A report looking into Vanguard’s assets and sustainability has said the group’s US equity assets are at risk of losing $3trn (£2.2trn) by 2050 if global temperatures rise by 2°C – a scenario more likely thanks to the group’s carbon-intensive holdings.

The damning conclusion from think tank Universal Owner in its report Vanguard and Universal Ownership is that despite the asset management giant’s climate commitments, it continues to invest in the most damaging fossil fuels, its ESG products have “virtually no impact” and its stewardship is “floundering”.

Universal Owner explained it has used the 2°C global warming scenario to show the scale of harm the world’s second largest asset manager risks inflicting on its own portfolios.

The think tank said Vanguard, with $7.2trn total assets under management, is erroneously focused on individual company risk disclosure when the nature of its broad holdings means it has an interest in health of the market as a whole.

Universal Owner director Thomas O’Neill said there is a disconnect in Vanguard’s strategy.

“The analysis shows Vanguard is not representing beneficiaries’ best interests on climate,” he said.

“Vanguard fails to internalise the proposition that its portfolios’ future value is dependent on the stability of the biosphere and to implement a stewardship and fossil fuel financing policy commensurate with the threat.”

Dirty holdings

The report stated the most polluting fossil fuels run deep in Vanguard’s equity and bond holdings: “Its equity gives it effective ownership of assets responsible for the production of 40 million tonnes of coal a year, and 1.5 billion barrels of oil from the Alberta tar sands. It has lent at least $7.6bn to coal companies through its outstanding bonds.”

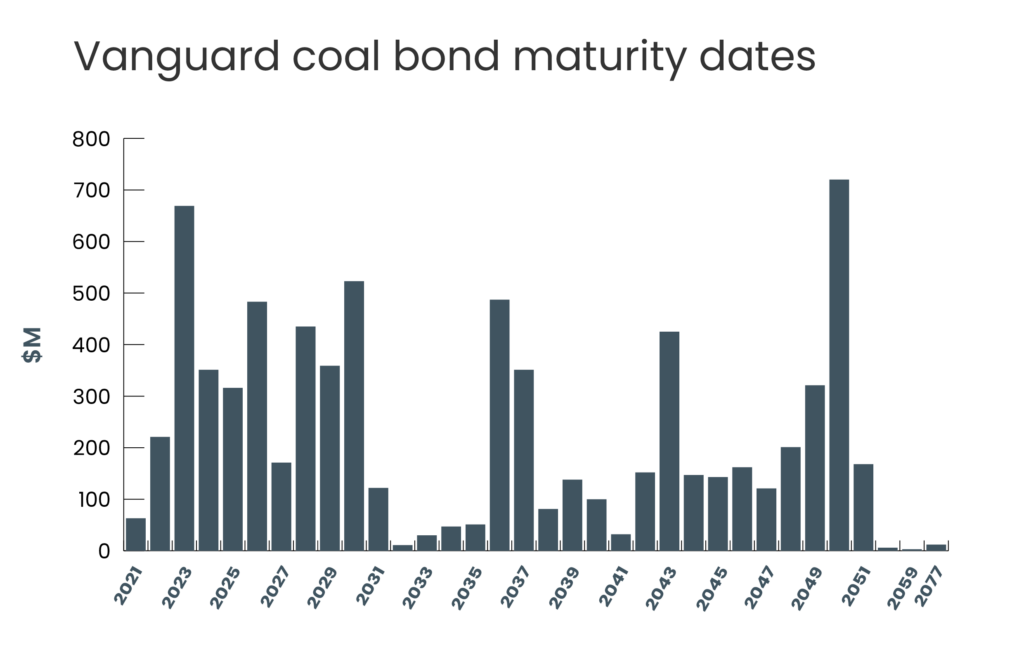

Universal Owner pointed out $3.6bn of these bonds are due to mature in the next 10 years – recapitalising these would be at odds with the International Energy Agency’s view the world can only reach net-zero by 2050 by ending investment in new fossil fuel supply projects and putting a stop to “further final investment decisions for new unabated coal plants”.

Source: Universal Owner

Vanguard is also not, according to Universal Owner, effectively transitioning from brown to green assets. The report said: “Unlike its peers Blackrock and LGIM, it has no policy to divest its discretionary funds from coal companies. It could also reconfigure its passive funds to track indices tweaked to screen against carbon-intensive companies on a firm-wide scale, but it is not.

“We find that, despite Vanguard’s new ESG funds, 94% of the capital flowing into the firm is still going to conventional funds.”

Stewardship

Stewardship is another area where the think tank found Vanguard fell short, saying its climate engagement “lacks ambitious objectives and a coherent escalation policy”.

Universal Owner also claimed Vanguard has insufficient staff focused on this area. It calculated one ESG staff member for every 300 portfolio companies and an ESG budget equivalent to 0.16% of its gross asset management fees, saying this made effective climate stewardship “untenable”.

In response, the asset manager claimed it is taking its fiduciary responsibility seriously pointing to its growing investment stewardship team, which has over 40 members.

Vanguard said in a statement this team engages with companies on risk oversight processes and effective disclosure through proxy voting.

“Through these efforts, we have and will continue to outline our expectations for companies where climate change is a material risk, including the need to establish climate-competent boards, demonstrate how climate risk is integrated in their long-term strategic planning, and effectively disclose climate-related targets, actions, and outcomes,” said a Vanguard spokesperson.

When it comes to companies Vanguard views to be out if sync with market regulation or with the action to mitigate climate risk, the asset manager said it takes action on behalf of its funds and in line with its voting policies.

Vanguard defended its position as one of the founding members of the Net Zero Asset Manager’s Initiative: “Additionally, I’ll note that we are fully committed as a signatory to the Net Zero Asset Manager’s Initiative, where emphasis on engagement with portfolio companies is integral to driving positive change on environmental risks like climate change.”

This article is written by Christine Dawson, a reporter on Portfolio Adviser sister title ESG Clarity. For more on ESG investing, please visit esgclarity.com