Interest in Japanese equities has surged in Q1 as UK fund buyers scour for value plays to ride the Covid recovery wave, according to a survey conducted by Last Word Research.

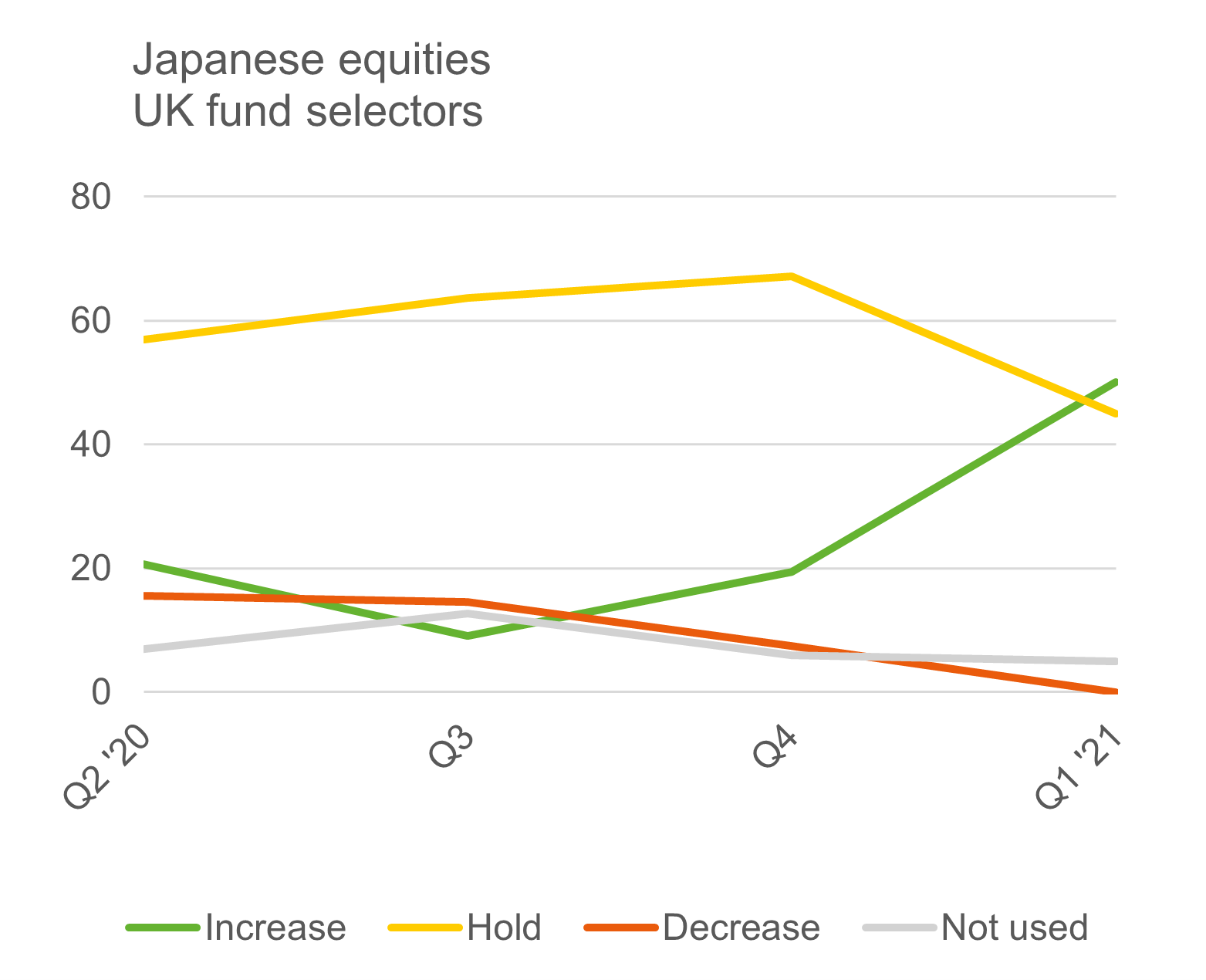

Half of UK fund buyers said they plan on topping up their Japanese equities exposure when polled during the first quarter, a massive spike from Q3 and Q4 2020 when only 9.1% and 19.4% expressed plans to boost their weightings.

A further 45% are leaving their current position unchanged and 5% did not hold any exposure to the asset class, meaning not a single buyer was looking to sell.

Japanese equities saw the second largest quarterly shift in net sentiment in Q1, just behind US equities, which bounced back from a big slump in net selling sentiment in the previous quarter.

Demand for the asset class was well above the next most popular asset classes, GEM equities and UK equities, which saw 40% of UK fund buyers planning on upping their allocations.

