal Reserve monetary policy decision

– First-half results from Auto Trader

According to the Share Centre, since listing in 2015, Auto Trader has made steady progress and was promoted to the FTSE 100 in December 2018.

“Investors in the company will be hoping that people trading in their cars for another second-hand model on a reasonably regular basis is a trend that will continue,” it said. “The share price has recovered strongly since March, with the market encouraged by strong demand post-lockdown. The company remains a clear market leader.”

– First-half results from AVEVA, Sainsbury and Wizz Air

– Trading statements results from RSA, Hikma Pharmaceuticals, Howden Joinery, Superdry, Derwent London and TI Fluid Systems

– Halifax UK house price index

– German factory orders

– EU retail sales figures

– Challenger, Gray & Christmas US job cuts survey

– In Japan, quarterly results from Nintendo

– In Europe, quarterly results from Arcelor Mittal, Societe Generale and Lufthansa

– In the US, quarterly results from Bristol Meyers-Squibb, Square, Uber, Barrick Gold, General Motors, Electronic Arts

Friday 6 November

– Non-life insurer Beazley trading statement

– In Japan, quarterly results from Honda Motor

– US non-farm payrolls, wage growth and unemployment data

– In the US, quarterly results from CVS Health and Hershey