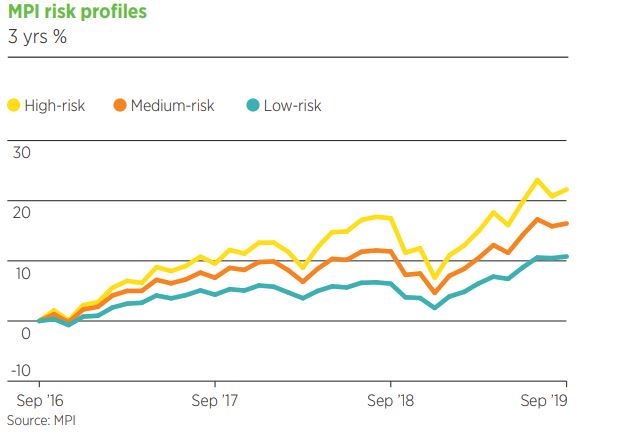

Looking back at the third quarter of this year, there were gains in all currencies and risk categories.

Sterling portfolios achieved an average return across each three risk categories of 1.7%. Euro portfolios posted slightly higher returns, ranging from 1.5% for low risk to 2.3% for high risk, while US dollar low-risk portfolios outperformed those in the high-risk category.

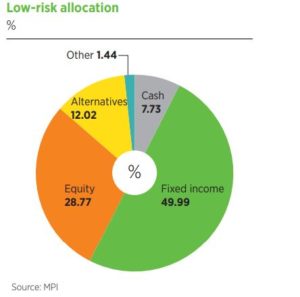

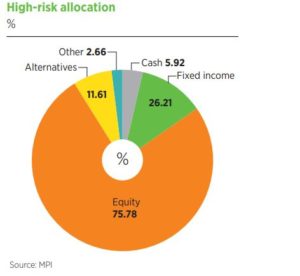

Equity weighting increased for medium and high-risk mandates, but in low-risk mandates, allocations to cash and fixed income increased at the expense of equities and alternatives.

Optimistic indicators

The US yield curve inverted in the summer, often seen as a signal for economic woes, and manufacturing activity, as measured by the PMI, came in at 47.8%, the lowest level for a decade.

In response to the deteriorating economic outlook, the Fed cut rates twice broadly as expected. However, according to Frédérique Carrier, head of investment strategy at RBC Wealth Management, there are many indicators that give reason to remain positive about the US.

“The US consumer is an area which remains robust; housing prices remain firm, the unemployment rate is at a 50-year low and the savings rate at a robust 7%,” he says.

In the UK, there were modest gains for equities as a weaker sterling provided a boost for exporters. Investors favoured more defensive stocks away from financials and commodities, which performed less well.

In politics, Boris Johnson finally got the election he didn’t want, just as the Conservatives were looking like they might get the working majority they need to deliver Brexit.

Daniel Casali, chief investment strategist at Smith and Williamson, says the Conservatives returning to government should give us reason to be optimistic. “We have become more constructive on UK equities over their international peers,” he says.

Casali adds the Conservative party is likely to follow the US lead by cutting red tape. “Under Trump, the US has cut over 32,000 pages (around 30%) of the US Federal Register of Regulations. While in the UK, the change in emphasis in the post-Brexit agreement with the wording around close alignment moving from the legal agreement to the political declaration gives more scope to deregulate and should lead to higher productivity.”

Making headway

Eurozone markets also made headway led by the defensive sector in July and August, with financials making a recovery in September. However, economic growth remained very weak with the economy expanding by just 0.2% in Q2. Germany, long considered the economic powerhouse of the eurozone, only narrowly avoided a recession in Q3.

However, according to Casali, concerns may be short-lived. “While Germany relies heavily on China to buy its goods, we believe Chinese consumer strength is higher than many people think. We expect the effects of more credit stimulus trickling down through the Chinese economy will lead to an export recovery in Germany.”

In Japan, the market also remains dominated by concerns over the Chinese economy and trade. However, investors have been encouraged back into the market by more attractive valuations, as Carrier explains. “We are more positive on Japan, a market that has been under-owned for a while and is now looking relatively cheap,” he says.

Some managers are suggesting central banks will be reluctant to raise rates if inflation picks up and, as a result, have been focusing on companies with reliable pricing power and low cyclicality.

Carrier explains: “We have recently introduced an exposure to infrastructure to our portfolios. Infrastructure tends to be a resilient asset class with stable cashflows and low correlation to business cycles.”

Infrastructure should also benefit from more public spending, although it could take some time for the positive effects to work through the economy.

Black swan events

There have been violent clashes between protesters and police in Hong Kong as people take to the streets in a rejection of the imposing of control from central government. According to Casali, however, the likelihood of significant escalation remains low.

“Hong Kong is a possible ‘black swan’ event,” he says. “However, China is unlikely to want to roll their tanks in, given the precarious trade relationship with the US and the fact that Chinese state-owned industries rely heavily on Hong Kong to raise capital.”

In the US, the impeachment of Donald Trump continues to play out on the political stage but does not seem a concern for investors. The focus is on who will take on Trump in next year’s election. According to RBC’s Carrier, the impact on election expectations and the economy will depend on who emerges as the Democratic frontrunner.

“A less business-friendly candidate would impact market sentiment. However, it is too early to judge how this will play out.”

Casali echoes this sentiment. “Elizabeth Warren’s progressive agenda, which includes a halt to fracking, pricing controls on healthcare, more financial regulation and breaking up big-tech will likely harm US markets if she emerges as frontrunner,” he says.

However, it’s a long road to the White House, and there is still time for a new centrist candidate to break through.

James Hoare is managing director at MPI

MPI is a free-to-use service to help advisers and trustees find and compare discretionary investment managers using performance data collated from more than 50 investment firms. To find out more and build your own panel of managers, go to www.mpindices.com