Having a set allocation of long-dated government bonds has fuelled the decade-long outperformance of the Vanguard Lifestrategy range, but with the global vaccine rollout and a positive economic outlook, is it time to re-evaluate that allocation?

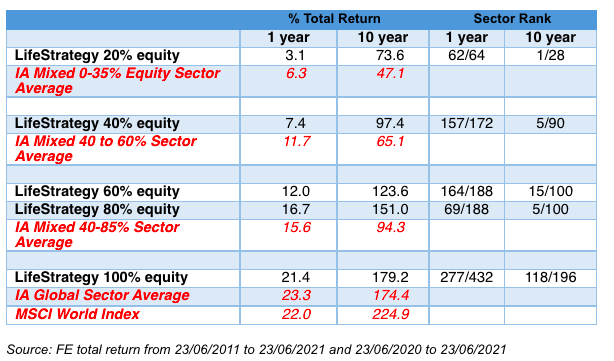

Vanguard’s Lifestrategy range is now close to £30bn in size and despite being passive, FE Fundinfo data shows all five funds have beaten the IA Mixed Investment 40-85% Shares sector average.

Since June 2011 to the end of June this year, the funds have delivered returns between 73.6% and 179.2%.

However, with four of the five funds having a set exposure to long-dated government bonds, AJ Bell’s financial analyst Laith Khalaf has questioned whether this fixed allocation could cause performance issues as the vaccine rollout progresses and the economy strengthens.

“If we are entering a period with more inflationary pressures, and tightening monetary policy, the Lifestrategy funds may find their fixed exposure to long-dated bonds makes it more difficult to perform. While active funds can adjust their asset weightings depending on prevailing market conditions, passive funds like Lifestrategy do not,” he says.

“If the past 10 years have taught us anything, it’s not to write off the bond market and the longevity of ultra-loose monetary policy. What’s more, Lifestrategy’s rebalancing of a fixed asset allocation acts as a natural brake on exuberance, taking money out of areas that have done well, and recycling into areas that have fared poorly. However, in a bond sell off, that would mean continuing to buy bonds on the way down, and in a prolonged bond bear market, that could prove painful.”

Allocation review

Independent wealth consultant, Adrian Lowcock, agrees that the range is particularly vulnerable to a change in outlook for interest rates because of exposure to longer dated government and corporate bonds.

However, he adds: “Vanguard are not likely to be too concerned given the nature of the product and their own views. They believe that the bulk of returns come from strategic asset allocation and not stock selection or tactical moves in asset allocation.

“In addition, costs play a significant role in long term returns, so Vanguard keep the product range fairly simple in order to keep cost low and reduce their impact.”

However, the latest data fund flow from the Investment Association suggests investors are not overly concerned by the recent bond sell-off, with the IA Mixed Asset 40-85% Shares named as the best-selling sector in May, gaining £692m in net retail sales.

“This reminds us that some investors are still looking for an element of resilience to their investments, despite strong market returns over the past year,” says Kate Marshall, acting head of investment analysis at Hargreaves Lansdown. “Funds in this sector invest partly in bonds and cash, so they’re not always fully exposed to the volatility that often comes with pure stock market investing.”

See also: Christopher Bishun: How has Vanguard Lifestrategy performed compared to active alternatives?

Other alternatives out there

While the passive, low-cost Vanguard Lifestrategy Range will appeal to some, there are similar active options available that would be better placed to navigate a sea change in the bond market.

Khalaf highlights the Personal Assets Trust and Rathbone Total Return fund for the more conservative investors – both of which offer investors a mixed asset portfolio but are actively managed.

“They have a wider toolkit than Lifestrategy funds to navigate markets, making use of other assets like gold and cash in the portfolio,” he says. “As active funds they do come with a higher annual fee, 0.57% for the Rathbone Total Return fund and 0.73% for Personal Assets Trust, compared to 0.22% per annum for the Lifestrategy range.”

BlackRock’s Consensus range, also passive, is widely considered to be the main competitor to the Vanguard funds. Where this fund differs, however, is that it doesn’t have fixed equity and bond exposures and instead follows the average allocations of UK pension funds.

See also: Blackrock rival to Lifestrategy prompts split views on static allocation

Lifestrategy to remain popular among investors who prefer someone else doing the work

For Lowcock, however, almost regardless of the wider market movements, Vanguard has its place in most portfolios.

He says: “Instead of trying to be all things to all people Vanguard have focused on offering a range that address one key aspect of long-term performance – strategic asset allocation -and manage this on behalf of investors. This approach is simple and low cost when well executed.

“For new investors, or those preferring to let someone else do the work, the solution is likely to remain attractive although past performance cannot be guaranteed.

“For more experienced investors and those wanting to add a bit more to their portfolio the Vanguard range is a good core solution which can be complemented by other options so the exposure to long-dated bonds only forms a segment of the whole and adds to diversification.”