Last Word Research is hopeful that 2021 will be a much better year – although it would be hard to be worse than 2020.

Despite being in lockdown 3.0, there is still some good news to be found. As vaccines are rolled out across Britain it is hoped we will start to see some normality returning to everyday life. This optimism has infected the UK’s fund selectors.

Macro shift

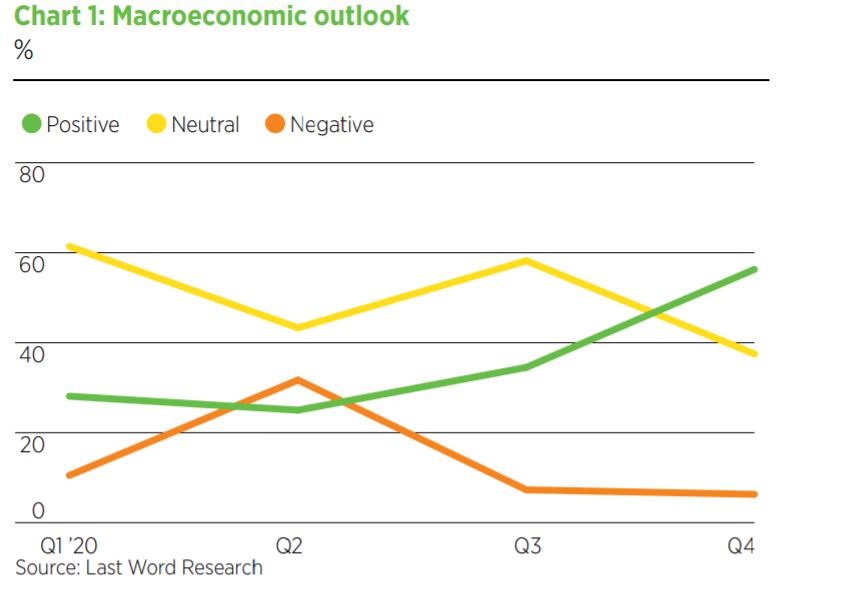

Taking the latest data from Last Word Research’s Asset Class Report, which surveys the top fund selectors from across the UK and Ireland, it is clear that investors are feeling positive about the macroeconomic outlook.

In fact, more than 50% of respondents reported an optimistic outlook heading into 2021, with hardly a pessimist in sight (see chart 1).

In Ireland, this upward shift is even more impressive, and a giant leap in optimism with not a single pessimist mirrors what is happing across much of continental Europe.

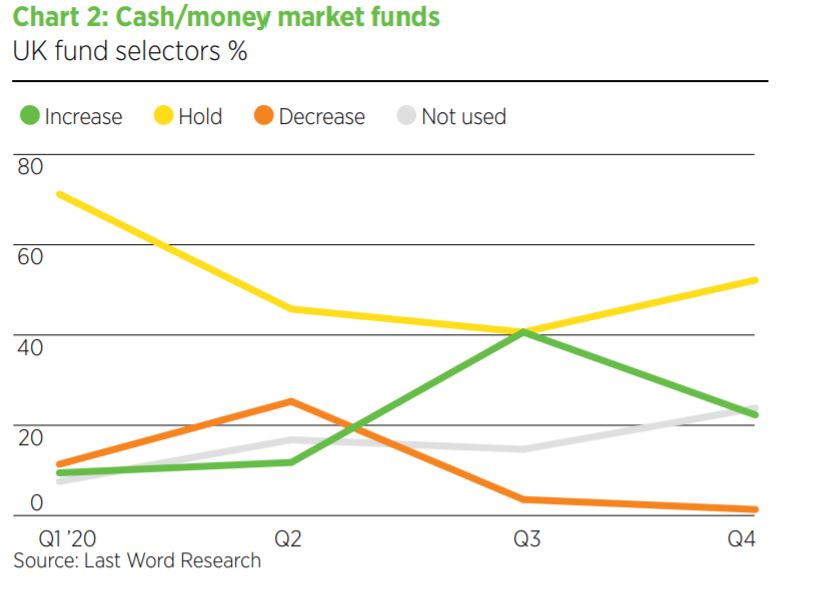

However, investors in the UK are still cautious. As you can see in chart 2, several fund selectors are planning to increase their allocation to cash/money market funds. Although this number has fallen sharply since last quarter, it is clear there remains some apprehension about the year ahead, which is perfectly understandable following the unpredictability of 2020.

