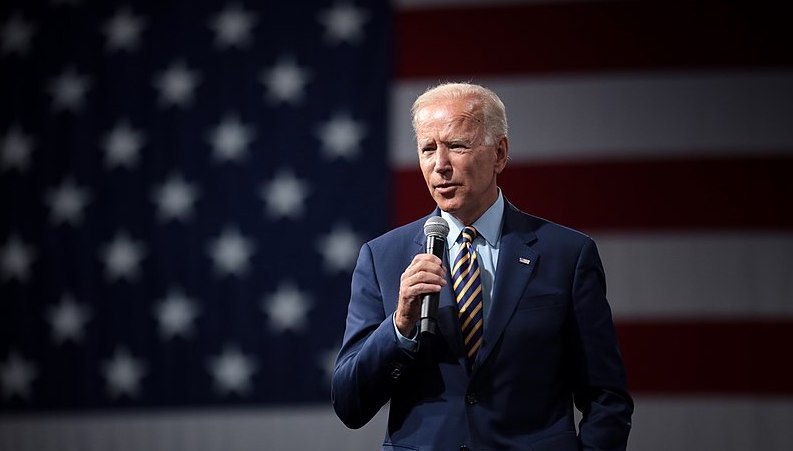

The inauguration of President Joe Biden is set to herald a sea change in policies on the environment with boosts for many business sectors and for sustainable investing.

The first and most obvious indication is Biden’s promise to re-join the Paris Agreement as a priority.

John David, head of Rathbone Greenbank says: “Joe Biden’s commitment to bring the US back into the Paris Agreement is a clear sign to the world that the US is ready to retake the reins and once again become a global leader in the fight against climate change.

“With Biden promising to expose ‘climate outlaws’ undermining global climate action, there will be increased pressure on laggard nations to avoid becoming isolated in a world accelerating towards net-zero goals.”

Biden will be able to pass the infrastructure package Trump failed to deliver

Experts say another important aspect of the new administration will be the alignment of the green and economic agendas. This is exemplified by Biden’s expected appointment of Janet Yellen to the cabinet position of Treasury secretary. She was, of course, until 2018 the chair of the Federal Reserve so the move is roughly the equivalent of a former governor of the Bank of England becoming the Chancellor of the Exchequer.

Randeep Somel, manager of the M&G Climate Solutions Fund, says: “Biden has nominated Janet Yellen, the former Federal Reserve chair. A very competent and skilled administrator, Yellen will play a crucial role in both stimulating the economy in the short term but ensuring its long-term prospects are not hindered.

“Yellen has been known to support the case made by Biden that cheap borrowing costs are an opportunity for public spending to boost the economy. This will aid an infrastructure package that President Trump talked about for his four years in office but was unable to achieve.”

“There does seem to be broad consensus amongst Democrats, and a small number of Republicans on tackling climate change, so this could be a key area and lasting legacy of the Biden Presidency.”

‘On the environment Donald Trump and Joe Biden are Yin and Yang’

The contrast between this administration and the last will be dramatic.

Gemma Woodward, director of responsible investment at Quilter Cheviot says: “On the environment, Donald Trump and Joe Biden are Yin and Yang. In the run up to his election victory, Biden committed to targeting net-zero carbon emissions by no later than 2050 and he has since proposed what is arguably the most ambitious climate programme from any President, including a $2trn climate package to be spent over his four years in office, supporting renewable energy and overhauling polluting industrials.”

Somel says President Biden’s ‘Build Back Better’ promise is underpinned by strong sustainable policy ideas.

This includes escalating the use of renewable energy for electricity generation, which will target emissions free power by 2035 and upgrading four million buildings to meet the highest standards for energy efficiency.

Demand for lithium batteries could rise 6.5x higher in five years

Another part of the plan will encourage adoption of electric vehicles with the US government, offering tax incentives to replace older cars and also funding over 500,000 new EV charging stations.

This element has prompted predictions of huge benefits for the battery supply chain.

A just-published Bloomberg Intelligence report entitled ‘Blue Wave Impact on Asia: Green Push, Reflation, Trade’ says that Biden’s clean energy vision which includes a net-zero emission target by 2050 and $2 trillion in funding will represent a huge boost for the global lithium battery sector.

It notes that along with those half million charging stations, it aims to replace 500,000 school buses with zero emission transport.

More broadly, the report suggests that lithium battery demand could rise by 6.5 times over the next five years, not just from policies in the the US, but also Europe, and China. It says energy storage system orders may grow about 68% a year driven by industrial and residential demand.

Such shifts could also prompt consolidation.

BIoomberg Intelligence senior industry analyst Horace Chan says: “The global battery supply chain will benefit from new US President Joe Biden’s $2 trillion clean energy plan – but weaker suppliers face being forced out of the market or taken over.”

He says the wider supply chain industry is likely to consolidate into a few leading firms in each market as buyers look to lower costs and set stricter quality standards.

“Producers which lack talent and resources may eventually be forced out of the market. There could be strong earnings momentum among key Chinese, Japanese and Korean frontrunners such as CATL, LG Chem, Samsung SDI and Panasonic on explosive demand growth and market share gains,” he adds.