Witan Investment Trust’s net asset value total return was down 14.3% over the six months to 30 June, while its composite global benchmark returned -9.6%.

The £1.6trn company generated a share price total return of -17.1%, owing to a widening of the discount from 5.8% to 8.9% over the six months.

Just before midday on Tuesday, the trust’s share price was trading marginally below its previous close of £2.36. Year-to-date it is down nearly 7.1%.

In a video interview published alongside the results, chief executive Andrew Bell (pictured) said: “There hasn’t been much consistency from almost one week to the next, let alone month to month, in terms of what the market has been concerned about. The bottom line is, over the six-month period, we underperformed.”

He added: “All of the underperformance came in the first couple of months of the year, so the lead up to and immediate aftermath of the Russian invasion of Ukraine.”

Witan described its direct exposure to Russian investments as “negligible”, with any remaining holdings held at nil value.

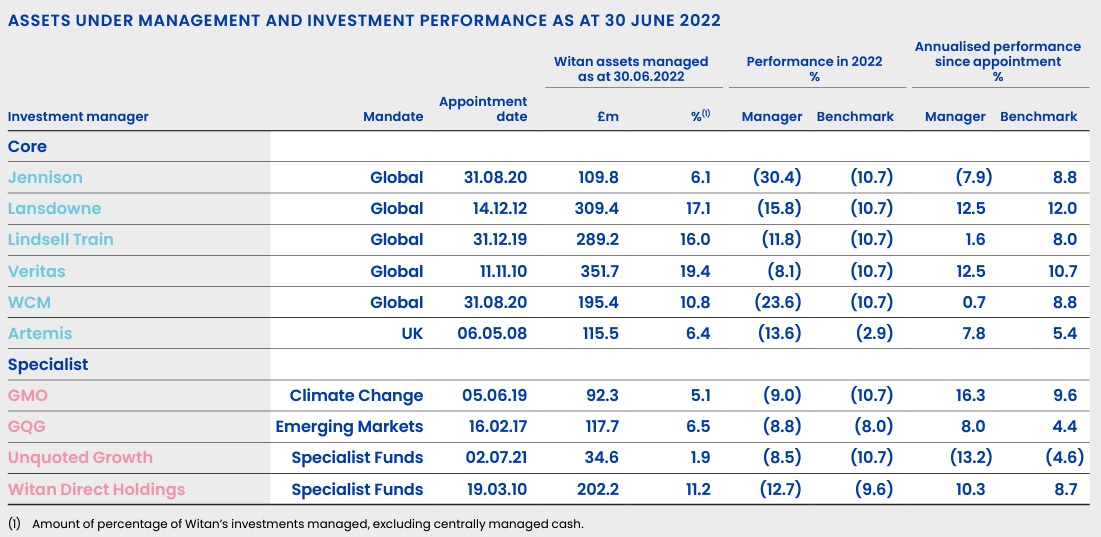

Founded in 1909, the trust uses a multi-manager approach, with nine external firms running various mandates, all of which delivered negative returns in the first half of the year:

Rough start but better second half

The first quarter saw the trust record a 6.3% fall in NAV compared with a 1.9% drop in its benchmark, while Q2 saw a convergence in the performance of the two, with Witan’s NAV returning -8.6% versus -7.8% for its benchmark.

The improving performance appears to have continued into H2, with the trust’s NAV and share price up 11.4% and 14.1%, respectively, between 1 July and 12 August. Its benchmark returned 9.9% over the same time frame.

Witan chairman Andrew Ross said: “The first half of 2022 was an unusually tough environment for investors, with both equity and bond markets registering significant falls. US equities on Wall Street exceeded the 20% fall often viewed as defining a ‘bear’ market.

“In these circumstances, Witan’s employment of gearing, while historically beneficial, proved a drag on returns, while our managers’ expectations for a post-pandemic reopening of economies were stymied by the impact of higher inflation and interest rates.”

He added: “The company has been active—in absolute terms and relative to its peers—in buying back shares, buying 30.7 million shares—4.2% of the total—into treasury in the period, at an average discount of 7.6%.

“This added £5.7m to the net asset value which, for perspective, more than offset the company’s investment management costs for the period.”

Dividend streak maintained

Witan has increased its dividend every year since 1974 and is ranked among the AIC’s dividend heroes.

The board advised that its policy remains to grow the dividend each year has stated its willingness to continue to smooth dividend pay-outs using retained revenue reserves, which amounted to £48.9m at the start of 2022.

A second interim dividend of 1.4p per ordinary share will be paid on 16 September 2022.