Risk is back on the table

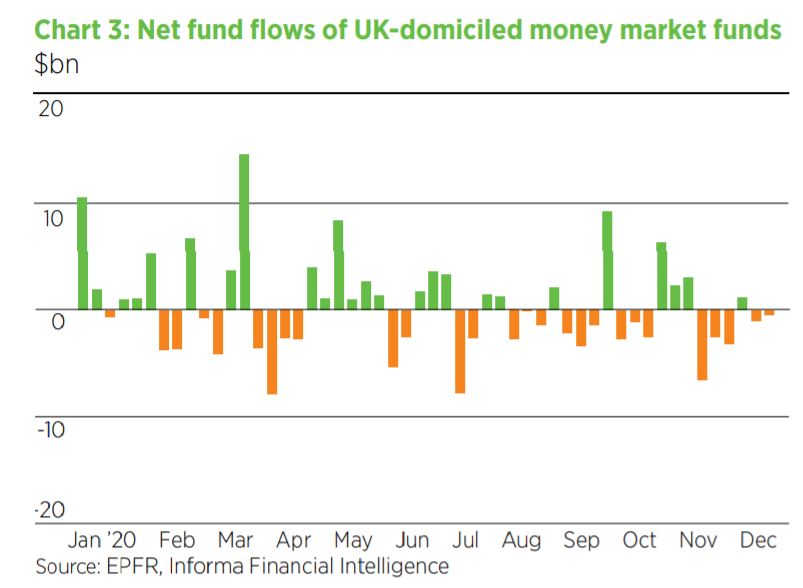

Despite this, the picture looks a lot rosier in the grand scheme of things. Using data provided by EPFR Informa Financial Intelligence, we have taken a look at the net fund flows into all UK-domiciled money market funds (see chart 3).

Of course, we can see the expected spikes – specifically in March 2020 when Covid-19 resulted in the first UK lockdown, and then again in October 2020, when lockdown 2.0 was instigated after the UK recorded one million positive Covid cases.

However, as chart 3 shows, net allocation to money market funds has become negative, especially during the past couple of months.

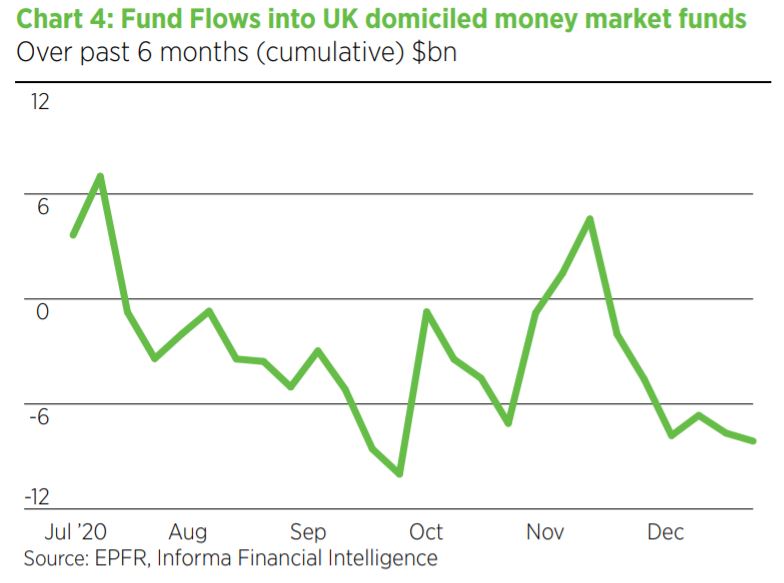

If we zoom in further for a closer look at the cumulative fund flows into UK domiciled money market funds (chart 4), there is a clear steady downward trend in the past six months, showing significant net outflows from cash and money market funds. This suggests investors are preparing to move into other asset classes and begin taking greater risk.

Dash from cash

Despite there still being a handful of cautious UK investors, with roughly one in four looking to increase their allocation to cash, plenty of fund selectors are looking to move back into the market and begin investing once again.

Overall, the latest Last Word Research Asset Class Report points to a more positive future, with investors looking to increase risk as it is hoped normality is just around the corner. It will be interesting to see how the latest lockdown, combined with the impact of the vaccine, affects fund selectors’ attitude towards risk.

For now though, it seems investors plan to move away from the safety of cash.

All this data is available in a comprehensive report. If you would like to get involved with our research or discuss this data further, please do not hesitate to get in touch with Lottie.mcgurk@lastwordmedia.com