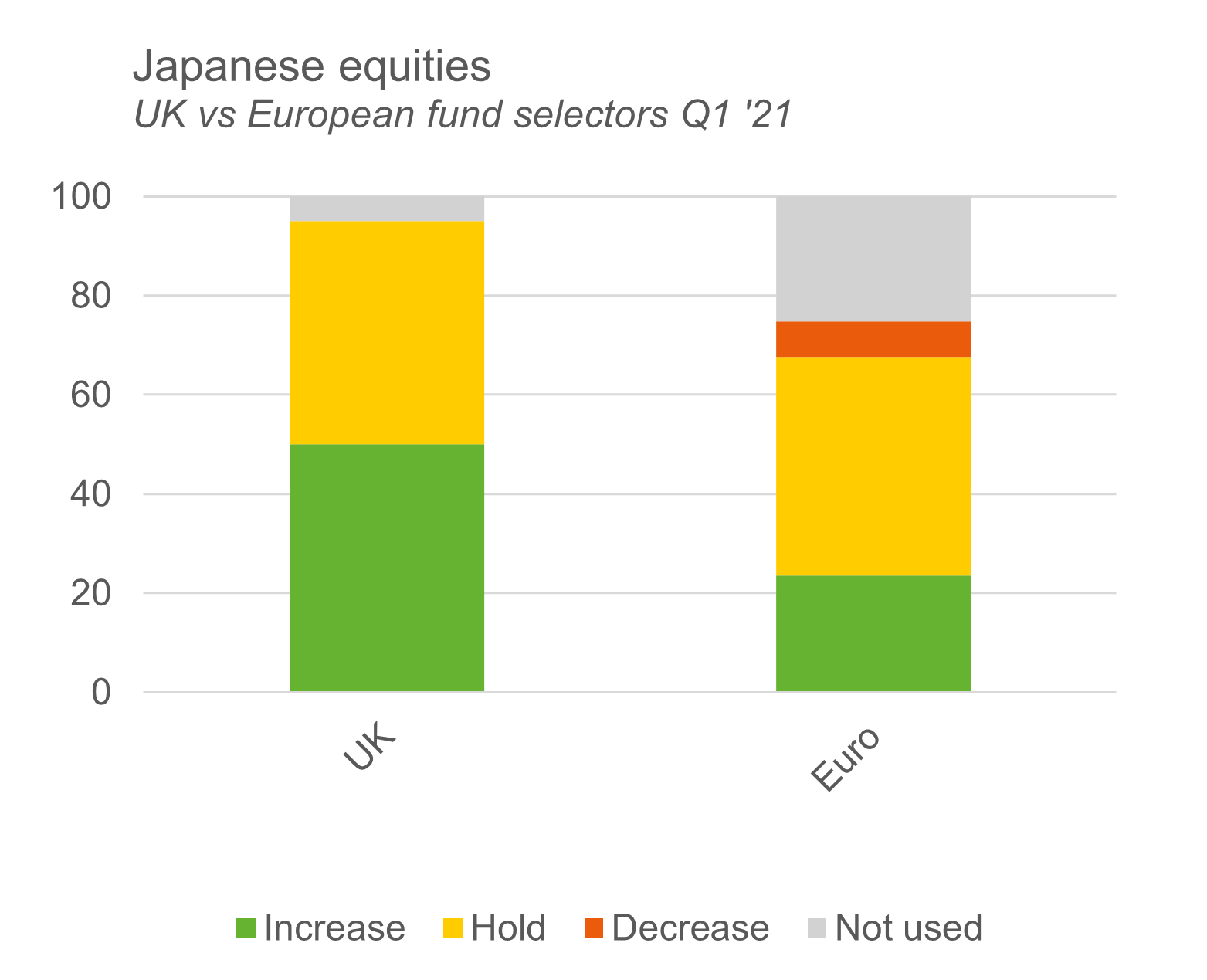

UK fund buyers more bullish on Japan than European counterparts

While European fund selectors have also shown a renewed interest in the asset class, their enthusiasm was nowhere near as strong as UK fund buyers.

Only 24% of the European fund selectors polled said they were looking to buy the asset class, while a similar level (44%) plan on holding their current allocation.

Another 7% said they were looking to sell and a quarter of respondents did not have exposure to the asset class.

Rathbones head of asset allocation research Ed Smith notes Japan, like the UK, has been one of the biggest beneficiaries of the hopes for a global economic rebound this year as Covid vaccines are rolled out.

Japan tends to do well in global recovery phases, thanks to its index being weighted toward industrials and exporters, Smith says.

However, he adds it also has plenty of stocks with ‘growth’ and ‘quality’ characteristics, like low levels of debt and high cash balances, which is why it has held up well since the nadir in March 2020.

‘Signs of life have emerged’

Liontrust multi-asset head John Husselbee is among the hoard of UK investors bullish on the region.

