There is plenty of optimism about the coming 12 months among UK, European and Irish fund selectors – but, so far, only the Irish are ready to start cutting down on cash. Will 2022 be the year that risk is back on the menu?

This year promises to be an exciting one, with much to look forward to. Several UK newspapers headlines are shouting that 2022 might be the year we beat Covid-19. Sporting events and festivals are all planned to go ahead, and there is an extra bank holiday to celebrate the Queen’s platinum jubilee in June.

So, are UK investors feeling positive?

Bonhill Intelligence conducts asset class research each quarter, surveying the top fund selectors across the UK and Ireland and tracking their forward-looking investment intentions. This information is then used to create our quarterly Future Flows report, which now covers the majority of the globe.

The UK

In the UK there has been a rise in positivity on the macroeconomic outlook among our respondents. Almost two-thirds of investors claim they feel optimistic and there is hardly a pessimist in sight.

Having said that, UK fund selectors have had a change of heart when it comes to certain asset classes.

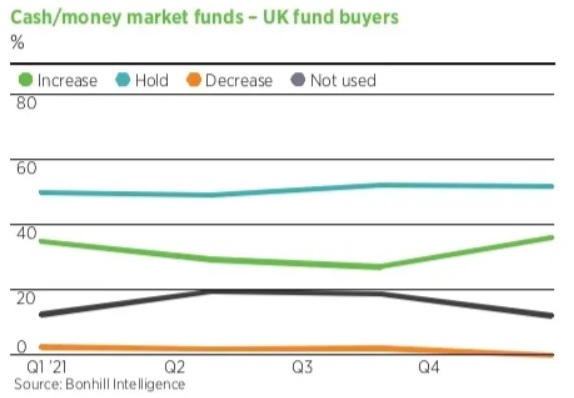

There has been a significant uptick in those looking to increase cash holdings, for example. In fact, nearly 90% of respondents plan to increase or maintain their cash weighting in the coming 12 months, suggesting UK investors may not be as upbeat as the macro outlook suggests.

Ireland

In Ireland, whereas the macroeconomic outlook was significantly different from the UK for much of 2021, it would seem investors are now much more on the same page, with 60% reporting a positive outlook.

This is where the similarities end, however. From an asset allocation perspective, optimism can clearly be seen among Irish investors, with hardly any looking to increase their cash allocations in the coming year.

In fact, most of our Irish respondents are considering decreasing their cash weighting, suggesting they are ready to take more risk in the year ahead. This can clearly be seen by the significant number of asset classes sitting in the green with plenty of buying appetite in Ireland in the coming 12 months – and only two asset classes stuck in the red this quarter.

Europe

Our European respondents also have a different attitude heading into 2022. Those who subscribe to our quarterly report will not be surprised to hear that optimism has been on the decline for the past three quarters. Although, with 50% still feeling positive about the coming year, this decline doesn’t feel like something to worry about just yet.

Similarly, while we have a clear consensus among our respondents in the UK and Ireland on cash allocation, in Europe this is not the case.

In fact, there are almost equal numbers of those looking to increase and decrease their cash allocations. The majority of investors are instead looking to maintain their current allocation.

Looking forward

All three regions have plenty of optimists when it comes to the macroeconomic outlook. However, it is Irish fund selectors who are ready to take the risk and start decreasing their cash allocation and putting money to work in other asset classes.

With 2022 promising to see normality return it will be interesting to see if the UK and Europe follow Ireland’s example and start taking more risk this year.

If you would like to subscribe to our quarterly report, or have any questions about the data in this article, please email Lottie.Sweeney@bonhillplc.com.

This article appears in the January edition of Portfolio Adviser magazine.