JO Hambro Capital Management is calling a “red hot recovery” for UK plc as companies gathered momentum in the first quarter amid the economic recovery from the Covid crisis.

The upbeat prognosis comes courtesy of the JO Hambro UK Profit Index, which analyses the latest quarterly results and half-yearly results published by all UK companies listed on the main market, excluding investment funds and Reits on a rolling 12-month basis.

The findings, published on Wednesday, revealed company revenues plunged by nearly a fifth in the 12 months to March 2021, equivalent to a £349bn top line hit.

The impact from the Covid crisis was more severe than any downturn in recent history and eight times bigger than the global financial crisis, which wiped £42bn off revenues peak to trough, JOHCM noted. It was also more widespread, with half of all UK companies reporting falling sales four quarters in a row.

Weaker sales and rising Covid-related costs gave way to a substantial fall in profits, which plunged 61% year-on-year to £55.3bn in the first 12 months of the pandemic.

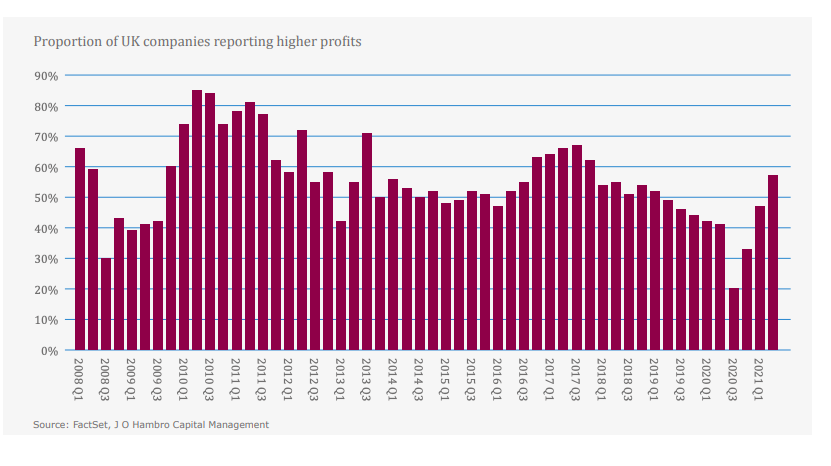

57% of companies reported higher profits in Q1

But JOHCM’s research suggests the worst is over, with the investment team predicting UK earnings should roughly double to £110bn by March 2022.

Company results covering Q4 2020 and Q1 2021 have shown activity bouncing back rapidly in nearly all sectors, according to the index.

Even with the lockdown pushing into Easter, revenues at UK plc in Q1 were only 5.8% lower compared to Q1 2020, the last pre-pandemic quarter.

Additionally, 57% of companies reported higher profits compared to a year ago with banks, oil and mining companies, some of the worst hit sectors in the initial months of the pandemic, leading the charge.

JOHCM is predicting the next set of results covering the three months to June, due out in summer, will be even stronger and reveal an “an unprecedented recovery in UK company profits, in both scale and speed”.

By March 2023 it expects UK earnings to return to their pre-pandemic levels.

Alexandra Altinger (pictured), CEO UK, Europe and Asia said: “After the shock of the pandemic the change of mood in Britain’s boardrooms is palpable. The recovery is now very strong indeed: high government spending, low interest rates, strong consumer demand, resurgent employment and a buoyant housing market mean that profits are now growing very fast, much faster than market expectations.”