“Japan has fallen off many investment radars over recent years, with the country long in the thrall of deflation, but it remains another of our favoured cheaper markets,” Husselbee says.

Recently “signs of life have emerged,” Husselbee adds, with the Nikkei breaching the 30,000 level in February for the first time in three decades.

Japan has also been one of the most resilient economies coming out of the Covid crisis, he notes, with GDP shrinking by just 4.8% in 2020, less than half the 9.9% contraction suffered by the UK.

Japan remains contrarian despite pick up in performance

Other DFMs told Portfolio Adviser they are being more cautious.

BMO Gam’s Kelly Prior says the multi-manager team is “very, very marginally underweight” Japan having been neutral a year ago.

“The fireworks have been in other markets, and Japan tends to outperform in more difficult market conditions hence our underweight,” Prior says.

Punter Southall Wealth made a similar call, cutting its Japanese equities exposure to 4% of the Balanced portfolio toward the end of last year after having increased its weighting during the pandemic-related sell-off.

Head of investment strategy Rory McPherson says exposure to the asset class has remained unchanged year-to-date.

“Our investment case is centred around corporate change within the region and a view that Japan remains a contrarian market in spite of recent performance,” he says.

“It is decent value on a global basis but is no longer cheap as it was when we initiated our overweight stance several years ago (hence paring back our position), but it does still sit at a marked discount to the US and global equity markets which have forward P/Es of over 20x.”

Looking beyond a cyclical play on growth

Though BMO Gam’s multi-manager team is not as enthusiastic as other investors about Japan, Prior thinks it is a “fascinating” market with far more diverse opportunities than people give it credit for.

“Japan is a market that struggles to be thought of as anything other than a cyclical play on global growth,” Prior says. “But its index is a poor representation of the opportunities that are available on the listed exchanges with a strong IPO market.”

The BMO Gam multi-manager team currently holds the Morant Wright Japan Nippon Yield fund and Coupland Cardiff Japan Alpha fund. The former fishes lower down the cap spectrum for “undervalued Japanese companies with strong balance sheets, sound business franchises and attractive dividend yields”, while the other “focuses on the ‘growthier’ end of the market, offering a focused list of potential future stars,” Prior explains.

“They complement each other and will both do well over any sensible time horizon we believe,” she says.

Top 10 IA Japan funds ytd

| Fund | (%) |

| Nomura Japan Strategic Value |

16.1 |

| Man GLG Japan Core Alpha |

15.3 |

| M&G Japan |

11.9 |

| Liontrust Japan Opportunities |

11.1 |

| Morant Wright Nippon Yield | 10.4 |

| Lazard Japanese Strategic Equity |

9.3 |

| Barclays GlobalAccess Japan |

9.2 |

| Xtrackers MSCI Japan UCITS ETF |

8.8 |

| Xtrackers JPX-Nikkei 400 UCITS ETF |

8.4 |

| Morant Wright Japan | 8.3 |

Source: FE Fundinfo

‘Abenomics is starting to pull Japan out of its long slump’

Husselbee says Liontrust’s multi-asset team tends to hold a blend of growth and value strategies across all markets. It currently holds the £3.6bn Baillie Gifford Japan fund and the £1.2bn Man GLG Japan Core Alpha fund.

Alongside improving performance and resilient economic data, Husselbee says the corporate regime change ushered in by former prime minister Shinzo Abe’s Abenomics programme has been effective.

“We are confident prime minister Yoshihide Suga will keep the fundamentals of his predecessor Shinzo Abe’s policies intact and continue to bring greater focus to Japan’s growth strategy backed by a digital revolution,” Husselbee says.

“With a large proportion of export-driven businesses, the country is well placed to benefit from a global economic rebound, and the structural reform Abenomics ‘arrow’ is starting to pull Japan out of its long slump.”

Smith agrees the investment case looks compelling. “For long-term global investors, Japan offers exposure to an interesting structural productivity growth story — which is still often overlooked,” he says.

“Its GDP growth per capita has been strong, in no small part due to a thoughtful and wide-reaching series of structural reforms. Return on equity has improved dramatically over the last decade. And earnings growth has outstripped that of Europe many times over.”

State of emergency

Despite the surge in enthusiasm from UK fund buyers and improving fundamentals, there are fears Japan’s progress could be derailed as the country tries to contain its fourth wave of the coronavirus.

At the start of the year Suga declared a state of emergency in several prefectures due to climbing cases and on Wednesday reports emerged that the government was on the brink of declaring a state of emergency in Tokyo and the neighbouring Osaka and Hyogo prefectures just three months out from the Olympic Games.

Husselbee says although a drop off in growth is expected in Q1, “consensus suggests this should only be a temporary setback”.