Jupiter fund managers Nick Williamson and Richard Watts are personally being given a combined £60.5m in newly issued Chrysalis shares, according to reporting in The Times.

An update from Chrysalis on Wednesday stated: “On 29 November, the company announced that it had entered into an agreement with the AIFM, Jupiter Unit Trust Managers, to settle 51% (£60.5m) of the performance fee due in respect of the year to 30 September 2021 in ordinary shares.”

It added: “The remaining 46% (£51.5m) of the performance fee amount will be settled in cash.”

The Times described the sum paid to Williamson and Watts as ‘unprecedented’.

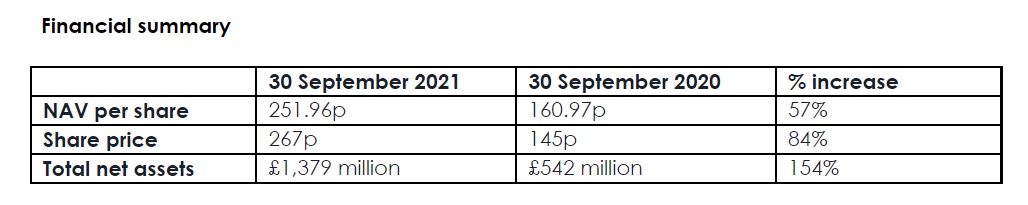

An analyst note from Peel Hunt stated that its early modelling had put the performance fee at £60m, but this nearly doubled to more than £112.1m due to the 57% growth in the trust’s NAV over the year to 30 September 2021.

See also: Chrysalis falls short of £125m placing target as Omicron jitters bite

Jupiter responds to Chrysalis’ bumper pay-out

As Chrysalis’ manager, Jupiter is currently entitled to 20% of all profits by which the adjusted NAV exceeds the higher of the performance hurdle, set at 8%, and the high water mark at the end of the relevant period.

A Jupiter spokesperson told Portfolio Adviser: “The performance fee, as in any year, is reflective of the significant value that has been created for shareholders by the investment management team over the course of the year.

“The calculation for the fee is consistent year-on-year, and fully set out in the company’s prospectus. Jupiter, alongside the board of the trust, is committed to ensuring continued alignment with the company’s shareholders, and keeps all fee arrangements under constant review.”

When asked if this type of fee arrangement is something the company will pursue moving forward, the spokesperson said that Jupiter has very few funds with performance fees and, in this instance, the structure was set by the independent board of the trust.

Board to review performance fee arrangements

Chrysalis chairman Andrew Haining credited the growth to strong performances and fund raising by key holdings Klarna, Wise and Starling Bank.

Referring to the performance fee arrangement, he said that “the board was pleased that the portfolio management team requested that the deferred element of its performance fee be taken in new Chrysalis shares […], a stance that the board believes was extremely constructive”.

But added, “to ensure continued alignment with stakeholders, the board will review fee arrangements, including the performance fee payment structure, in 2022 after consultation with relevant parties”.

In a further change, Chrysalis will assume direct responsibility for the AIFM role, including the valuation and risk management aspects, replacing Jupiter Unit Trust Managers.

“The board has determined that it has now reached a stage in its evolution at which it would be more efficient to become a self-managed investment company in 2022,” Haining said.

Jupiter Investment Management will, however, continue to provide portfolio management services.

The change is expected to take place by 30 June.