While Covid-19 takes over the media headlines, it is easy to get caught up in the short term. However, as the UK continues to adjust to the new normal, Last Word Research has taken a long-term look at what fund selectors feel are the most important investment themes to focus on.

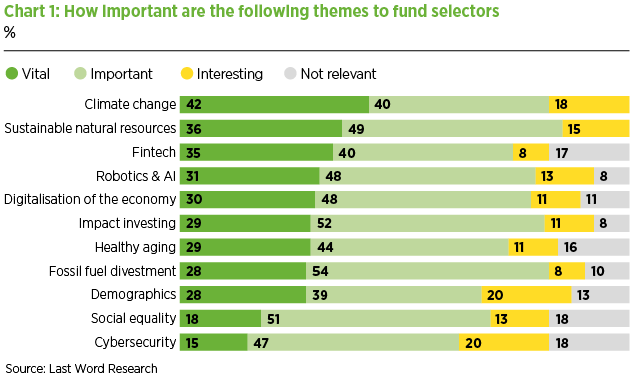

We approached the top UK fund selectors to discuss thematic investment choices, and to see which themes they ranked highest. Given the current situation, it will come as little surprise that taking the top spots were climate change and sustainable natural resources, with the majority of fund selectors marking these as either vital or important.

As we have covered in previous articles, an interest in climate change and sustainable resources is to be expected. Over the past three years, we have reported the steady rise in investors focusing on ESG, and the impact of their investment decisions. Engagement with fund groups that focus on ESG has significantly increased in just the last 12 months.

Similarly, in the past three years, we have seen an escalation in money moving into ESG strategies, with 73% of fund selectors putting more money into the area, while 48% of fund selectors’ clients are demanding more in-depth ESG reporting from fund groups relative to 2017.

While for many the focus is on the short term and getting through the current pandemic, it is also clear that there is plenty of appetite among UK investors for long-term investment options. Last Word Research has discussed ESG investing at length, but there is another investment theme which cannot be ignored.

Artificial horizon

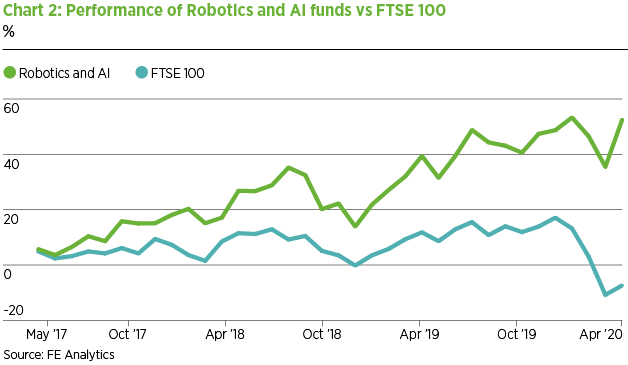

As Chart 1 below shows, just under a third of our respondents consider robotics and AI a vital investment theme, and it is clear this is not a new area of interest. Since May 2017, UK-domiciled robotic and AI funds have consistently been outperforming the FTSE 100.

You can see from the Chart 2 below that during April there was a substantial uptick in performance in this sector. Impressive, considering the whole economic environment.

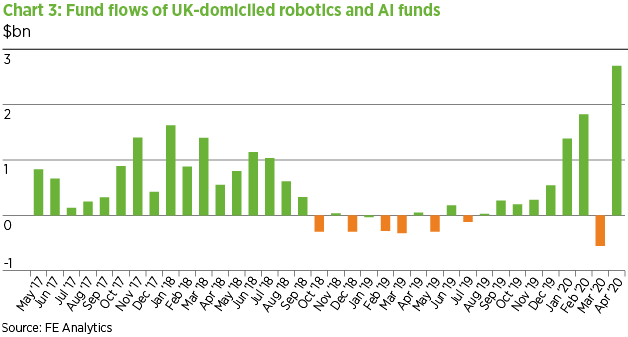

Money has also been flowing into these funds. Between January 2020 and April 2020, over £5.3bn went into UK-domiciled robotic and AI funds.

According to the International Federation of Robotics: World of robotics report (2016), it has been predicted that there will be a 15% growth each year in the demand of robots across the globe. From being required in medicine and agriculture, to entering everyday life in all kinds of different ways, robotics is becoming an essential part of modern life.

Interestingly, in the latest data gathered by EPFR Global, actively managed UK equity funds are significantly overweight when it comes to the relevant sectors. These are categorised by EPFR as software and services, consisting of AI stocks, and pharmaceutics and biotechnology, which includes restoration robotic stocks.

Automatons for the people

Over the past two years, active investor allocation towards AI and robotic sectors has steadily been increasing, while passive portfolios instead have had more of a weighting towards financial, utilities and energy sectors.

It is not just in the UK that there is plenty of appetite for robotic and AI funds. Back in February 2020, PA’s sister publication Expert Investor highlighted the increased in popularity for robotics when it comes to thematic investing, with more that half of the money flowing into global thematic funds coming from European investors. This has been supported by our own in-house data, with a recent survey revealing that just under two thirds (62%) of European fund selectors considered investing in robotics and AI to be either vital or important to their strategic objectives. LW

This article was written by Lottie McGurk, a quantitative researcher at Last Word Research

To discuss any of this data, or if you would like to get involved with a project with Last Word Research, please contact Lottie McGurk at Lottie.mcgurk@lastwordmedia.com.